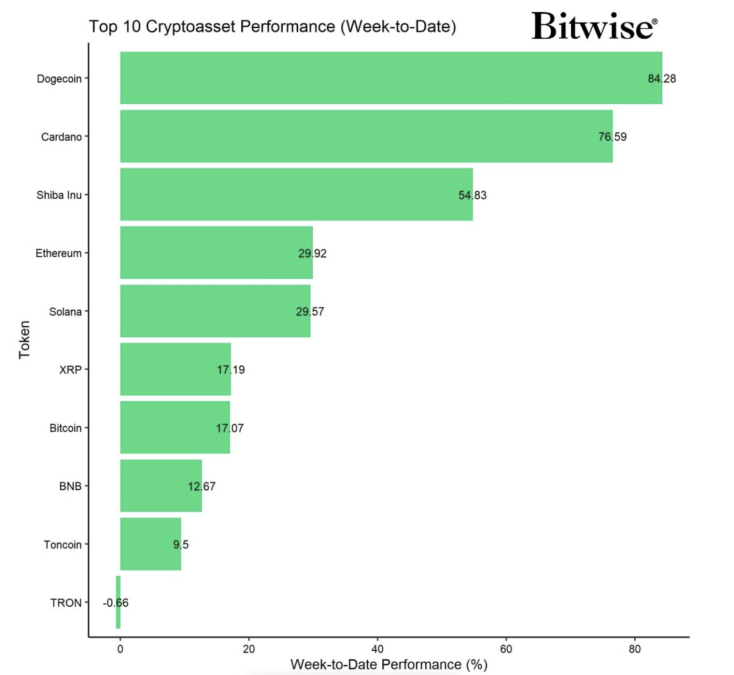

DOGE, ADA and SHIB surge past BTC in weekly rally amid expected regulatory changes

Dogecoin, cardano, and shiba inu have outperformed bitcoin over the past week, surging 80%, 85%, and 50% respectively, amid a broader altcoin rally, amid reduced regulatory uncertainty, analysts said.Bitwise Europe reports that bitcoin whales have recently resumed accumulation, moving a net -17,400 BTC off exchanges, while miners’ limited exchange activity is helping stabilize prices.

Dogecoin, cardano, and shiba inu have outperformed bitcoin over the past week, driven by an altcoin rally amid reduced regulatory uncertainty following Donald Trump’s election victory, analysts say.

Dogecoin surged over 80%, cardano climbed more than 85%, and shiba inu rose over 50% in the past week, while bitcoin gained around 20% over the same period, according to The Block’s Price's Page .

Bitwise European Head of Research Europe André Dragosch noted that some altcoins appear more responsive to regulatory outlook shifts.

"With Elon Musk potentially heading the Department of Government Efficiency in Trump’s new administration, sentiment has lifted for tokens like Dogecoin, which Musk has championed in the past," Dragosch said.

He added that the prospect of a lighter regulatory approach could boost memecoins like dogecoin and shiba inu along with other altcoins previously seen as vulnerable to heavy regulation.

"There is generally a decline in regulatory uncertainty anticipated with the new Trump administration which should benefit memecoins and other altcoins subject to tougher regulation," Dragosch told The Block.

Bitwise Europe analysts added in a Monday report that around 80% of tracked tokens across the altcoin market outperformed bitcoin in the past week, consistent with ether's recent outperformance against the largest cryptocurrency by market cap.

In addition, some election-themed memecoins like Peanut the Squirrel (ticker: PNUT) and Department of Government Efficiency (DOGE) have posted notable weekly gains since Trump’s win, up 797% and 301%, respectively, according to Coingecko data . The Peanut the Squirrel memecoin is inspired by the controversial euthanasia of a pet squirrel seized by New York's Department of Environmental Conservation, an event that became a rallying cry for Republicans. Similarly, the Department of Government Efficiency memecoin is based on Elon Musk’s potential involvement in a possible new initiative under the Trump administration, with Musk expressing support for improving government efficiency.

Dogecoin, Cardano, and Shiba Inu have surged past Bitcoin in a weekly rally, fueled by reduced regulatory uncertainty. Image: Bitwise Europe.

Whale activity and futures trends indicate sustained market optimism

Bitwise Europe’s latest report indicates that bitcoin whales—entities holding at least 1,000 BTC—have recently shifted from selling to accumulating the digital asset.

“Whales moved a net -17,400 Bitcoin off exchanges last week, showing a pattern of renewed accumulation,” Bitwise Europe analysts said. They added that bitcoin miners remain largely inactive on exchanges, reducing selling pressure and supporting price stability.

Additionally, the analysts observed a notable increase in Bitcoin’s perpetual futures funding rates , reaching levels not seen since March 2024. This elevated funding rate—currently around 0.04% on Bitmex and 0.03% on Binance—reflects a strongly bullish sentiment among leveraged traders.

Deribit CEO Luuk Strijers added that the high funding rate signals growing confidence in the crypto markets, especially among institutional investors.

"Perpetual futures are outpacing spot markets, showing heightened enthusiasm among investors,” Strijers told The Block.

Outlier Ventures Research Lead Jasper De Maere commented that open interest in bitcoin futures has surged, further signaling an increase in bullish positioning. "The uptick in open interest and positive funding rates could continue as bullish sentiment holds strong," he told The Block.

In addition, the 3-month annualized basis for Bitcoin futures recently hit 13.3%, the highest since June 2024, underscoring investors' optimistic medium-term positioning.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

New spot margin trading pair — HOLO/USDT!

FUN drops by 32.34% within 24 hours as it faces a steep short-term downturn

- FUN plunged 32.34% in 24 hours to $0.008938, marking a 541.8% monthly loss amid prolonged bearish trends. - Technical breakdowns, elevated selling pressure, and forced liquidations highlight deteriorating market sentiment and risk-off behavior. - Analysts identify key support below $0.0080 as critical, with bearish momentum confirmed by RSI (<30) and MACD indicators. - A trend-following backtest strategy proposes short positions based on technical signals to capitalize on extended downward trajectories.

OPEN has dropped by 189.51% within 24 hours during a significant market pullback

- OPEN's price plummeted 189.51% in 24 hours to $0.8907, marking its largest intraday decline in history. - The token fell 3793.63% over 7 days, matching identical monthly and yearly declines, signaling severe bearish momentum. - Technical analysts cite broken support levels and lack of bullish catalysts as key drivers of the sustained sell-off. - Absence of stabilizing volume or reversal patterns leaves the market vulnerable to further downward pressure.

New spot margin trading pair — LINEA/USDT!