Analysis: More investors may believe that the Fed will cut interest rates by 25 basis points in November and December as planned

Bitget2024/10/06 04:17

According to reports, there may be some upside risks to the US September CPI data next Thursday, especially the core CPI. According to the preliminary value of the S P Global Purchasing Managers' Index, corporate purchasing prices rose at the fastest pace in six months. Although the ISM manufacturing survey showed a decline, non-manufacturing reports confirmed the acceleration of price pressures. Therefore, if the data shows some stickiness in inflation, more investors may believe that the Fed will proceed as planned and cut interest rates by 25 basis points in November and December.

Jim Baird, Chief Investment Officer of Plante Moran Financial Advisors, said, "After a series of relatively weak employment data in the summer, the September employment report was exactly what the Fed wanted. It broke recent trends and provided optimistic reasons for the labor market to remain resilient." He added that although the report will not change the economic outlook, it should ease any concerns of investors or the Fed about the labor market. Earlier this week, Fed Chairperson Powell said he did not want to see further weakness in the labor market. One of the main reasons for the Fed's decision to cut interest rates by 50 basis points last month was the slowdown in hiring and the rise in unemployment earlier this year.

1

0

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

PoolX: Earn new token airdrops

Lock your assets and earn 10%+ APR

Lock now!

You may also like

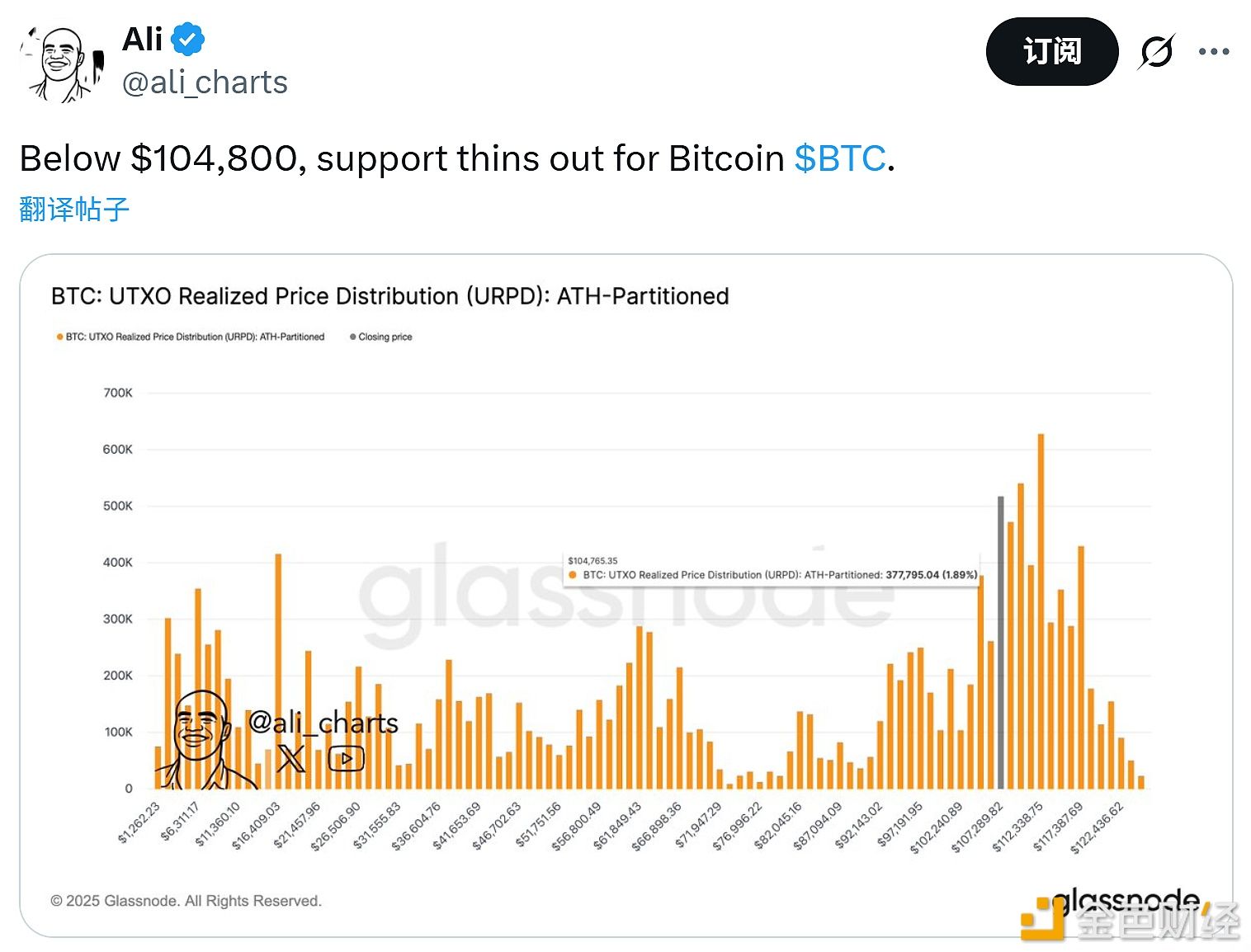

Opinion: Bitcoin Lacks Buying Support Below $104,800

金色财经•2025/11/04 11:45

Data: An entity has almost fully repaid the borrowed 66,000 ETH, earning a profit of $26.9 million.

Chaincatcher•2025/11/04 11:10

Trending news

MoreCrypto prices

MoreBitcoin

BTC

$104,260.59

-3.58%

Ethereum

ETH

$3,515.34

-5.64%

Tether USDt

USDT

$0.9995

-0.05%

XRP

XRP

$2.28

-5.54%

BNB

BNB

$951.69

-6.97%

Solana

SOL

$161.25

-8.52%

USDC

USDC

$0.9998

-0.01%

TRON

TRX

$0.2812

-4.12%

Dogecoin

DOGE

$0.1653

-5.67%

Cardano

ADA

$0.5425

-6.27%

How to buy BTC

Bitget lists BTC – Buy or sell BTC quickly on Bitget!

Trade now

Become a trader now?A welcome pack worth 6200 USDT for new users!

Sign up now