Bernstein: Bitcoin ETF inflows, crypto stocks, and retail trading sentiment all indicate an extremely high risk preference

According to The Block, as Bitcoin attempts to break through the $70,000 resistance level again, nearing its all-time high, analysts from research and brokerage firm Bernstein indicate that inflows into Bitcoin ETFs, the cryptocurrency stock market and retail trading sentiment are all "strongly showing a risk preference."

Bernstein analyst Gautam Chhugani stated that like other risky assets, the market believes there is an increasing likelihood of Trump's pro-cryptocurrency stance winning him the U.S. presidential election. At the same time, Vice President Harris has also issued more optimistic and clearer crypto policy statements which have reduced concerns about downside risks in the market. Investors believe now is a good time to enter.

The analyst pointed out that US spot Bitcoin ETFs have returned to strong net inflow status with $2.1 billion flowing in last week - this is highest since mid-March when Bitcoin was close to its historical peak of $74,000 with an influx of $2.6 billion.

Chhugani said: "We believe incremental ETF inflows are increasingly driving demand for spot bitcoin because asset management companies focus on distributing them to wealth advisors and large securities firms while initial ETF demand comes from spot CME derivative arbitrage trades."

Chhugani also noted Robinhood's cryptocurrency trading revenue grew 160% year-on-year – another indicator of bullish retail sentiment. Meanwhile according to analysts MicroStrategy’s returns so far this month stand at 49%, continuing to outperform almost all stocks; it serves as a leading indicator for Bitcoin.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Analyst: Dovish Fed Stance Favors Risk Assets

Tom Lee predicts the S&P 500 will reach 7,700 points by 2026

U.S. stocks open with the Dow slightly up, Oracle plunges and drags down AI stocks

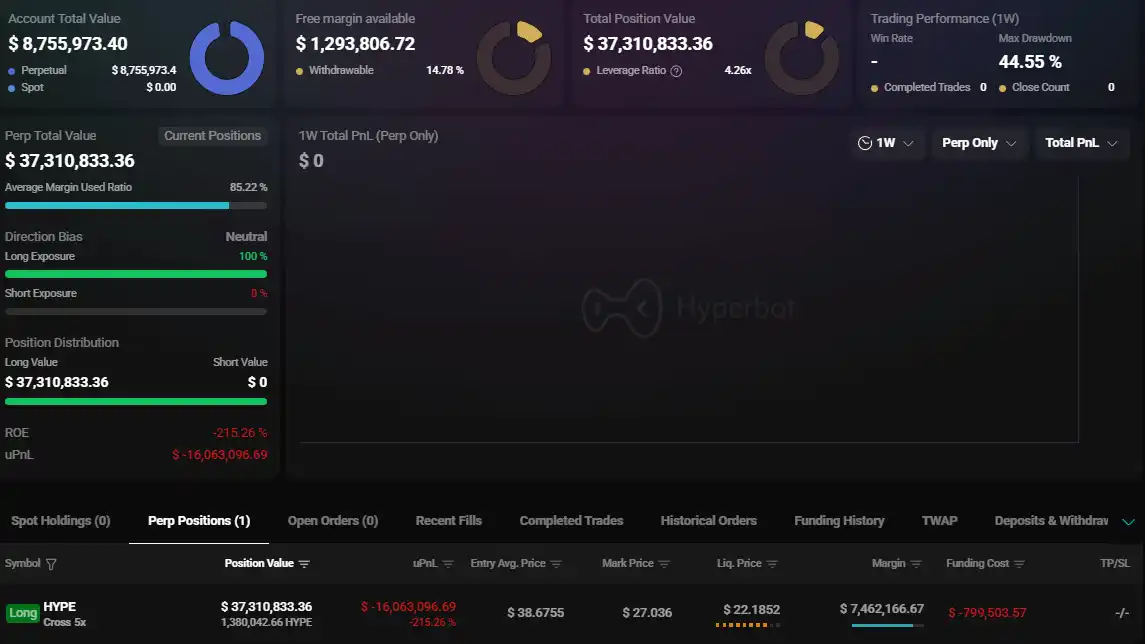

"HYPE Listing Insider Whale" suffers a floating loss of $16 million on 5x HYPE long positions