Bitwise Alpha Head of Strategy: a modest BTC allocation would make the business like gold armor

On October 27th, Jeff Park, Head of Strategy at Bitwise Alpha, posted on the X platform that while some people argue that Microsoft shouldn't be buying Bitcoin to fill its balance sheet, claiming that it would distract them from their core business, they're overlooking a key understanding of modern equity: that a modest allocation of BTC would make the business like a suit of golden armor, much more powerful than any financial engineering available Much more powerful than any available financial engineering, this strategy will make stocks harder to short, expose balance sheets to greater tailwinds of upside in exponential trends, and if one believes in BTC, one understands that Bitcoin actually offers one of the greatest long term cost of capital arbitrage opportunities, especially if you have $70 billion in cash sitting around. Even a 1-5% allocation to BTC won't worry shareholders about losses (and won't affect the volatility of their multiples), but there will be asymmetric financial upside, and board members who don't understand this fiduciary responsibility won't be around long enough to realize that equity is just “return on capital” and doesn't need to be made overly complex by injecting personal interest into it. overcomplicated by injecting personal interests.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

WLFI advisor Ogle purchased 4.87 million VALOR tokens for $10,000

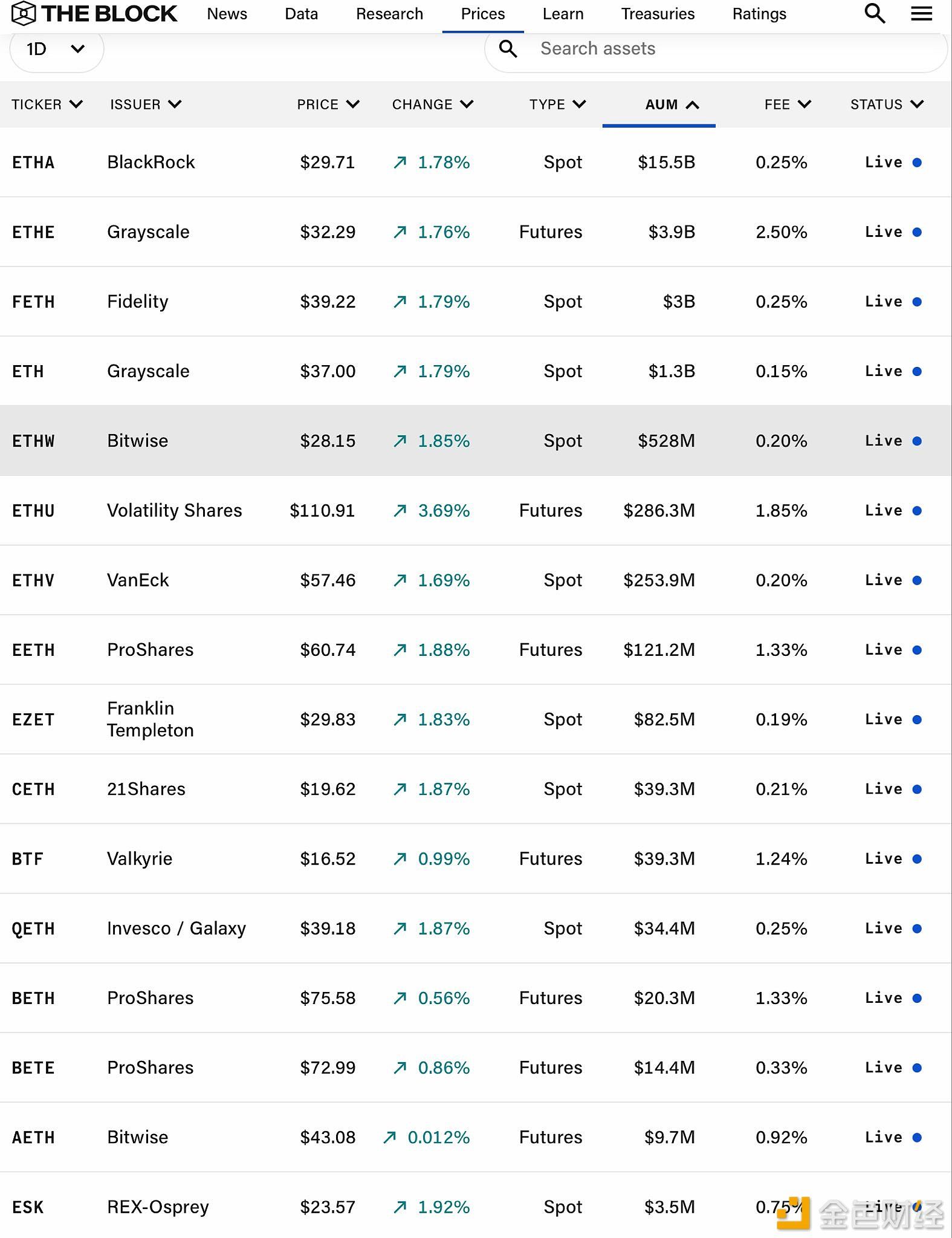

Largest Ethereum ETF and DAT holdings: ETHA $15.5 billions, BMNR $12.7 billions