ANALYSIS: SOL/ETH Pair Overbought, BTC to Gold Ratio Maintains Downward Trend

On October 24, CoinDesk reported that the SOL/ETH spot pair on the Binance platform has risen more than 15% since October 1, continuing an uptrend of the past three months, but is now showing overbought signals. The pair's 14-day Relative Strength Indicator (RSI) has clearly broken above 70, the strongest overbought reading since March of this year.

Yesterday, the SOL/ETH pair hit an all-time high of 0.069, driven by a pickup in activity on the Solana network. Analysts note that while an RSI above 70 doesn't mean the bull market is over, it suggests that the recent rally has been too fast and may need to take a break. Technicals suggest that a potential pullback could find support at 0.064 (August high). It is worth noting that some experienced traders believe that the longer-term overbought RSI is instead showing strong bullish momentum.

On the other hand, the bitcoin-to-gold ratio has started to retreat after hitting resistance at the trendline connecting the March and June highs, and the MACD indicator has dead-crossed, suggesting that BTC may continue to show weakness. A similar technical pattern was seen in late July, after which the ratio experienced a prolonged decline.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

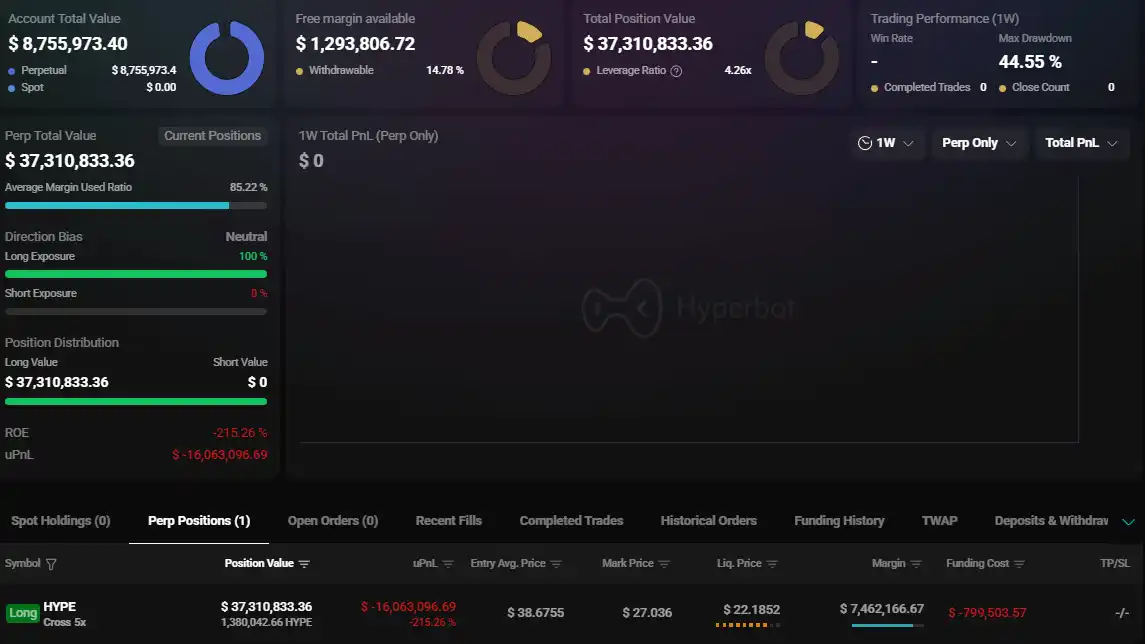

"HYPE Listing Insider Whale" suffers a floating loss of $16 million on 5x HYPE long positions

Disney to make $1 billion equity investment in OpenAI

ETH swing whale buys low and sells high, withdrew 2,779.8 ETH again 4 hours ago