Polymarket CEO emphasizes platform's non-partisan position ahead of election, says it provides 'much needed alternative data'

Quick Take Polymarket CEO Shayne Coplan said the firm is “strictly non-partisan” and it never envisioned itself as a political platform. Instead, political bets could buoy Polymarket’s focus on market-based forecasting, he noted Friday in a post on X.

Shayne Coplan, CEO of the decentralized prediction platform Polymarket, rebutted a recent article from the New York Times calling Polymarket a "crypto-powered gambling website" that showed high 64% odds of Donald Trump winning the 2024 presidential election.

Coplan noted that Polymarket is "strictly non-partisan" and it never envisioned itself as a political platform. Instead, political bets could buoy Polymarket's focus on market-based forecasting.

"We get told we're Dem operatives and MAGA, depending on the day," Coplan wrote Friday on the social media platform X. "Unfortunately the story is much less juicy, we're just market nerds who think prediction markets provide the public with a much needed alternative data source."

"The idea is if people disagree with the market price, they have the opportunity to capitalize by buying the side they think is priced too low," he said.

Trump's winning odds on the platform nearly double that of his Democratic opponent Kamala Harris, the current U.S. vice president, at 35%, according to the platform. Polymarket revealed Thursday that a French national bet a cumulative $45 million across four accounts for Trump, which could raise market manipulation concerns. However, the platform said the trader's position reflects their personal views of the election, and it did not find market manipulation or attempted market manipulation.

Coplan also pushed back on criticism of the company's ties to billionaire Peter Thiel after his Founder's Fund led Polymarket's $45 million Series B funding round in May.

"It's crazy I have to say this, but it's time to put the 'Thiel-controlled' narrative to rest. He has no direct contact or control with the company," Coplan said, adding later, "His politics have no bearing on how Polymarket works, operates or what the prices are — end of story."

The prediction market for who will win the 2024 U.S. presidential election is the largest on Polymarket. Its total betting volume sits at $2.4 billion after crossing the $2 billion mark on Oct. 17. Polymarket's monthly cumulative volume for October already hit $3.69 billion as the Nov. 5 election looms closer.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

a16z: 17 Major Potential Trends in Crypto Forecasted for 2026

Covers intelligent agents and artificial intelligence, stablecoins, tokenization and finance, privacy and security, and extends to prediction markets, SNARKs, and other applications.

Hex Trust will issue and host wXRP to expand its DeFi applicability across multiple blockchains.

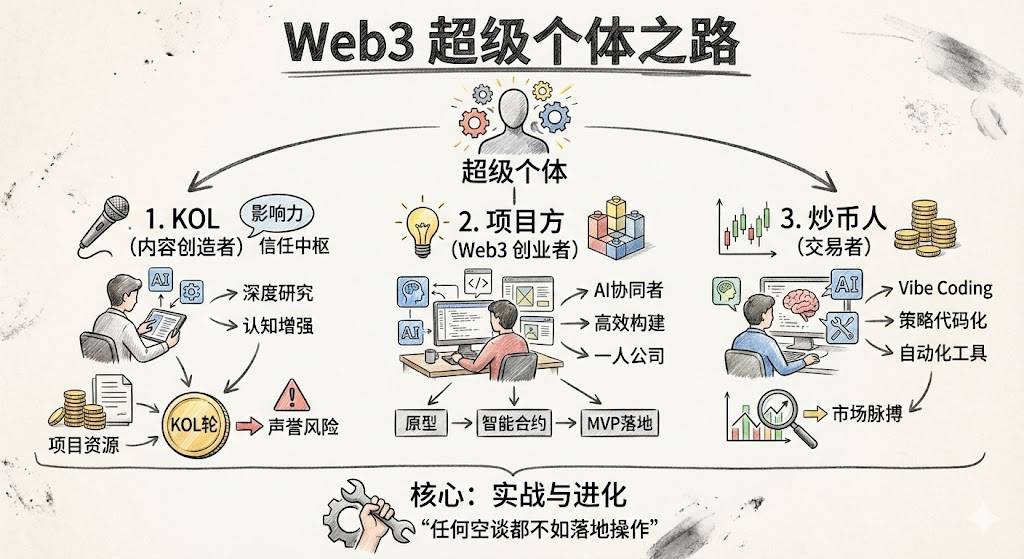

How to Become a Web3 Super Individual?

A Personal Awakening Guide for the AI+Crypto Era.