Despite a sharp rise in cryptocurrency ownership in 2024, the adoption of crypto as a payment method remains sluggish, especially in the United States (US).

A significant number of Americans own digital assets, with the US accounting for approximately 15.5% of global crypto holders, yet less than 1% of online shoppers in the country are using cryptocurrency for transactions.

Users view crypto more as an asset than a currency

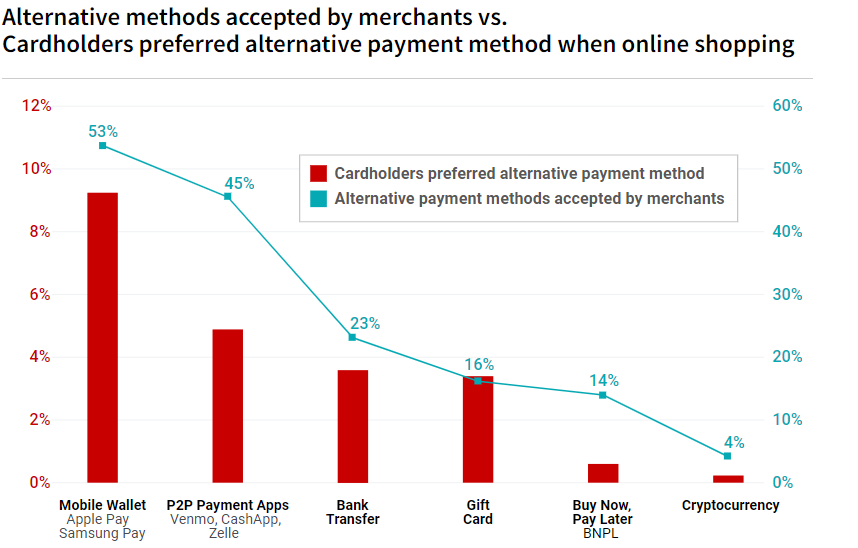

According to the Strawhecker Group US survey , about 80% of respondents prefer using debit or credit cards for online shopping, while another 10% leaned toward mobile wallets, leaving less than 1% clinging to crypto for online payments.

With about 560 million people worldwide owning crypto assets, and the United States accounting for about 15.5% of that, it is clear that many crypto owners view digital assets primarily as a store of value rather than a payment method.

Then again, only some online retailers in the United States offer crypto as an alternative payment method. According to last year’s report, only about 4% of the sellers provided crypto as an available payment option.

Source: Chargebacks911

Source: Chargebacks911

In contrast, about 53% of online retailers offered mobile payments, 45% accepted payments through P2P apps like Venmo, Cashapp, and Zelle, and about 23% allowed bank transfers. The only alternative payments close to crypto’s low score among online retailers then were gift cards at 16% and Buy Now Pay Later(BNPL) with a 14% acceptance rate.

Jarrod Wright, the head of marketing for Chargebacks911, commented on retailers’ low crypto acceptance rate, saying:

This is not to say that cryptocurrency is dead. However, it’s hard to deny that the promise of cryptocurrency as a decentralized, widely accepted means of exchange has failed to materialize so far. If consumers don’t want to pay in crypto, merchants won’t be incentivized to maintain it as an option.

~Jarrod Wright

Mobile wallets are increasing their penetration across the world

The Strawhecker Group US survey reveals that India saw the highest mobile wallet use and penetration, with roughly 91% of respondents using their mobile wallets to make payments last year. The same high use of mobile wallets prevailed across many other countries in the Asia Pacific, where around nine out of the top ten nations for mobile wallet adoption are situated.

Unlike Asia-Pacific or the Middle East, mobile wallets in Europe and North America compete against existing digital payment systems such as credit cards or debit cards, hence a lower penetration score. However, countries like Italy, Ireland, and Sweden had adoption scores of over 52%. Moreover, in the United States, about 46.7% of respondents used a mobile wallet, and in the UK, about 45.8% of respondents.