Bitcoin demand stabilizes, but needs stronger growth for Q4 rally: CryptoQuant

Quick Take Bitcoin’s demand has shown signs of stabilization, but a more significant uptick is required in Q4 to support higher prices, according to CryptoQuant analysts. The digital asset’s price has gained a muted 1.2% in the past hour, and is currently trading above the $62,000 mark.

Bitcoin BTC -0.94% 's demand has shown signs of stabilization, but it will need to grow significantly in the fourth quarter to sustain higher prices, according to a report issued by CryptoQuant analysts on Tuesday.

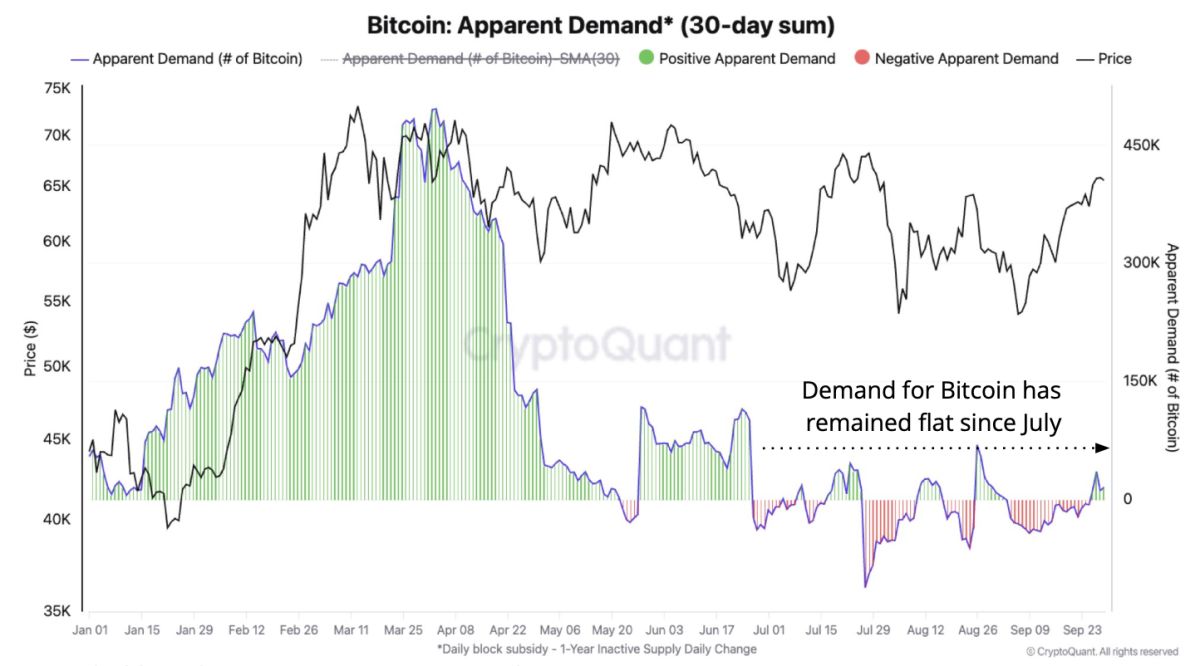

Since July, bitcoin’s apparent demand—calculated by CryptoQuant as the difference between the daily total bitcoin block subsidy and the daily change in the amount of bitcoin that has remained unchanged for one year or more—has fluctuated between a monthly net loss of 23,000 and a gain of 69,000 bitcoin . However, September saw less volatility, with demand increasing steadily throughout the month.

Despite this, analysts noted that the demand growth in September alone was insufficient to trigger a sustained price rally. "For comparison, bitcoin’s apparent demand grew by as much as 496,000 bitcoin in April, when the price was hovering at $70,000. It seems that demand has a lot of room to grow in the fourth quarter," the analysts said.

The report also highlighted that bitcoin holder behavior at the start of 2024 mirrors patterns seen during past halving cycles in 2016 and 2020. Long-term holders sold off bitcoin to new buyers earlier in the year, driving demand growth, but this trend cooled during the summer.

"If historical trends continue, we should see demand growth resume, leading to a potential increase in short-term supply," the analysts said.

Bitcoin apparent demand picked up in September and was less volatile. Image: CryptoQuant.

Spot bitcoin ETF demand increased in September

One area of renewed strength has been U.S. spot bitcoin exchange-traded funds (ETFs). September marked a shift from net selling of 5,000 bitcoin at the beginning of the month to net buying of 7,000 bitcoin on September 30—the highest daily purchase volume since July.

"Spot ETFs bought on average almost 9,000 bitcoin daily in the first quarter of 2024, helping to drive the price of bitcoin to fresh highs. If ETF demand continues to accelerate it can have the effect of propelling prices up in the last quarter of 2024," the analysts said.

However, despite the positive trend, Tuesday saw the first daily net outflows from spot bitcoin ETFs since September 3, ending an eight-day streak of positive flows. BlackRock’s IBIT, the largest spot bitcoin ETF, was the only fund among the top 12 to record positive flows yesterday, with $40.84 million entering the product.

Bitcoin’s price has gained a muted 1.2% in the past hour and was sitting at around $62,139 at 12:15 a.m. ET, according to The Block’s Bitcoin Price Page .

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

New spot margin trading pair — HOLO/USDT!

FUN drops by 32.34% within 24 hours as it faces a steep short-term downturn

- FUN plunged 32.34% in 24 hours to $0.008938, marking a 541.8% monthly loss amid prolonged bearish trends. - Technical breakdowns, elevated selling pressure, and forced liquidations highlight deteriorating market sentiment and risk-off behavior. - Analysts identify key support below $0.0080 as critical, with bearish momentum confirmed by RSI (<30) and MACD indicators. - A trend-following backtest strategy proposes short positions based on technical signals to capitalize on extended downward trajectories.

OPEN has dropped by 189.51% within 24 hours during a significant market pullback

- OPEN's price plummeted 189.51% in 24 hours to $0.8907, marking its largest intraday decline in history. - The token fell 3793.63% over 7 days, matching identical monthly and yearly declines, signaling severe bearish momentum. - Technical analysts cite broken support levels and lack of bullish catalysts as key drivers of the sustained sell-off. - Absence of stabilizing volume or reversal patterns leaves the market vulnerable to further downward pressure.

New spot margin trading pair — LINEA/USDT!