GCR Suggests He Gamed Donald Trump Polymarket Odds, Whale Dumps $3 Million in Bets

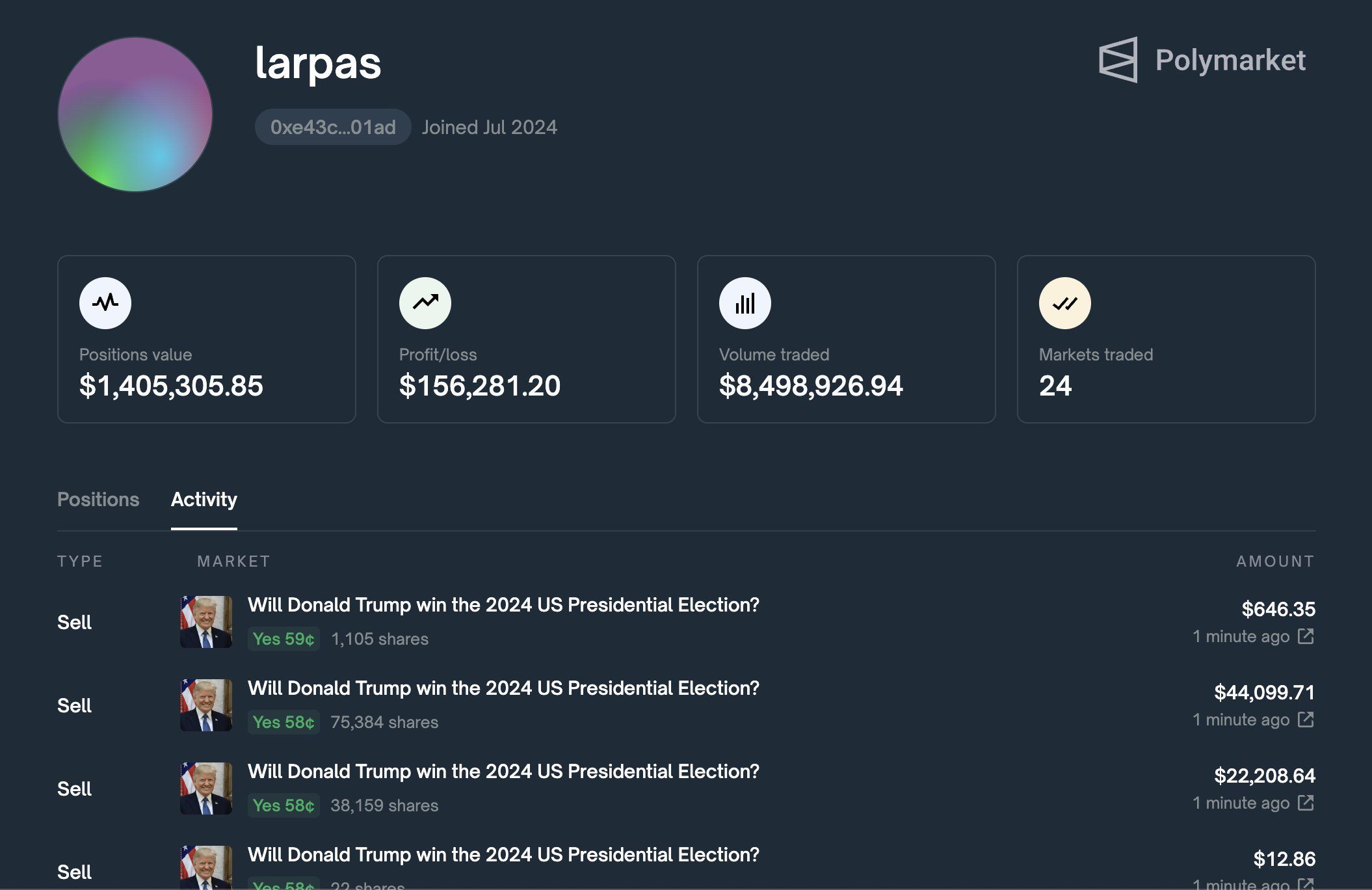

Polymarket whale "larpas" sold $3 million in Trump bets after trader GCR alleged prediction markets skewed odds for right-wing candidates.

On-chain data from Arkham Intelligence shows that larpas, a Polymarket whale, dumped over $3 million in pro-Trump Presidential election bets on Monday. These sales began immediately after GCR suggested he gamed Polymarket odds.

Gambling on the US election has ballooned to a billion-dollar industry on Polymarket and other platforms, but its stated odds might bear little resemblance to reality.

Pro-Trump Bets on Polymarket

According to new data from blockchain analytics firm Arkham Intelligence, Polymarket whale “larpas” sold over $3 million in Presidential election bets. Larpas dumped their bets in favor of Donald Trump to the extent that they impacted Polymarket’s reported odds of a Donald Trump victory. The election in question will take place today; therefore, users will have little time to hedge any bets.

Read More: What is Polymarket? A Guide to The Popular Prediction Market

Larpas Dumping Pro-Trump Polymarket Bets. Source:

Arkham Intelligence

Larpas Dumping Pro-Trump Polymarket Bets. Source:

Arkham Intelligence

Sell-offs began immediately after Giant-Cassocked Rebirth (GCR), a notorious crypto trader, discussed election bets via a social media post. Specifically, GCR suggested that he identified a categorical error in the markets’ ability to assess right-wing candidates correctly and then profited. This aligns with previous rumors that GCR was a major pro-Trump meme coin whale.

“In 2021, I had a conviction that prediction markets would have a right wing skew. Therefore, the expected pricing on the eventual Republican nominee would drift to 65. Therefore, it was max value to bid infinite Trump at below 10% implied odds, knowing it would move to 65+% if my bearish thesis was correct,” GCR stated.

GCR went on to claim that his predictions proved accurate, and he “took profit on [his] positions” after capturing “the meat of the move.” He also recommended that his readers neither use leverage in bets nor engage in reckless gambling.

Read More: How To Use Polymarket In The United States: Step-by-Step Guide

The 2024 Presidential election has spurred political Polymarket bets to a billion-dollar market and shows few signs of letting up. The trade volumes were enticing enough for Robinhood to offer election betting with only a week remaining in the race. Cryptocurrency has taken a prominent role in this electoral cycle, as the electorate is noticeably drifting more pro-crypto.

However, the titanic hype about prediction markets has not translated into accurate odds. Last week, research claimed that Donald Trump’s odds were systematically inflated on the platform.

Up to 30% of trades in favor of Trump are reportedly fake, and whale accounts might push his odds further. In the next 24 hours, GCR might not be the only one to win by gaming prediction markets.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Subscribe to ETH Earn products for dual rewards exclusive for VIPs— Enjoy up to 10% APR and trade to unlock an additional pool of 50,000 USDT

Bitget Spot Margin Announcement on Suspension of SANTOS/USDT, MYRO/USDT, DUSK/USDT, PHB/USDT, ALPINE/USDT Margin Trading Services

CandyBomb x RAVE: Trade futures to share 200,000 RAVE!

Bitget TradFi: Trade gold, forex, and more assets in one account