Data from Glassnode, an on-chain analytics and intelligence platform, reveals that BTC has more holders now than ever before. The asset’s illiquid supply has steadily increased for months, according to Glassnode. On the other hand, short-term holder supply and exchange balances have been declining.

Strong holding signals among Bitcoin enthusiasts have increased significantly, showing bullish sentiments around the asset’s future performance. Crypto Banter pointed out that Bitcoin’s stored supply has increased for months. According to the post, the surging Bitcoin stored supply gives ‘mega HODLing vibes,’ implying that a potential rally could be imminent.

Glassnode data reveals BTC investors are holding

According to data from Glassnode, stored supply metrics show increasing trends, while active supply metrics show a declining trend. The stored supply metrics include Bitcoin HODLed or lost coins, long-term holder supply, and Bitcoin’s illiquid supply. In contrast, active supply metrics include short-term holder supply and exchange balances, as well as liquid and highly illiquid supply.

Bitcoin’s illiquid supply is at an all-time high. BTC’s long-term holder supply has also increased significantly since the year began. The short-term holder supply, on the other hand, has dropped.

Liquid and highly liquid supply has also been on a steady decline since the year 2024 began. Glassnode data also denotes that the number of BTC held or lost coins has dipped slightly from an all-time high recorded at the beginning of the year.

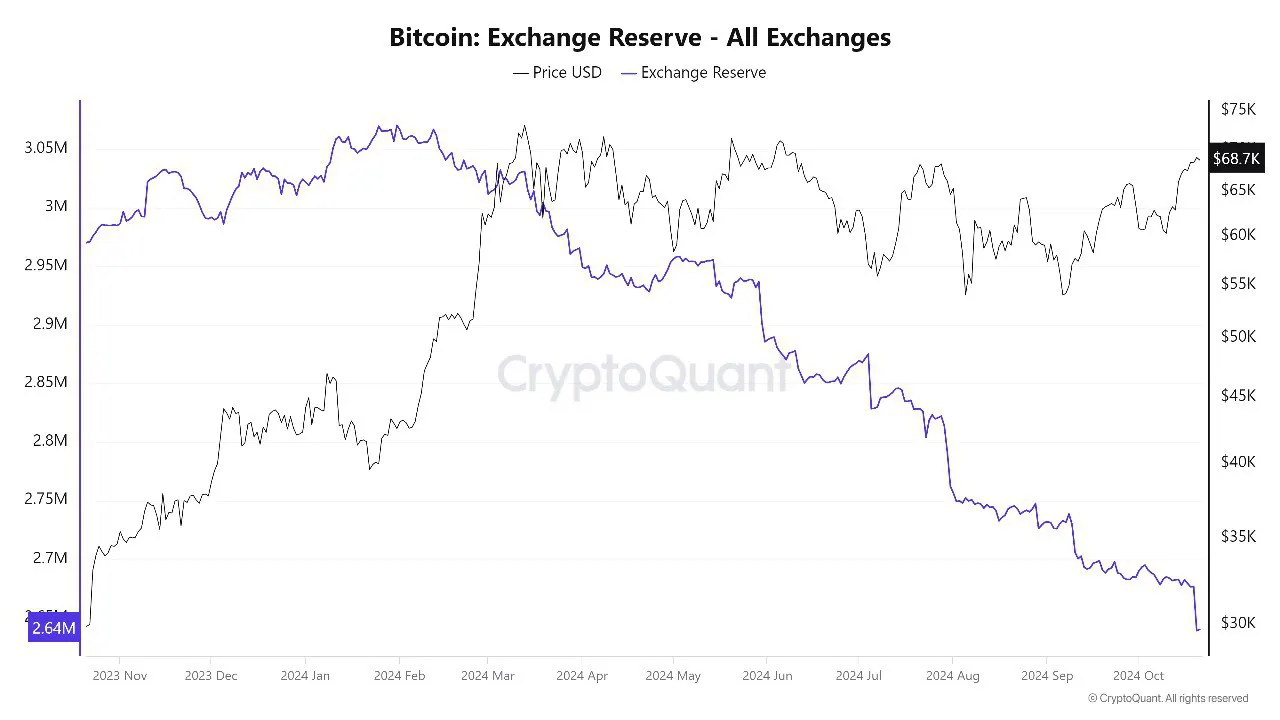

According to data from CryptoQuant, Bitcoin reserves in all centralized exchanges, which represent the total number of coins held in each exchange, have dropped significantly.

The decline has happened since November 2023, and the reserves currently sit at 2.64 million, near all-time lows at the time of this writing. Typically, a higher exchange reserve figure in all exchanges shows the market is experiencing a higher selling pressure, and the prices are likely to decline.

Source: CryptoQuant

Source: CryptoQuant

The declining reserves on centralized exchanges correspond to Glassnode’s data, which shows that Bitcoin’s stored supply has been on the rise. The data highlights that Bitcoin investors prefer to hold their assets and are now opting for self-custody away from centralized exchanges.

Institutional BTC adoption has also grown significantly

Bitcoin has also attracted institutions and large-scale investors. A report by River Financial released in September revealed that institutional Bitcoin adoption grew by 30% in one year and culminated in a 587% surge since 2020. The report also detailed that businesses and institutions now hold over 3% of all Bitcoin in circulation.

The report detailed that the institutions see Bitcoin as a strategic hedge against inflation and a means for diversifying their Treasury assets. U.S.-based companies have 49.3% of business bitcoin holdings, equivalent to $19.7 billion.

On the same note, BTC-approved ETFs in the U.S. have rapidly grown in recent months. The funds registered positive flows worth $273.71 million on October 18th, marking a 6-day positive flow according to data from SoSoValue. The ETFs cumulatively hold net assets worth $66.11 billion.