Solana Price Surge: Is $180 in Sight for October 2024?

Solana price has been struggling to break it to new heights, always battling resistance levels to fall back to the usual support levels, just like over the past year. During March 2024, it peaked at over $200, like $209, and then $202, before falling back to $169 and similar to that back in May reaching $187, and later in July hovering around $194, before always going back to lows of around $130, with a major fall in early August to $111. From these price swings, could SOL price break $180 this October, let's dive first into what's driving the recent rally to get a more precise Solana price prediction .

By TradingView - SOLUSD_2024-10-21 (1D) - Technical Indicators

By TradingView - SOLUSD_2024-10-21 (1D) - Technical Indicators

Solana Price Surge: What’s Driving the Recent Rally?

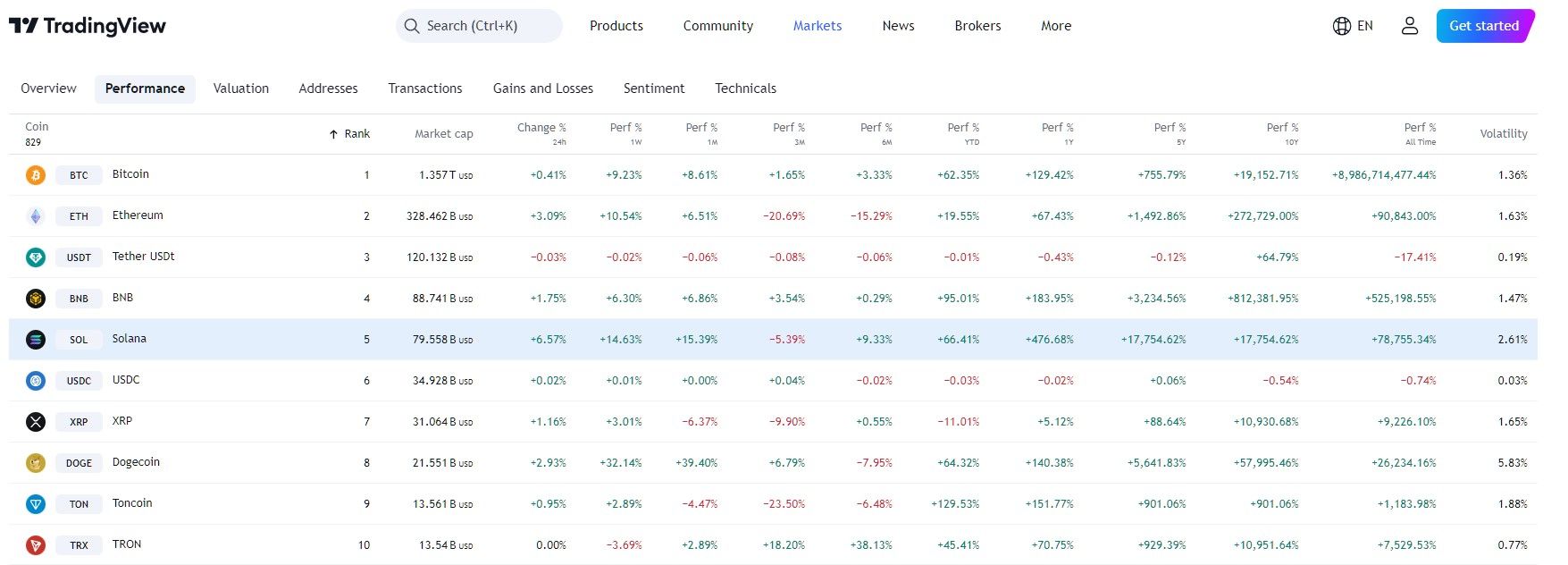

Solana (SOL) is experiencing a significant price surge, currently trading at $169.46, up 6.57% in the past 24 hours. This follows a steady upward trend, with SOL gaining 14.63% over the last 7 days and 15.39% over the past month. The cryptocurrency's market cap stands at $79.45 billion, while its 24-hour trading volume has soared by 86.44%, reaching $3.23 billion.

By TradingView - SOL Price Performance

By TradingView - SOL Price Performance

Several factors have contributed to this price rally:

- Historical Bullish Trends: Solana has historically performed well in October, averaging a 14% gain during this month over the past four years. Analysts predict that SOL could continue this trend, potentially reaching the $180 mark before the end of the month.

- On-Chain Activity Surge: Solana's active addresses have increased by 15% recently, indicating a rise in user engagement. This spike in network activity is fueling demand for the SOL token, supporting the bullish momentum.

- Bullish Pennant Pattern: Technical analysis reveals the formation of a bullish pennant pattern on Solana's daily chart. If this pattern holds, SOL could break through its current resistance levels and challenge the $180 target in the coming weeks.

- Broader Market Influence: Bitcoin’s strong performance , recently retesting the $69,000 mark, has also lifted altcoins like Solana. Favorable market conditions, including optimism following the Token2049 event , have boosted investor confidence in Solana .

Solana Price Prediction: Could SOL Hit $180?

By TradingView - SOLUSD_2024-10-21 (1D)

By TradingView - SOLUSD_2024-10-21 (1D)

The combination of historical performance increased on-chain activity, and a bullish technical setup indicates that Solana is well-positioned to reach $180 by the end of October. However, investors should watch for resistance around the $170-$180 levels, as any failure to break through could lead to a temporary pullback. A dip toward $160 or even $127 remains a possibility if bearish forces take control.

By TradingView - SOLUSD_2024-10-21 (YTD)

By TradingView - SOLUSD_2024-10-21 (YTD)

Despite these potential challenges, the overall sentiment around Solana remains positive . If the bullish momentum continues, we could see SOL approach its next resistance at $180, with potential for further gains into early 2025, especially if the broader crypto market continues to perform well .

By TradingView - SOLUSD_2024-10-21 (5D)

By TradingView - SOLUSD_2024-10-21 (5D)

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

New spot margin trading pair — HOLO/USDT!

FUN drops by 32.34% within 24 hours as it faces a steep short-term downturn

- FUN plunged 32.34% in 24 hours to $0.008938, marking a 541.8% monthly loss amid prolonged bearish trends. - Technical breakdowns, elevated selling pressure, and forced liquidations highlight deteriorating market sentiment and risk-off behavior. - Analysts identify key support below $0.0080 as critical, with bearish momentum confirmed by RSI (<30) and MACD indicators. - A trend-following backtest strategy proposes short positions based on technical signals to capitalize on extended downward trajectories.

OPEN has dropped by 189.51% within 24 hours during a significant market pullback

- OPEN's price plummeted 189.51% in 24 hours to $0.8907, marking its largest intraday decline in history. - The token fell 3793.63% over 7 days, matching identical monthly and yearly declines, signaling severe bearish momentum. - Technical analysts cite broken support levels and lack of bullish catalysts as key drivers of the sustained sell-off. - Absence of stabilizing volume or reversal patterns leaves the market vulnerable to further downward pressure.

New spot margin trading pair — LINEA/USDT!