Matrixport: It is anticipated that Bitcoin volatility will further decrease, and options trading may become a profitable strategy in the coming months

Matrixport released a chart stating that a year ago, we predicted that the volatility of Bitcoin would remain within +/-20% in any 30-day rolling period, implying that the likelihood of its significant rebound or decline is relatively small. This provided an opportunity for option sellers to earn extra premiums, thereby increasing the yield on Bitcoin.

This strategy only experienced minor temporary losses during two brief periods at the end of the third quarter of 2023 and the first quarter of 2024. With the launch of Bitcoin spot ETFs, volatility is expected to further decrease, making selling options potentially an effective profit strategy in the coming months.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

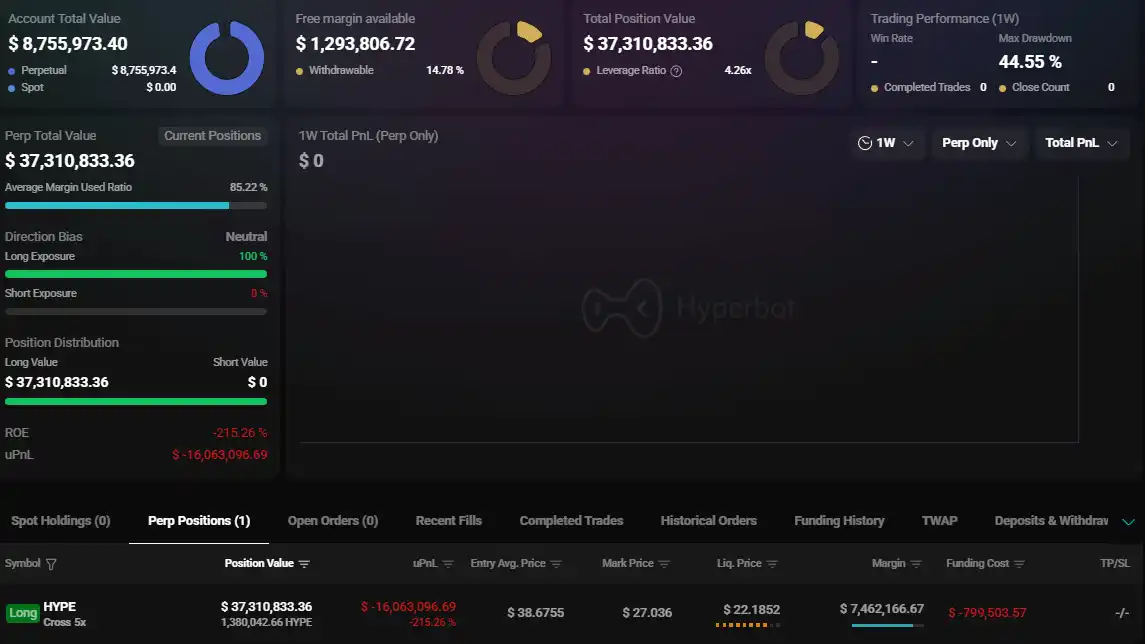

"HYPE Listing Insider Whale" suffers a floating loss of $16 million on 5x HYPE long positions

Disney to make $1 billion equity investment in OpenAI

ETH swing whale buys low and sells high, withdrew 2,779.8 ETH again 4 hours ago