Polymarket bets are strongly leaning towards a rate cut of 25 basis points in November. A status quo or larger cuts seem less likely after the Fed’s aggressive start to loosening its policy.

CME FedWatch also indicates changing market expectations after the first monetary policy adjustment this year. As the odds shift, Deloitte’s US economy forecast believes that US growth will be stable in 2024.

There is a likelihood of a 0.25% rate cut

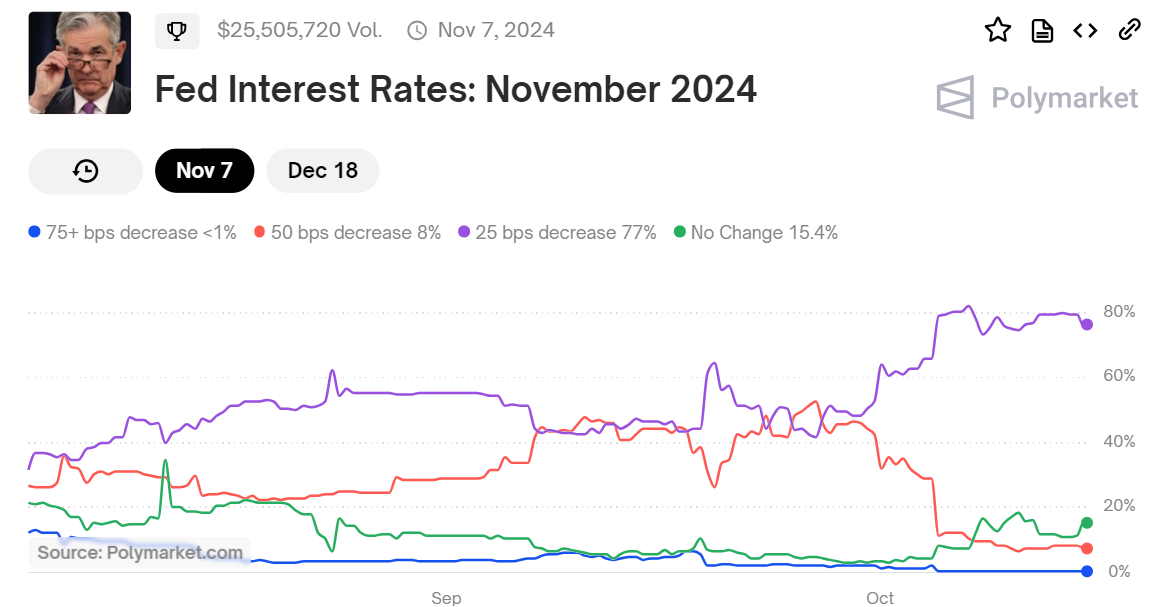

Polymarket bets overwhelmingly predict that the Federal Reserve will cut rates by 25 basis points in November. CME FedWatch tracks that probability at 88% against Polymarket odds of 77%. Over the last month, the odds of a 50 bps rate cut have fallen from over 50% to 8% after the central bank’s aggressive monetary policy loosening in September. A rate cut of 75 bps also seems unlikely in the betting market, with predictions below 1%.

Polymarket’s November FOMC decision bets.

Polymarket’s November FOMC decision bets.

Since the start of the bet, the 25 bps rate cut has been the most favored prediction, starting at 32% in August and rising to as high as 82% by October. Meanwhile, the likelihood of no rate change has reduced over time with CME now placing it around 12%.

Before the Fed made its first rate cut after 2020, inflation became less of the central bank’s worries. Currently, the benchmark rate is at 4.75%-5.00%. That has also made the markets gear up for more cuts in 2024 and 2025. As a result, cheap money has rallied the S&P 500 with the largest 12-month gains. The Kobeissi Letter notes that the index is up 43% since October 2023 with US Elections also playing a role.

US economy remains “fundamentally strong”

According to Deloitte’s Q3 2024 forecast, the US economy is “fundamentally strong” despite the global headwinds and inflation concerns. The report notes that the 2024 growth is driven by consumer spending, business investments, and lower interest rates.

Deloitte underlines that the economy had a slow start in early 2024 before a 3% growth in Q2. The report predicts that the trend could continue, with a 2.7% growth forecast for the year. However, the GDP growth is expected to slow down to 1.5% in 2025.

When it comes to consumer spending, lower interest rates are reportedly helping the numbers. Deloitte projects consumer spending will grow by 2.4% this year. Meanwhile, companies are investing heavily in manufacturing and technology, with laws like the Inflation Reduction Act driving investments. But, geopolitical conflicts and trade issues could lead to higher inflation and slower growth, according to the audit firm. Deloitte believes that if conflicts cause oil prices to rise or lead to new trade tariffs, inflation might stay above 3% into 2025.

Central banks generally maintain a status quo if inflationary concerns arise. However, the report sees a possibility of higher growth if emerging tech like AI leads to greater productivity. “Growth in intellectual property investment is expected to slow compared to the gains observed in 2021 and 2022 but will remain elevated over the course of the forecast period as many sectors incorporate AI and other technologies,” it adds.