Trader Issues Bitcoin Warning, Says BTC Bulls Likely To Be Liquidated Before Real Rally Begins

A widely followed crypto analyst believes Bitcoin ( BTC ) is poised for one more liquidation event before sparking a fresh bull run.

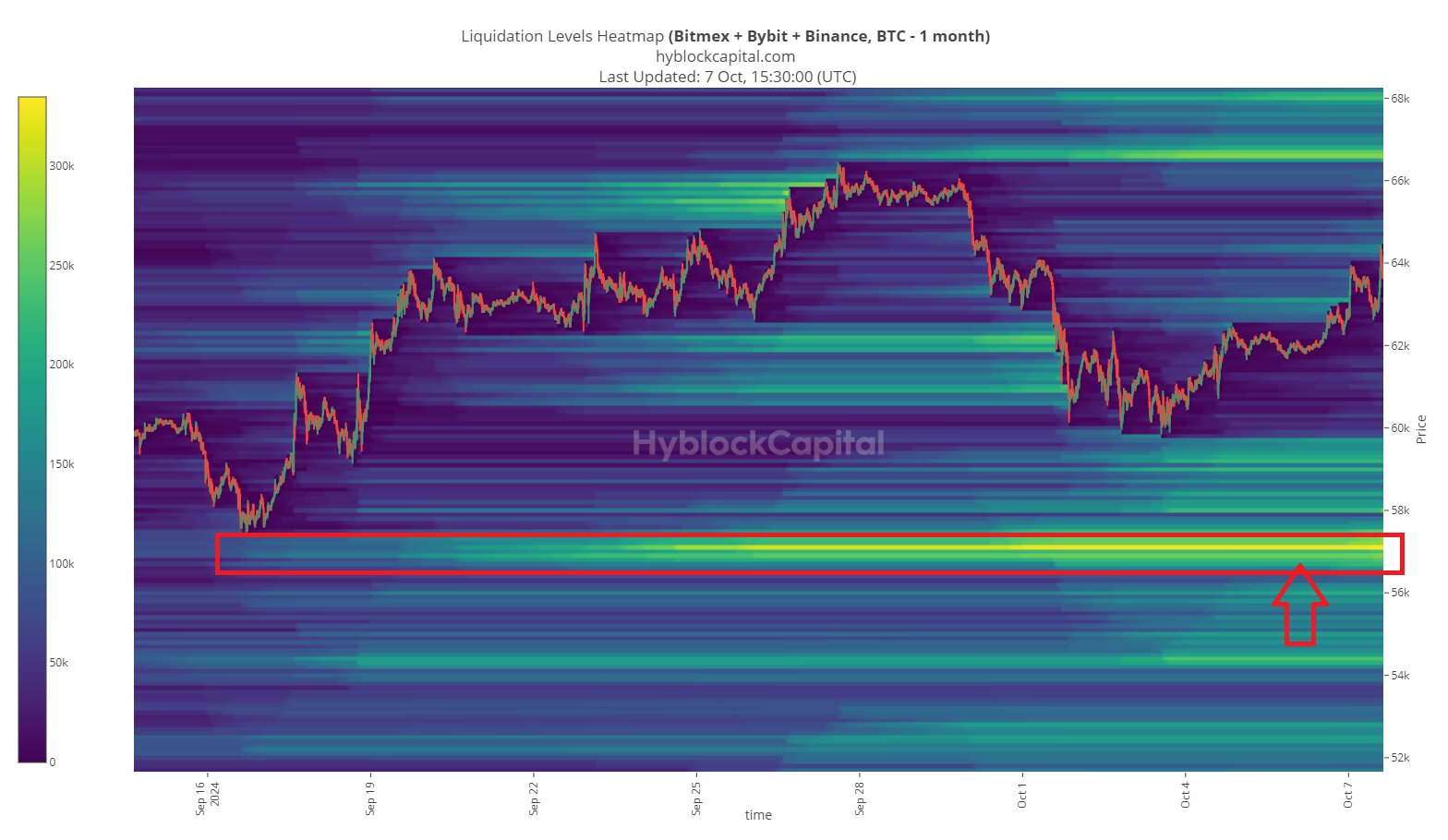

Trader Justin Bennett tells his 112,400 followers on the social media platform X that Bitcoin’s heatmap suggests that BTC bulls have piled up long positions at $57,000.

The crypto strategist thinks that the market will likely hunt the liquidity zone to shake out those who were early before BTC witnesses a big upside move.

“The size of the BTC long liquidations at $57,000 is FAR greater than the shorts we saw liquidated at $63,000.

It would be a shame if Bitcoin took these out before the real rally begins, especially now that I’m once again an idiot for suggesting more ranging from a market that’s ranged for seven months.”

Source: Justin Bennett/X

Source: Justin Bennett/X

Looking at Bitcoin’s chart, Bennett says the fall to $57,000 will be confirmed once BTC breaks its immediate support level.

“Markets love symmetry, and this lines up perfectly with those Bitcoin long liquidations at $57,000.

It also intersects with the BTC Sept. 2023 trend line.

The trigger for this move is a sustained break below $62,300.”

Source: Justin Bennett/X

Source: Justin Bennett/X

At time of writing, Bitcoin is trading for $62,139, slightly below the trader’s key area.

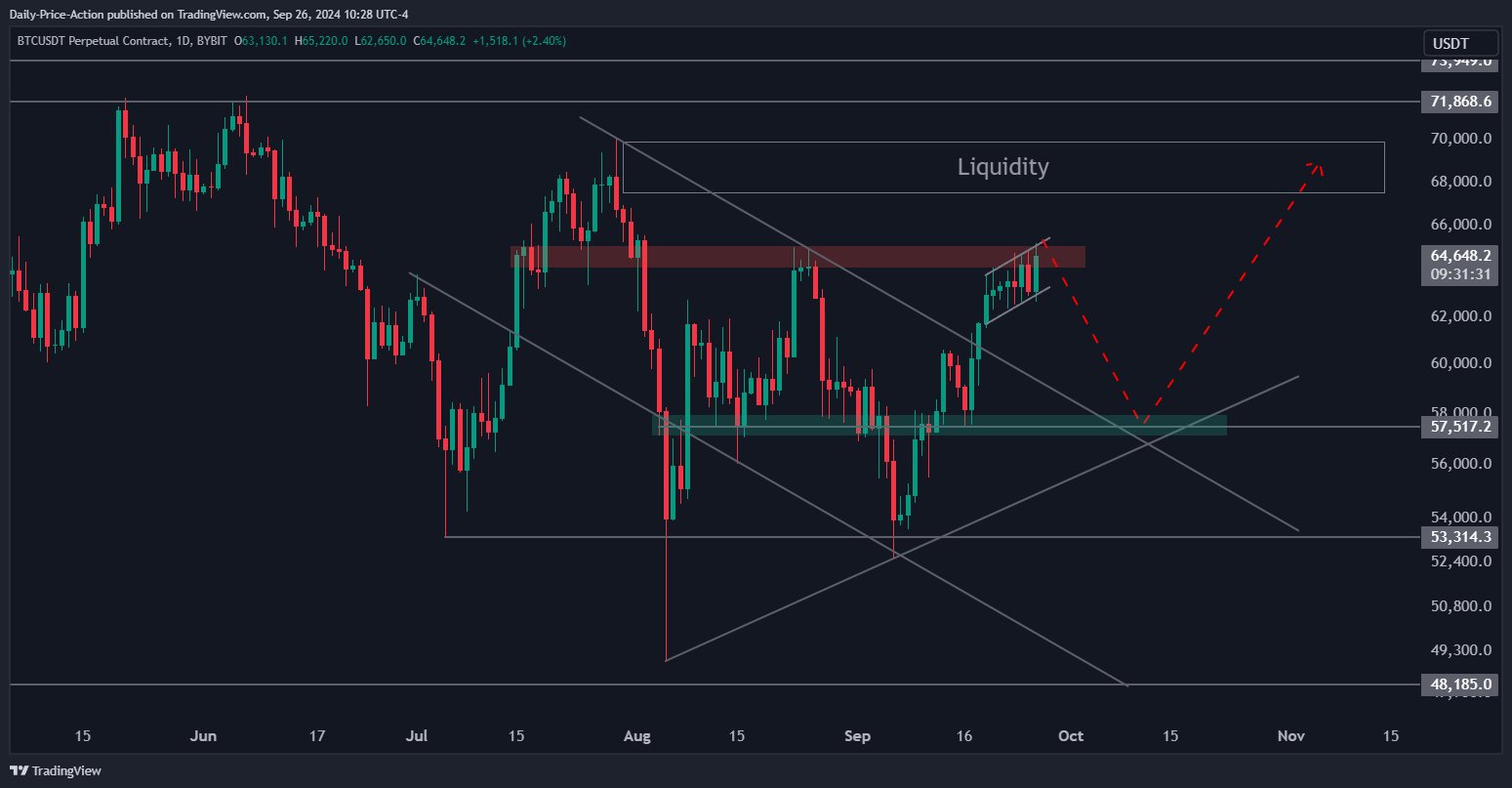

In late September, Bennett predicted that a big rally to $70,000 would follow the correction to $57,000.

“The conditions favor sweeping the BTC $57,000-$58,000 longs before targeting the $68,000-$70,000 liquidity.

Invalidation on a sustained break above $65,000.”

Source: Justin Bennett/X

Source: Justin Bennett/X

Don't Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on X , Facebook and Telegram

Surf The Daily Hodl Mix

Generated Image: Midjourney

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

New spot margin trading pair — HOLO/USDT!

FUN drops by 32.34% within 24 hours as it faces a steep short-term downturn

- FUN plunged 32.34% in 24 hours to $0.008938, marking a 541.8% monthly loss amid prolonged bearish trends. - Technical breakdowns, elevated selling pressure, and forced liquidations highlight deteriorating market sentiment and risk-off behavior. - Analysts identify key support below $0.0080 as critical, with bearish momentum confirmed by RSI (<30) and MACD indicators. - A trend-following backtest strategy proposes short positions based on technical signals to capitalize on extended downward trajectories.

OPEN has dropped by 189.51% within 24 hours during a significant market pullback

- OPEN's price plummeted 189.51% in 24 hours to $0.8907, marking its largest intraday decline in history. - The token fell 3793.63% over 7 days, matching identical monthly and yearly declines, signaling severe bearish momentum. - Technical analysts cite broken support levels and lack of bullish catalysts as key drivers of the sustained sell-off. - Absence of stabilizing volume or reversal patterns leaves the market vulnerable to further downward pressure.

New spot margin trading pair — LINEA/USDT!