- TIA holds $4.68 support, eyes $4.80 as traders weigh bullish rebound potential

- Market pauses on TIA as declining volume signals caution in volatile session

- Longs face $3M in liquidations as TIA’s range struggles test trader sentiment

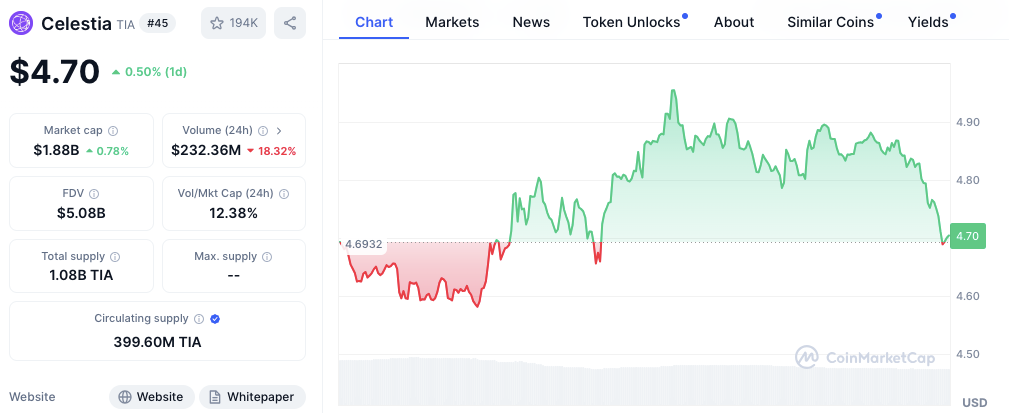

Celestia’s native token, TIA, is attracting attention as traders assess its recent price action. Priced at $4.69 at press time, TIA has fallen 0.27% in the past day, suggesting a volatile environment. This decline reflects a general intraday price pattern where TIA peaks before falling back to its current level.

TIA’s immediate support level is $4.68. This zone has historically helped stabilize the price. If TIA drops below this mark, it could fall further to around $4.50, a critical level that may prevent further declines.

Read also: Celestia Raises $100M, TIA Token Jumps 17% Overnight

Source: Coinmarketcap

Source: Coinmarketcap

On the upside, TIA faces resistance near $4.93, which has limited recent upward momentum. Additionally, $4.80 represents another hurdle, as the price repeatedly tests and retreats from this level during intraday trading. These resistance points will likely determine the upper bounds of TIA’s price action if buyers gain momentum.

Potential Price Scenarios

TIA’s price path depends on its ability to stay above $4.68. If it does, a rally to retest $4.80 is possible, with a subsequent push toward $4.93. A breakout beyond this mark could lead to further gains. However, a drop below $4.68 could trigger a downtrend, targeting the $4.50 support level.

Derivatives Data and Market Sentiment

As per Coinglass data , TIA’s derivatives data reveals a cautious trader sentiment, indicated by declining trading volume and open interest. The 24-hour trading volume fell by 12.46% to $987.69 million, while open interest decreased by 3.71% to $284.20 million. These reductions highlight a market pullback, with traders potentially reacting to recent price volatility.

Moreover, while the long/short ratios on OKX and Binance show a tendency toward long positions OKX at 3.04 and Binance at 2.81 the overall market exhibits a near-parity long/short ratio of 0.9421. This balanced ratio indicates relatively equal interest in both long and short positions.

Notably, long traders faced significant losses, with liquidations totaling $1.03 million and $2.03 million over the past 12 and 24 hours, respectively. Short liquidations were comparatively lower, at $178.69K and $536.52K, suggesting recent price fluctuations may have affected over-leveraged long positions.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.