What’s the market saying about the Trump win?

With respect to today’s FOMC meeting, Powell needs to carefully consider where he wants to attempt guiding yields

This is a segment from the Forward Guidance newsletter. To read full editions, subscribe .

After Trump’s election win was confirmed (and with a likely sweep of Congress), markets began to digest the news.

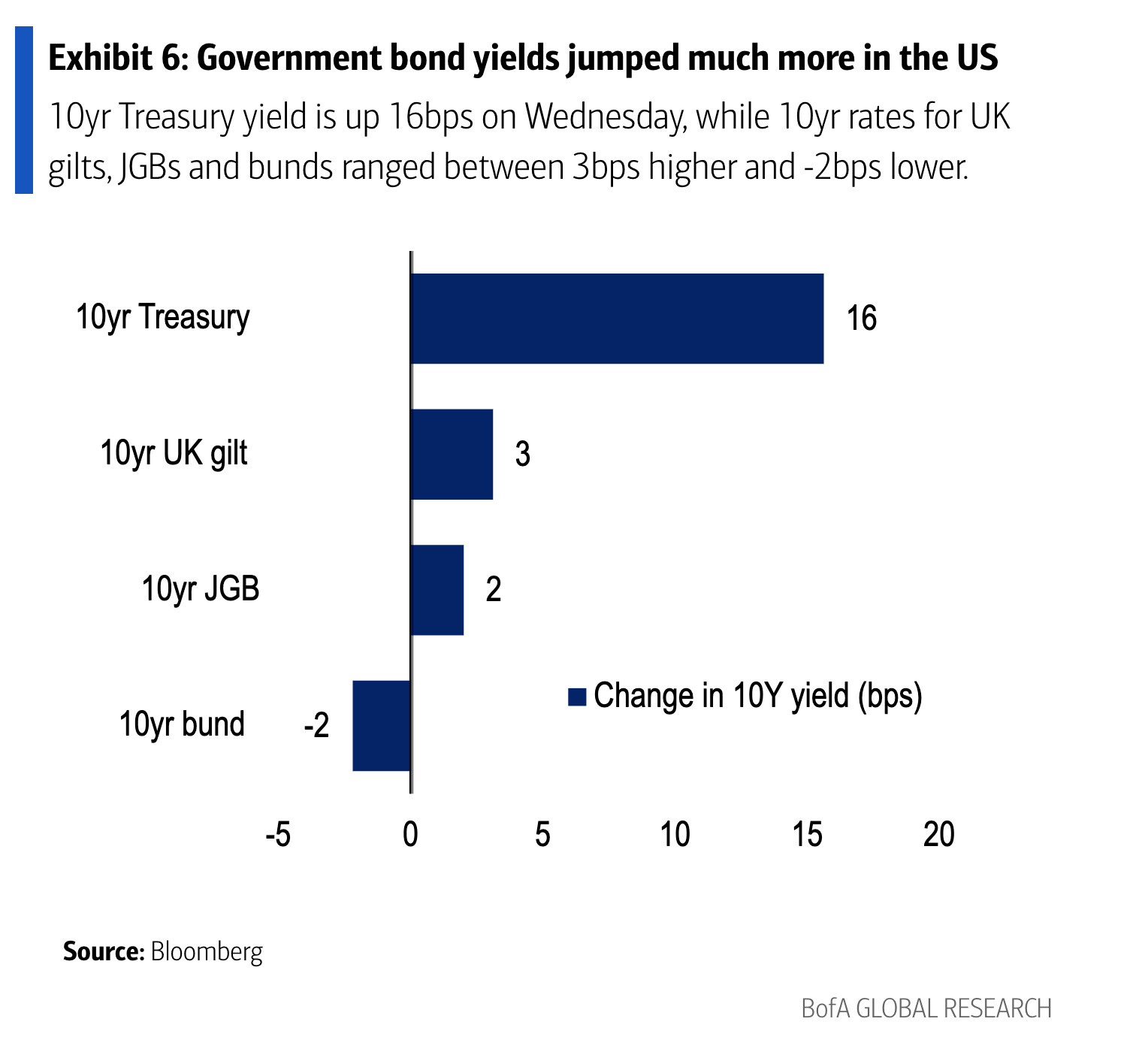

In bond markets, the major factor was a Congress sweep that will allow unrestrained legislation from the Republican party. This — paired with concerns around a re-accelerating economy and potential inflationary policies, such as Trump’s tariffs — sent long bond yields soaring globally, but especially domestically:

At the same time, the DXY soared as global investors anticipated higher nominal growth and a roaring economy in the US. That said, half the move has reversed today alongside a calming down of long bond yields.

Newsletter

Subscribe to Forward Guidance Newsletter

So what does this all mean? And what were the implications for the Fed as it entered its FOMC meeting today?

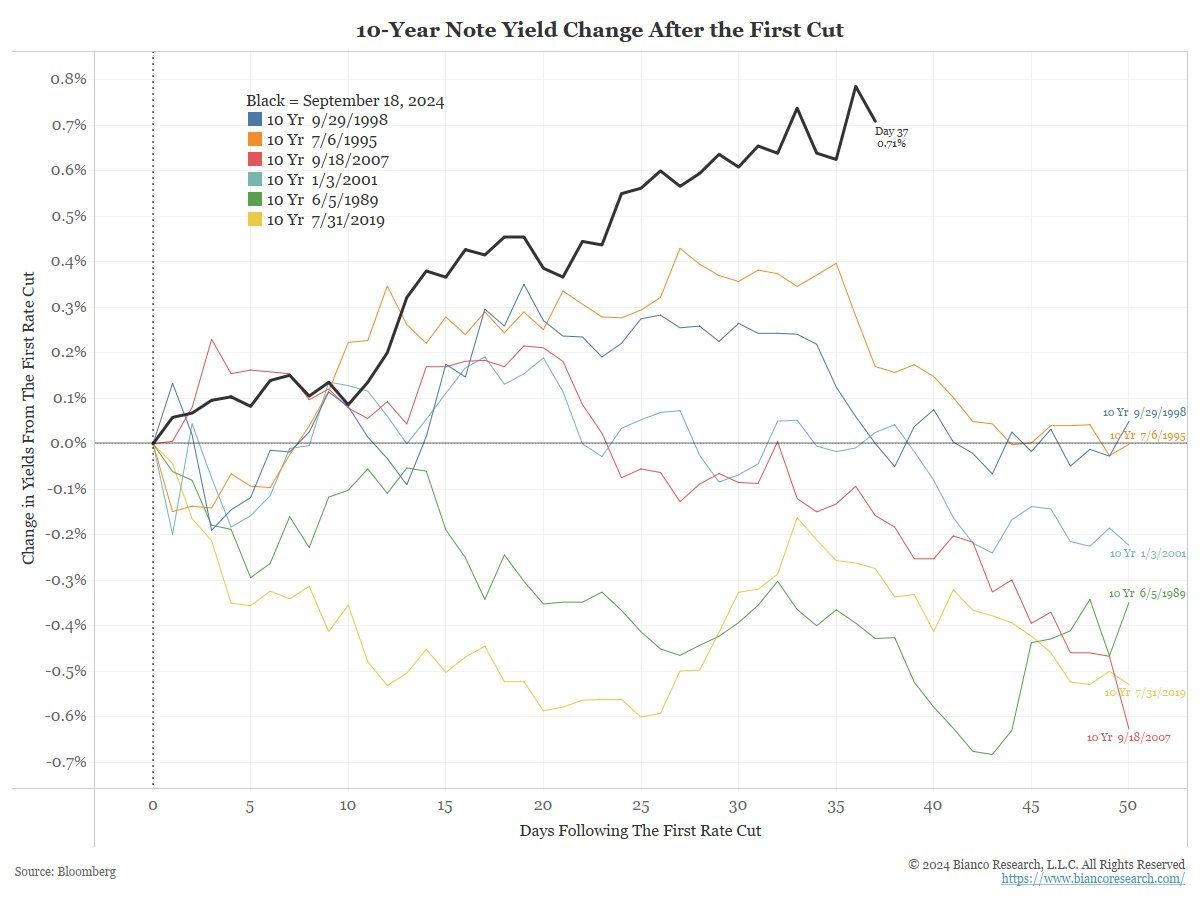

As Jim Bianco shows in the chart below, this reverse in yields on the long end since the Fed’s first rate cut is historic:

Regardless of what the Fed does to the short rate (i.e the fed funds rate), the vast majority of the economy borrows and lends on the long end of the yield curve, such as mortgages.

Therefore, regardless of what happens to the short rate, the surge in long bond yields has been tightening financial conditions.

With respect to today’s FOMC meeting, Powell needs to carefully consider where he wants to attempt to guide yields. There are currently two evolving approaches:

Andy Constan of Damped Spring Advisors believes that for yields to come down and counter-intuitively ease financial conditions, the Fed needed to be more hawkish today and potentially pause its cuts. In his view, more rate cuts could actually tighten conditions as bond vigilantes show up and send bond yields higher — doing the tightening the Fed refuses to do.

On the other side is Tom Lee , who believes the Fed needs to be even more dovish. This is because a large portion of what comprises the price of long bond yields is expectations on short rates for the maturity of the bond.

With the FOMC’s 25bps cut today and no signal yet of an end to QT, it’s looking likely the Fed will continue to wait and observe how its current rate-cutting path transpires and is digested by markets.

Start your day with top crypto insights from David Canellis and Katherine Ross. Subscribe to the Empire newsletter .

Explore the growing intersection between crypto, macroeconomics, policy and finance with Ben Strack, Casey Wagner and Felix Jauvin. Subscribe to the Forward Guidance newsletter .

Get alpha directly in your inbox with the 0xResearch newsletter — market highlights, charts, degen trade ideas, governance updates, and more.

The Lightspeed newsletter is all things Solana, in your inbox, every day. Subscribe to daily Solana news from Jack Kubinec and Jeff Albus.

- Donald Trump

- FOMC

- Forward Guidance newsletter

- Interest Rates

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

New spot margin trading pair — HOLO/USDT!

FUN drops by 32.34% within 24 hours as it faces a steep short-term downturn

- FUN plunged 32.34% in 24 hours to $0.008938, marking a 541.8% monthly loss amid prolonged bearish trends. - Technical breakdowns, elevated selling pressure, and forced liquidations highlight deteriorating market sentiment and risk-off behavior. - Analysts identify key support below $0.0080 as critical, with bearish momentum confirmed by RSI (<30) and MACD indicators. - A trend-following backtest strategy proposes short positions based on technical signals to capitalize on extended downward trajectories.

OPEN has dropped by 189.51% within 24 hours during a significant market pullback

- OPEN's price plummeted 189.51% in 24 hours to $0.8907, marking its largest intraday decline in history. - The token fell 3793.63% over 7 days, matching identical monthly and yearly declines, signaling severe bearish momentum. - Technical analysts cite broken support levels and lack of bullish catalysts as key drivers of the sustained sell-off. - Absence of stabilizing volume or reversal patterns leaves the market vulnerable to further downward pressure.

New spot margin trading pair — LINEA/USDT!