The US SEC has filed Form C with attachments to challenge the court’s previous ruling from August in the Ripple lawsuit. The securities agency wants to overturn parts of the decision but XRP’s status as a non-security will not be disputed.

Ripple’s CLO confirmed that the company has plans to respond next week with its own filing. The review will focus on XRP sales and the use of XRP as a payment method, with the SEC revisiting claims against top executives.

SEC will appeal Ripple executives’ role in XRP sales

The Securities and Exchange Commission (SEC) filed a Civil Appeal Pre-Argument Statement (Form C) to appeal the previous court decision in the Ripple case. Ripple Chief Legal Officer Stuart Alderoty said that the company will file its Form C next week. He also clarified that the court ruling that “XRP is not a security” is not being contested.

The pre-argument statement is considered an early step in the appeal process. It has been filed in the United States Court of Appeals for the Second Circuit, under case number 24-2648.

The Securities and Exchange Commission (SEC) alleged that Ripple Labs, along with its executives Bradley Garlinghouse and Christian A. Larsen, violated Sections 5(a) and 5(c) of the Securities Act by offering and selling XRP without registration. The document states, “The SEC also alleges that Garlinghouse and Larsen aided and abetted Ripple’s Section 5 violations.”

The district court granted partial summary judgment in favor of the SEC regarding Ripple’s sales to institutional investors but also granted partial summary judgment to the defendants concerning sales on digital asset trading platforms and other specific transactions.

XRP price unmoved by SEC appeal

Ripple’s XRP down 1% after SEC appeal

Ripple’s XRP down 1% after SEC appeal

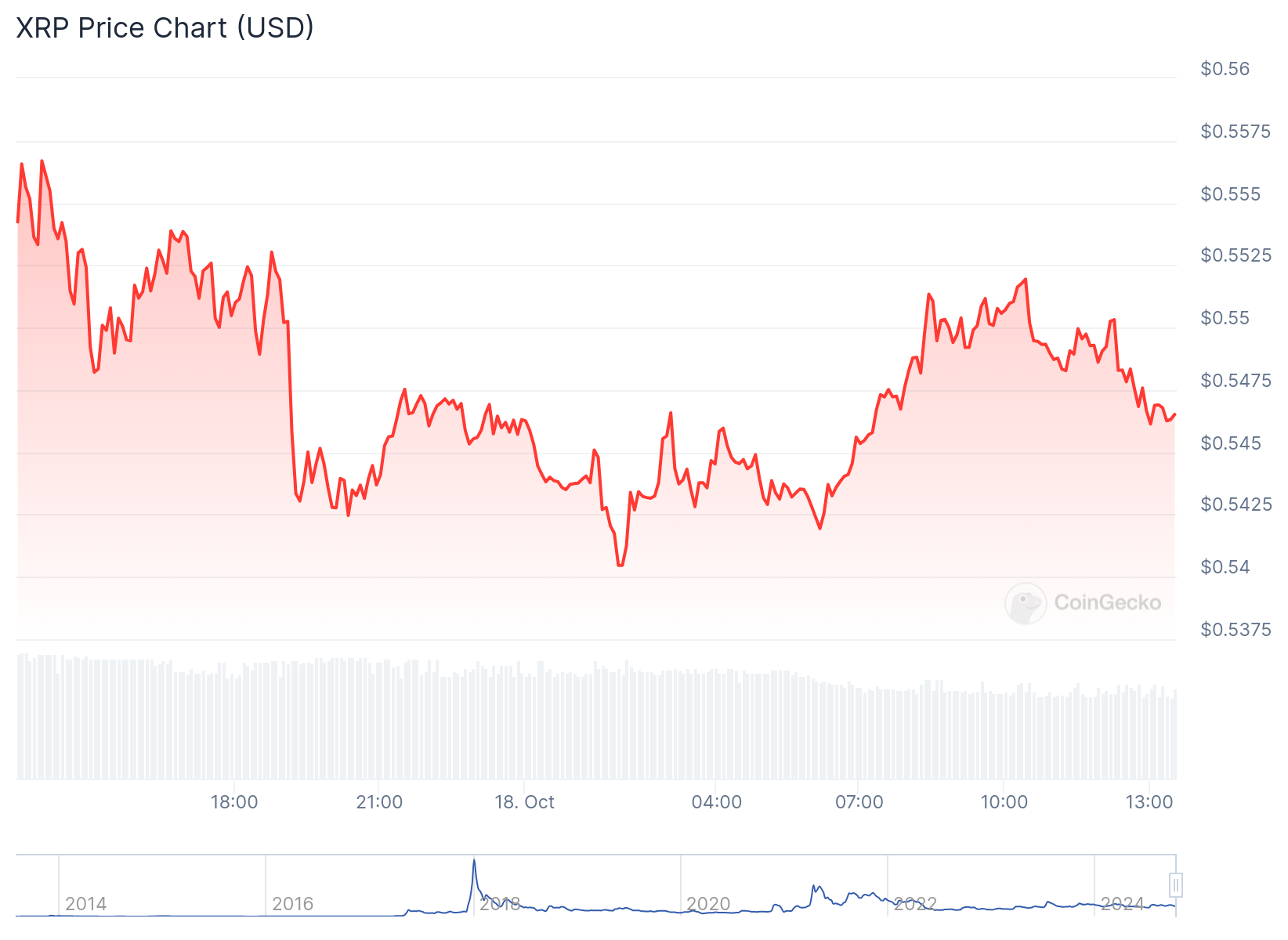

In response to the appeal, the XRP market is largely muted. On CoinGecko, it is maintaining a 24-hour range between $0.54 and $0.55. It has dipped by 1% since the news broke about the SEC appeal.

The SEC’s appeal includes issues regarding the district court’s decision to grant partial summary judgment to the defendants. The SEC calls for a review of previous judgments that it considers potentially “erroneous.”

The district court grants 14 days after the appeal to fill Form D called the Court of Appeals Transcript Information/Civil Appeal Form.

Meanwhile, the crypto community supporting Ripple is optimistic the judge will dismiss the appeal.

Attorney Jeremy Hogan explains that Ripple’s XRP sales on exchanges and its use of XRP as a payment method will be the matters in focus during the appeal. Form C specifies that these matters will be reviewed De Novo. It means that the appellate court will review the case without relying on what the trial court decided about the law, making it an independent review.

Hogan also sees the SEC’s claims against Ripple executives Garlinghouse and Larsen as a weak move, because they have been dropped earlier. He also underlines that if Ripple loses the appeal, it could face stricter penalties.

In its August judgment, the court denied the SEC’s request for disgorgement of $876 million in profits from XRP sales. However, the securities agency will reportedly not challenge the court’s decision around disgorgement this time around as well.