SignalPlus: The open interest of BTC futures has also surged significantly, which could be a positive indicator that the market is establishing new long positions

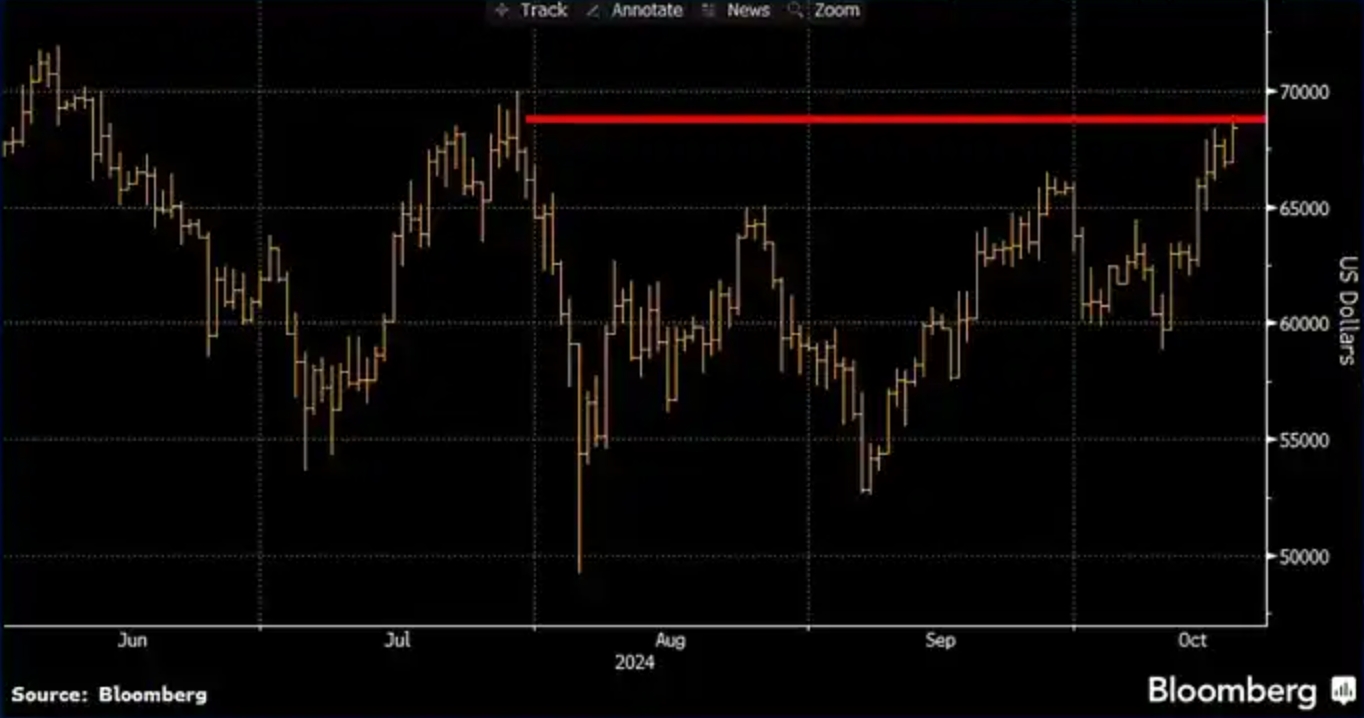

In its latest post, SignalPlus pointed out that BTC seems to be awakening from a long-term slumber, breaking through its downward channel and seeking to challenge historical highs before the election. The price recently broke through $68,000, while about $2.4 billion flowed into ETFs in the past six trading days. Meanwhile, the open interest of BTC futures also surged significantly, which may be a positive indicator that the market is establishing new bullish positions.

Excitingly, the increase in BTC inflows coincides with a significant increase in derivative trading activity on the Chicago Mercantile Exchange (CME). CME's open interest exceeded $11.5 billion, reaching a new historical high.

Moreover, according to research by K 33 ,the growth of CME's open interest is driven by 'direct participants', rather than leveraged capital inflow. This presents a healthier bullish structure and more aggressive buying tendency. In addition considering that traditional finance (TradFi) participants are mostly restricted when trading on centralized exchanges,the surge in CME trading activity also indicates an increased participation from mainstream and TradFi players.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Powell: The peak inflation rate may be a few tenths of a percentage point higher or lower than the current level

Powell: The rise in long-term interest rates is due to expectations of higher growth

Powell: There is no zero-risk path for policy