- GOAT’s recent surge reflects strong investor interest in AI-driven cryptocurrencies.

- Key support at $0.00003611 and resistance near $0.000048 shape price movements.

- Liquidations of $2.44M signal volatile trading conditions for GOAT in the market.

The rise of AI-driven cryptocurrencies continues, and GOAT is leading the way. GOAT has recently broken its all-time high (ATH) and is surging.

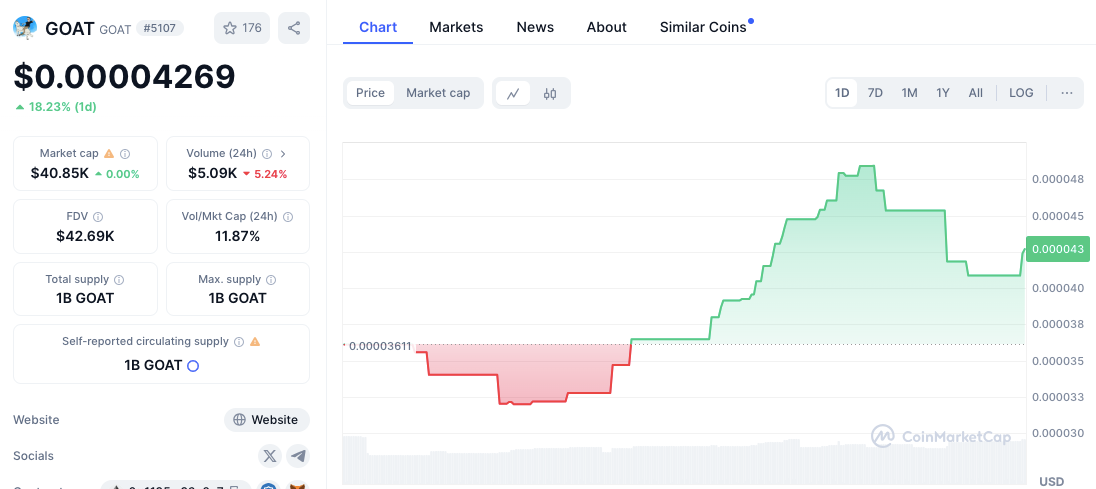

Currently trading at $0.00004269 , it has experienced an impressive 18.23% increase in the past 24 hours. This sudden surge follows a low of $0.00003611, showcasing a recovery that many traders are excited about. With a market cap of $40.85K and a fully diluted valuation of $42.69K, GOAT is proving to be more than just a passing trend.

Market Activity and Price Movements

The trading activity around GOAT has been notably volatile, oscillating between $0.00003611 and $0.000048. This price fluctuation indicates strong market interest. Recent data shows a 24-hour trading volume of $5.09K, reflecting a decline of 5.24%.

Source: Coinmarketcap

Source: Coinmarketcap

However, the derivatives market tells a different story. Trading volume has surged by 264.39% to $682.53M, and open interest has climbed 139.01% to $48.96M. This shows growing confidence among traders, despite some price retracement.

Key Support and Resistance Levels for GOAT

To understand potential price movements, it’s important to identify key support and resistance levels. The price of $0.00003611 is a significant support level, marking the low point before the current recovery.

Read also : Arthur Hayes Apes Into GOAT Coin as Solana Meme Token Surges 270%

The psychological level of $0.000040 could act as interim support. On the other hand, the resistance level at $0.000048 presents a challenge, as the price recently retraced from this point. The minor resistance at $0.000045 could also slow down upward momentum.

Liquidation Insights and Market Sentiment

Liquidation data provides further insights into GOAT’s market performance. According to Coinglass , total liquidations in the past 24 hours were $2.44M, with $1.45M from longs and $997.29K from shorts.

Read also : Beyond Bitcoin: Exploring DePIN, AI, Memecoins, RWA, and GameFi

In the last four hours, $400.88K were liquidated. The Binance GOAT/USDT pair has a high long/short ratio of 2.3003 for accounts and 2.0506 for top traders. However, the lower ratio of 1.52 on OKX shows differing trader sentiment across platforms.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.