BlackRock’s Bitcoin ETF received more than $1.05 billion in the past five trading days as investors continue to show more interest in the spot products. BlackRock’s Chief Investment Officer of ETFs, Samara Cohen, confirmed that out of the 80% of direct investors purchasing IBIT, only 5% had owned an iShare, believing there was so much pent-up demand for Bitcoin.

BlackRock has long been the major receiver of investor funds among all other ETF providers. In the last five days, it received roughly 50% of the earned net inflows, attracting over $393 million on October 16 alone.

Crypto fans flock to invest in BlackRock’s ETFs

On October 18, Blackrock received about $70.4 million, marking its lowest inflow of the past five trading days. BlackRock’s chief investment officer for ETFs, attributed the huge inflows to the accumulated demand for Bitcoin and their efforts to educate more investors on the advantages of ETFs.

She said:

So we went into this journey with the expectation that we needed to educate ETF investors on crypto and on Bitcoin specifically. As it turns out, we have done a lot of education for crypto investors on the benefits of the ETP wrapper.

– Samara Cohen

She added that out of the 80% of direct investors making IBIT purchases, 75% had never before owned an iShare.

US spot Bitcoin ETFs have earned over billions in inflows

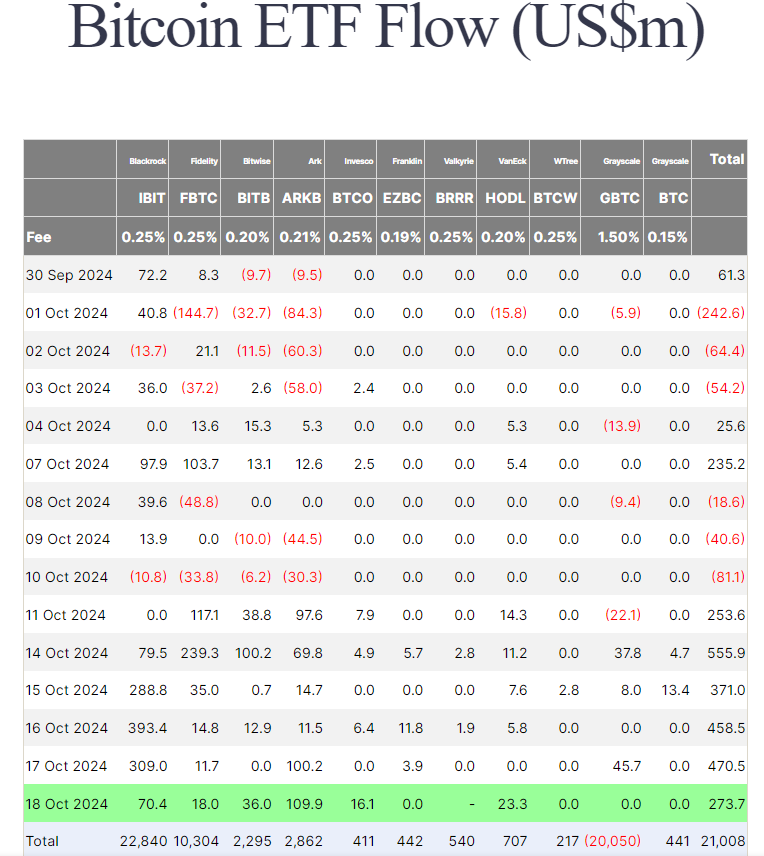

So far, all the eleven spot Bitcoin ETFs have a cumulative market capitalization of $63 billion, with close to $20 billion coming from inflows. According to Bitcoin ETF tracker, Farside , the 11 spot Bitcoin ETFs earned almost $560 million on October 14 alone, marking their most significant daily inflow since June.

Source: Farside

Source: Farside

Fidelity’s Wise Bitcoin Origin Fund (FBTC) took the daily lead in inflows with $239.3 million—its highest since June—while IBIT lagged slightly behind, receiving only $79.5 million. On October 17, these Bitcoin ETFs received another $470 million, the second-highest amount received in the last five trading days.

Eric Balchunas, an ETF analyst at Bloomberg and Author of “The Institutional ETF Toolbox”, drew a parallel between the recent rise in Bitcoin ETFs and trends seen in gold products, hinting that Bitcoin is becoming more widely accepted as a mainstream investment. He remarked on X that since the launch of Bitcoin ETFs, the cryptocurrency had achieved record highs on five occasions. In contrast, gold has reached such highs 30 times despite having just $1.4 billion in net inflows against $19 billion for Bitcoin ETFs.

Bitcoin’s price is also at a new high this week, settling at around $68,300. This is a 9.2% rise in the past week and a 0.9% rise in the last 24 hours. Analysts have attributed the rise in Bitcoin prices to investors’ renewed interest in Bitcoin spot ETFs.