- Bitcoin’s breakout from the re-accumulation phase signals the start of its parabolic growth cycle, historically lasting a year.

- Institutional interest in Bitcoin surges as exchange balances shrink, indicating strong investor confidence and reduced selling pressure.

- Analysts predict Bitcoin could peak at $84K by December 2024, driven by historical post-halving trends and robust market dynamics.

According to an analysis by Rekt Capital, Bitcoin (BTC) has entered the final phase of its halving cycle. Bitcoin recently broke out of its re-accumulation range, signaling an imminent transition into a parabolic uptrend. Historically, this phase has driven Bitcoin’s most significant price gains, typically lasting over a year.

Bitcoin Halving and Market Phases

Rekt Capital outlines three distinct phases of the Bitcoin halving cycle. The first is the pre-halving retrace, which has historically seen Bitcoin pull back by significant margins. In 2024, Bitcoin experienced two retraces of 18% each before halving. These retraces set the stage for the second phase, known as re-accumulation.

Related: Bitcoin (BTC) Price Prediction 2024-2030: Will BTC Price Hit $100,000 Soon?

The re-accumulation phase consolidates Bitcoin’s price within a specific range, allowing the market to stabilize. This phase is crucial as it forms the foundation for the parabolic uptrend. Investors often become impatient during this period, as price movements remain subdued.

Transition to Parabolic Growth

Bitcoin’s breakout from the re-accumulation range signals the onset of the parabolic phase. This phase has historically seen accelerated growth, pushing Bitcoin to new all-time highs. According to Rekt Capital, previous parabolic phases have lasted around 385 days. However, current market conditions suggest an accelerated cycle could shorten this duration.

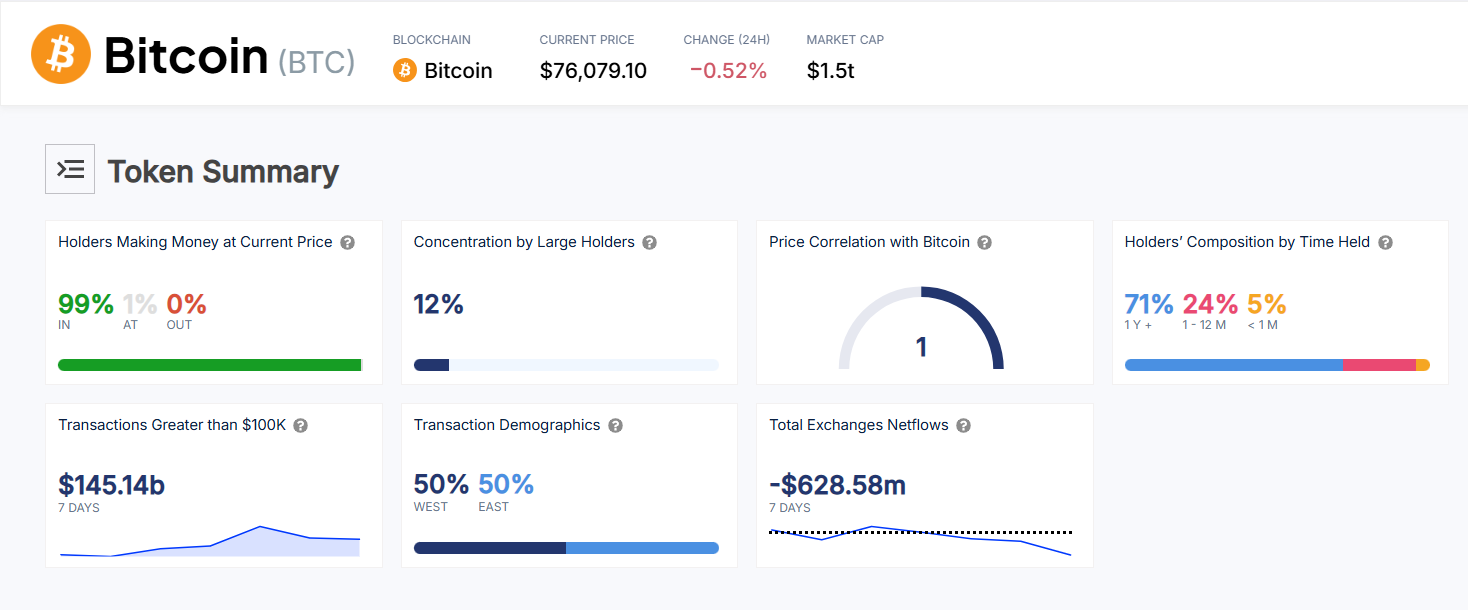

Bitcoin is priced at $75,982.92 , with a market capitalization of over $1.5 trillion. Despite a minor 24-hour dip of 0.03%, bullish sentiment dominates the market. The Crypto Fear and Greed Index holds steady at 75, indicating strong investor confidence. Additionally, Bitcoin dominance has decreased by 3.65%, potentially signaling a shift in focus toward altcoins.

Source: IntoTheBlock

Source: IntoTheBlock

Institutional activity has surged, with options interest and CME BTC futures positions seeing significant increases. Moreover, Bitcoin exchange balances are shrinking, a bullish indicator as investors move their holdings to cold storage.

Price Projections and Market Outlook

Changellyblog analysts predict that Bitcoin could hit a minimum of $59,821.02 by December 2024. The maximum projected peak for the month is $84,052.07, with an average trading value of $71,936.55. These projections align with historical post-halving trends, which have consistently led to substantial rallies.

Bitcoin’s strong fundamentals, coupled with reduced selling pressure, suggest a bullish outlook for the coming months. Bitcoin’s trajectory indicates that it is on the brink of a parabolic uptrend. With historical patterns and market dynamics aligning, the stage is set for substantial growth.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.