BTCfi and Pendle join forces: a win-win alliance

The BTCfi and BTC liquidity pools launched by Pendle have captured more than $560 million in BTC liquidity. Pendle accounts for more than one-third of the total locked value (TVL) of BTCfi, driving the growth of multiple BTCfi protocols.

Over the past month, the BTCfi ecosystem has experienced a Cambrian explosion in influence and total value locked (TVL). At the forefront of this rapid growth, Pendle has played a vital role in accelerating liquidity and utility in this market.

Source: Dune

The Pendle Effect: Driving BTCfi

Roughly a month ago, Pendle launched its first BTCfi and BTC liquidity pool, and the results are jaw-dropping - over $560 million in BTC liquidity has been captured.

Source: @PendleIntern

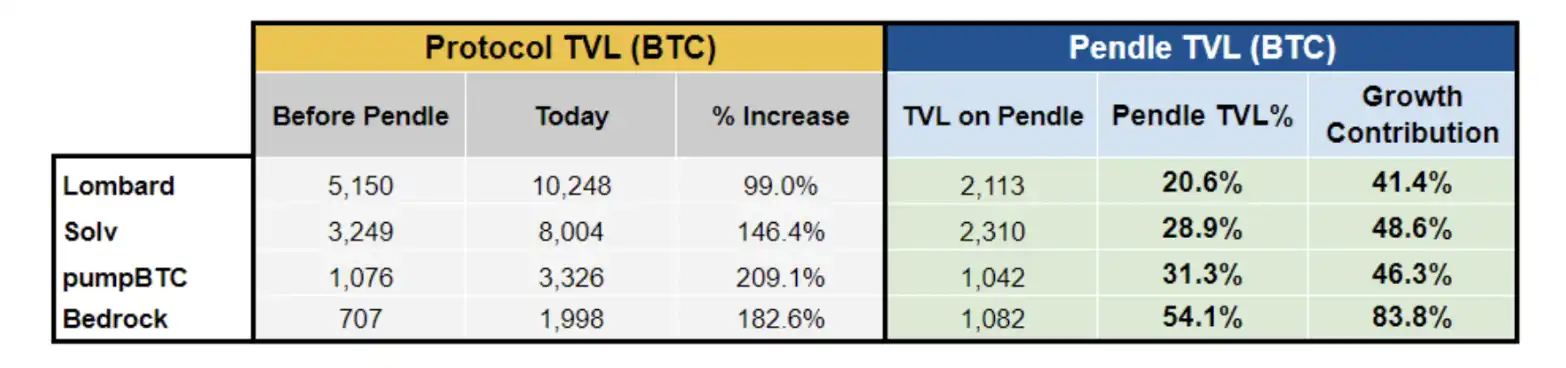

Pendle currently accounts for more than one-third of BTCfi's total TVL, driving the growth of multiple BTCfi protocols such as Lombard, Solv Protocol, Bedrock, pumpBTC, and Corn.

Source: DeFiLlama

This symbiotic relationship not only allows Pendle to gain benefits in the BTCfi market, but also provides new opportunities for speculation, hedging and yield optimization for users of the BTCfi protocol. At the same time, the growth of BTCfi has in turn strengthened Pendle's value positioning, making it firmly a leading DeFi protocol.

Source: @kenodnb

Currently, only 0.1% of BTC supply has participated in BTCfi, which means there is still a huge market to be tapped in the future. As more liquidity flows into BTCfi, market depth, adoption, and yields will increase further. Pendle is strategically positioned in this ecosystem to continue to capture value from this growing market.

The future looks bright and lucrative for participants at the forefront of this trend.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

New spot margin trading pair — HOLO/USDT!

FUN drops by 32.34% within 24 hours as it faces a steep short-term downturn

- FUN plunged 32.34% in 24 hours to $0.008938, marking a 541.8% monthly loss amid prolonged bearish trends. - Technical breakdowns, elevated selling pressure, and forced liquidations highlight deteriorating market sentiment and risk-off behavior. - Analysts identify key support below $0.0080 as critical, with bearish momentum confirmed by RSI (<30) and MACD indicators. - A trend-following backtest strategy proposes short positions based on technical signals to capitalize on extended downward trajectories.

OPEN has dropped by 189.51% within 24 hours during a significant market pullback

- OPEN's price plummeted 189.51% in 24 hours to $0.8907, marking its largest intraday decline in history. - The token fell 3793.63% over 7 days, matching identical monthly and yearly declines, signaling severe bearish momentum. - Technical analysts cite broken support levels and lack of bullish catalysts as key drivers of the sustained sell-off. - Absence of stabilizing volume or reversal patterns leaves the market vulnerable to further downward pressure.

New spot margin trading pair — LINEA/USDT!