Global crypto investment products add $1.2 billion in net weekly inflows as Ethereum funds break five-week negative streak: CoinShares

Digital asset investment products brought in $1.2 billion worth of net inflows globally for the third consecutive week, according to CoinShares.The positive flows were a reaction to continued expectations of dovish monetary policy in the U.S. and associated positive price momentum, Head of Research James Butterfill said.

Net inflows into global crypto funds run by asset managers such as BlackRock, Bitwise, Fidelity, Grayscale, ProShares and 21Shares continued their rebound into a third consecutive week, adding $1.2 billion, according to CoinShares.

The positive net inflows — the largest in 10 weeks — were driven by “continued expectations of dovish monetary policy in the U.S. and associated positive price momentum, with total assets under management rising by 6.2% last week,” CoinShares Head of Research James Butterfill wrote in a Monday report.

The Securities and Exchange Commission’s approval for listing and trading of options for BlackRock’s spot Bitcoin BTC -2.62% exchange-traded fund likely boosted sentiment, although trading volumes did not rise accordingly, falling 3.1% week-over-week, Butterfill added.

U.S.-based funds generated $1.2 billion in net inflows last week, with spot Bitcoin ETFs accounting for $1.1 billion of those flows alone, according to The Block’s data dashboard.

Switzerland-based crypto investment products also attracted net inflows of $84 million. However, funds in Germany and Brazil witnessed net outflows of $21 million and $3 million for the week.

Overall, bitcoin-based investment products registered the majority of last week’s net inflows, adding $1.1 billion globally. However, short bitcoin investment products also generated net inflows of $8.8 million amid a price rise that saw bitcoin gain 3.5% last week. Bitcoin is currently trading for $64,393 according to The Block’s Bitcoin Price Page , down 1.8% over the past 24 hours.

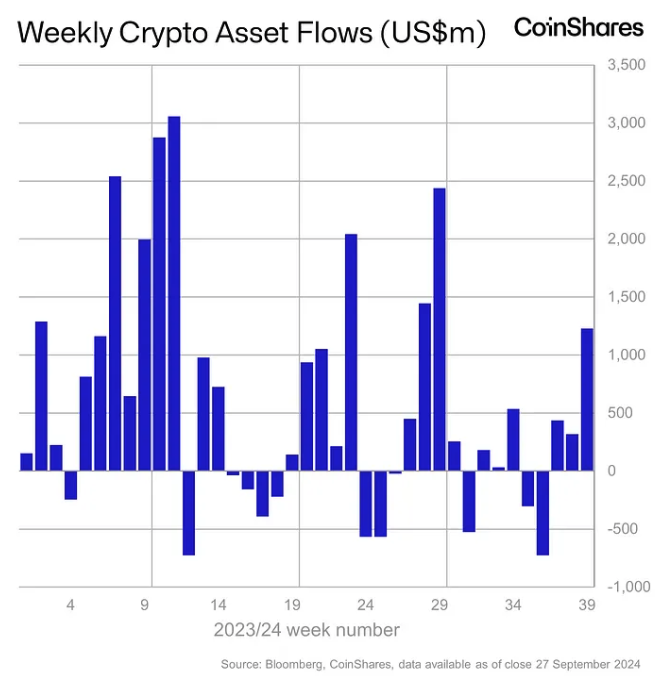

Weekly crypto asset flows. Images: CoinShares .

Ethereum investment products break outflow streak

Contributing to last week’s net inflows, Ethereum ETH -0.67% -based investment products broke a five-week negative spell last week, with global funds adding $87 million. U.S. spot Ethereum ETF accounted for $85 million of the net inflows alone — their largest net weekly inflows since early August.

Conversely, Solana-based investment products ended their positive five-week run of net inflows, with $.8 million exiting the funds globally last week.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

CandyBomb x US: Trade to share 5,400,000 US

[Initial Listing] Bitget to list Almanak (ALMANAK). Grab a share of 4,200,000 ALMANAK

[Initial listing] Bitget to list Cysic (CYS) in the Innovation zone

[Initial listing] Bitget to list Talus (US) in the Innovation and AI zone