U.S. home sales contracts rose slightly in August on expectations that the Federal Reserve will cut interest rates

Contracts for the sale and purchase of US homes rose slightly in August from a record low in July on expectations that the Federal Reserve will cut interest rates, leading to a drop in mortgage rates, which mildly boosted homebuyer affordability, according to data from NAR, the National Association of Realtors.

The index of contracted home sales rose to 70.6, the lowest level since the index began compiling in 2001.Lawrence Yun, NAR's chief economist, said the slight rise in the index reflected a modest improvement in housing affordability, largely due to the drop in mortgage rates to 6.5 per cent in August.

Pending home sales activity will likely remain subdued, however, as rising home prices continue to partially offset the decline in borrowing costs despite the decline, and home inventories also remain limited.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

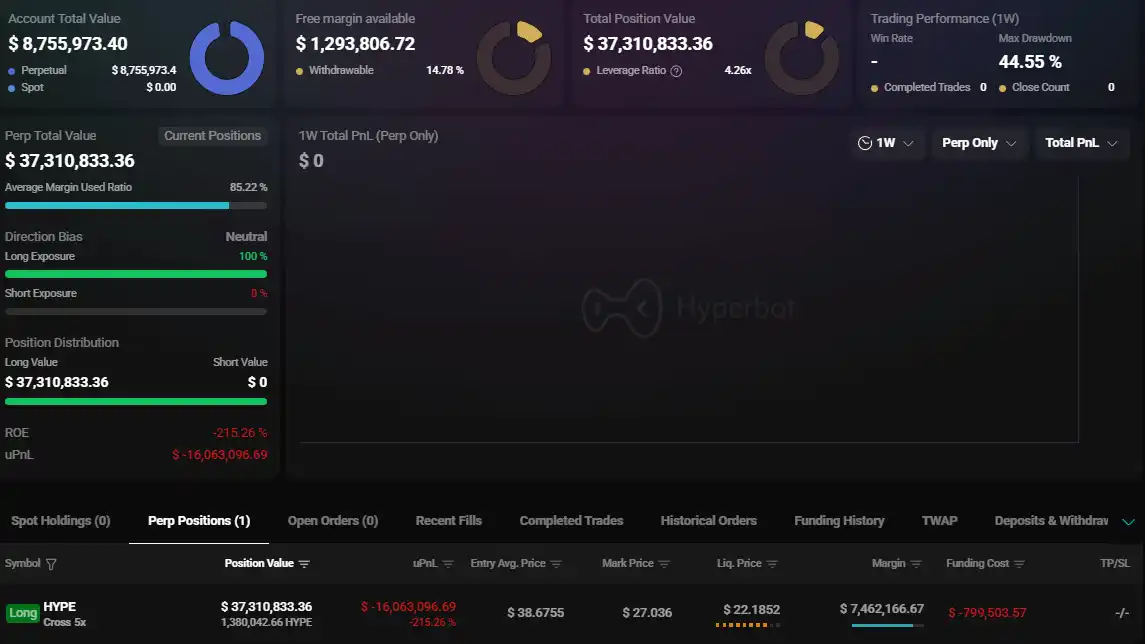

"HYPE Listing Insider Whale" suffers a floating loss of $16 million on 5x HYPE long positions

Disney to make $1 billion equity investment in OpenAI

ETH swing whale buys low and sells high, withdrew 2,779.8 ETH again 4 hours ago