Bitwise Chief Investment Officer: Bitcoin and gold have completely different impacts on portfolios, reflected in the risk and return trade-off

Odaily Planet Daily News Bitwise Chief Investment Officer Matt Hougan wrote on X: "Historically, Bitcoin and gold have had very different effects on portfolios. In the long run, one has increased returns without increasing risk, while the other has reduced risk without reducing returns. Please note that this is not investment advice, but only a historical study. Past performance does not guarantee future returns. The best way to understand the impact of Bitcoin and gold on a portfolio is to look at what has happened historically when you add more and more of these two assets to the portfolio. Historically, when you add more and more Bitcoin, the total return of the portfolio rises sharply.

At the same time, the standard deviation data, which measures volatility, has hardly changed. According to the simulation, a 2.5% Bitcoin allocation would increase the portfolio's return from 98% to 148%, an increase of 50 percentage points, while the standard deviation would only rise by 33 basis points. Throughout the 10-plus years of the study, a 2.5% gold allocation would only increase the portfolio's return by 1%, with little effect on the return. However, where gold does have an effect is in terms of volatility (standard deviation data), which will decline as more and more gold is added. Each asset has its own trade-offs. There is no guarantee that these same features will continue to exist in the future. But as we enter a new era of government stimulus around the world, it’s important to remember that the two assets are different and they play different roles in a portfolio.”

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

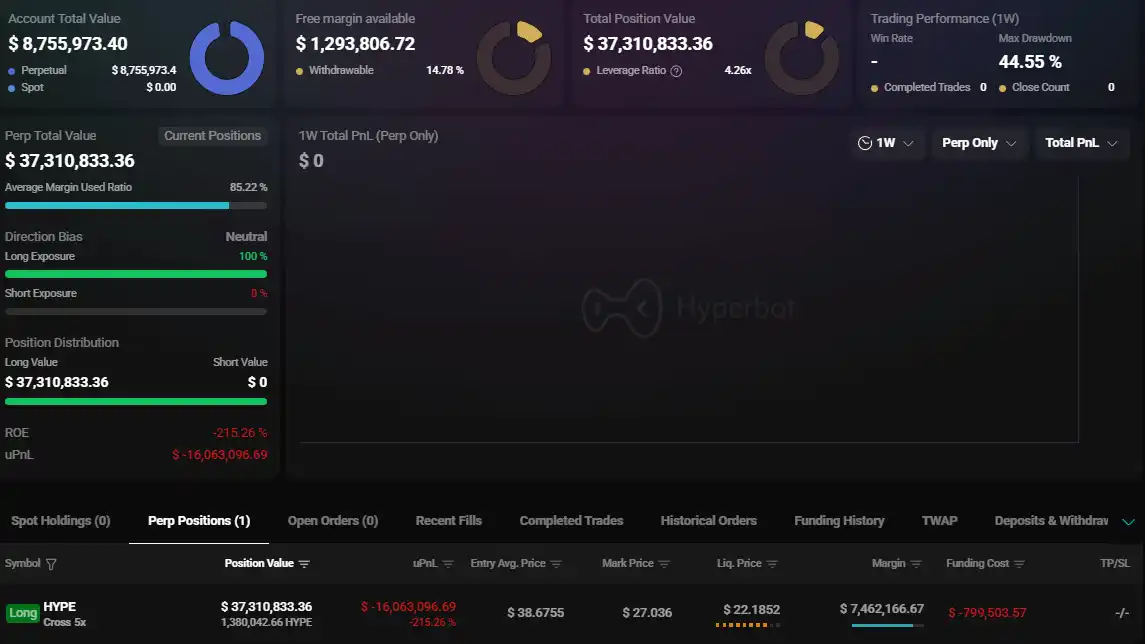

"HYPE Listing Insider Whale" suffers a floating loss of $16 million on 5x HYPE long positions

Disney to make $1 billion equity investment in OpenAI

ETH swing whale buys low and sells high, withdrew 2,779.8 ETH again 4 hours ago