Bitcoin options traders position for price gains post-U.S. election

Bitcoin options traders are increasingly buying post-U.S. election expiry call options in the $70,000-$80,000 range, according to an analyst.Donald Trump is widening his lead over Vice President Kamala Harris on the decentralized betting platform Polymarket.

Bitcoin options traders are gearing up for a potential price increase following the U.S. presidential election on Nov. 5, according to Arbelos Markets CEO Joshua Lim, who said that there is an increase in traders purchasing post-election expiry call options at the $70,000-$80,000 strike price range.

"There’s been a combination of month-end systematic selling by yield-seekers and a 'steepening' bias to buy post-election call options cheapened by selling pre-election options," Lim told The Block. This strategy signals expectations of a potential upward price breakout in bitcoin's market trajectory despite the uncertainties looming in global markets. "I see a surge in call buying of strikes in the $70,000-$80,000 range and selling of $100,000 plus as the expectation is for implied volatility to come in once the election resolves," he added.

According to Lim, bitcoin is increasingly seen as both an inflation hedge and a proxy for the U.S. presidential election, particularly in the event of a Donald Trump victory. "The options market is pricing a 7% move on the U.S. election day, which feels a touch low relative to Bitcoin's beta to risk assets," he said.

Trump leads on betting markets

In the lead-up to the election, Donald Trump is widening his lead over Vice President Kamala Harris in blockchain-based betting markets. Currently, Trump holds a 60.3% chance of winning on Polymarket, compared to Harris's 39.6%.

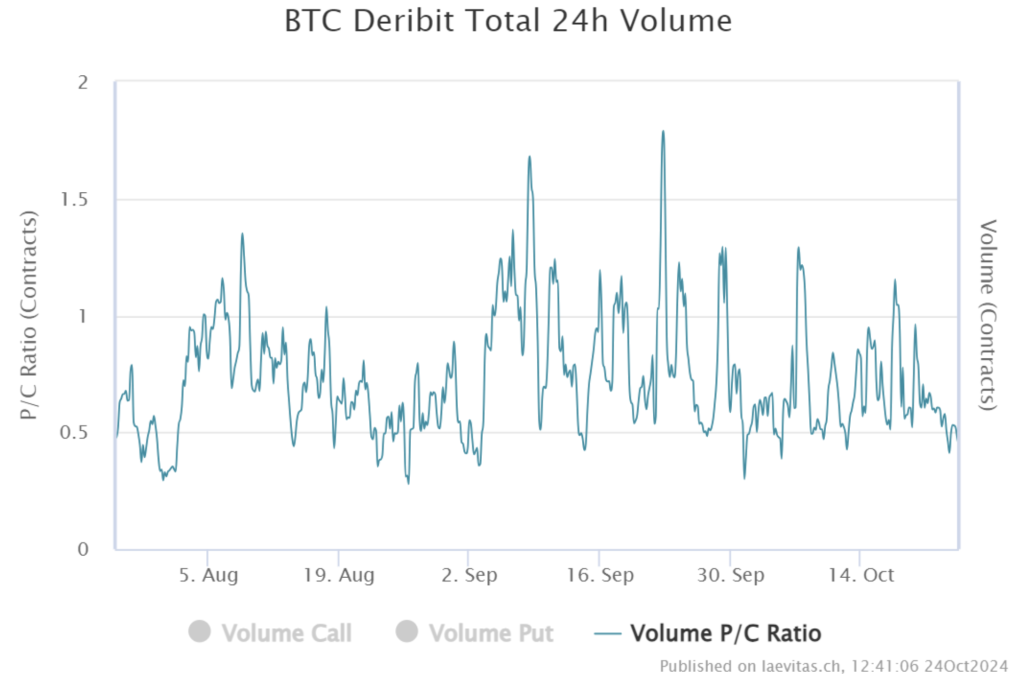

The increased focus on Trump as a potential bitcoin catalyst ties into broader market positioning. Lim highlighted that the put-call volume ratio for bitcoin options is falling, suggesting a net increase in activity in call options. This trend shows that traders bet on bitcoin price appreciation in the weeks following the election.

Lim highlighted that the put-call volume ratio for bitcoin options is falling. Image: Laevitas.ch

Bitcoin is currently changing hands at $67,500, according to The Block's Price Page . The global cryptocurrency market cap today is $2.42 trillion, a 0.2% decrease in the last 24 hours, according to Coinglass data .

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

New spot margin trading pair — HOLO/USDT!

FUN drops by 32.34% within 24 hours as it faces a steep short-term downturn

- FUN plunged 32.34% in 24 hours to $0.008938, marking a 541.8% monthly loss amid prolonged bearish trends. - Technical breakdowns, elevated selling pressure, and forced liquidations highlight deteriorating market sentiment and risk-off behavior. - Analysts identify key support below $0.0080 as critical, with bearish momentum confirmed by RSI (<30) and MACD indicators. - A trend-following backtest strategy proposes short positions based on technical signals to capitalize on extended downward trajectories.

OPEN has dropped by 189.51% within 24 hours during a significant market pullback

- OPEN's price plummeted 189.51% in 24 hours to $0.8907, marking its largest intraday decline in history. - The token fell 3793.63% over 7 days, matching identical monthly and yearly declines, signaling severe bearish momentum. - Technical analysts cite broken support levels and lack of bullish catalysts as key drivers of the sustained sell-off. - Absence of stabilizing volume or reversal patterns leaves the market vulnerable to further downward pressure.

New spot margin trading pair — LINEA/USDT!