Viewpoint: BlackRock's IBIT options launched today, providing a foundation for BTC to rise

QCP Capital released a research report stating that Nasdaq will begin listing options for the BlackRock Bitcoin Spot ETF (stock code: IBIT) today. This marks a significant milestone in the bitcoin derivatives market, as derivatives of traditional assets often grow to 10-20 times the market value of the underlying market.

This development is expected to attract a new wave of institutional investors who face restrictions on entering domestic cryptocurrency options markets such as Deribit. These investors may focus on generating returns from their long-term spot ETF holdings, which could further compress implied volatility. This reflects the trend of institutions using MicroStrategy as a proxy for Bitcoin exposure.

Third-quarter 13F filings show that MicroStrategy's institutional holders surged from 667 to 738, with Vanguard increasing its holdings by nearly 16 million shares, an increase of up to 1000%. Among all these positive factors, Goldman Sachs also plans to divest its digital asset platform, further highlighting the increasing integration of cryptocurrencies and traditional finance. We believe this can provide the necessary foundation for BTC's rise.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Glassnode: Ethereum spot ETF shows signs of recovery, with moderate inflows suggesting redemption pressure has eased

Bitcoin rewards app Lolli now supports withdrawals on the Lightning Network

Nasdaq-listed Lion Group spends $8 million to purchase 88.49 bitcoins

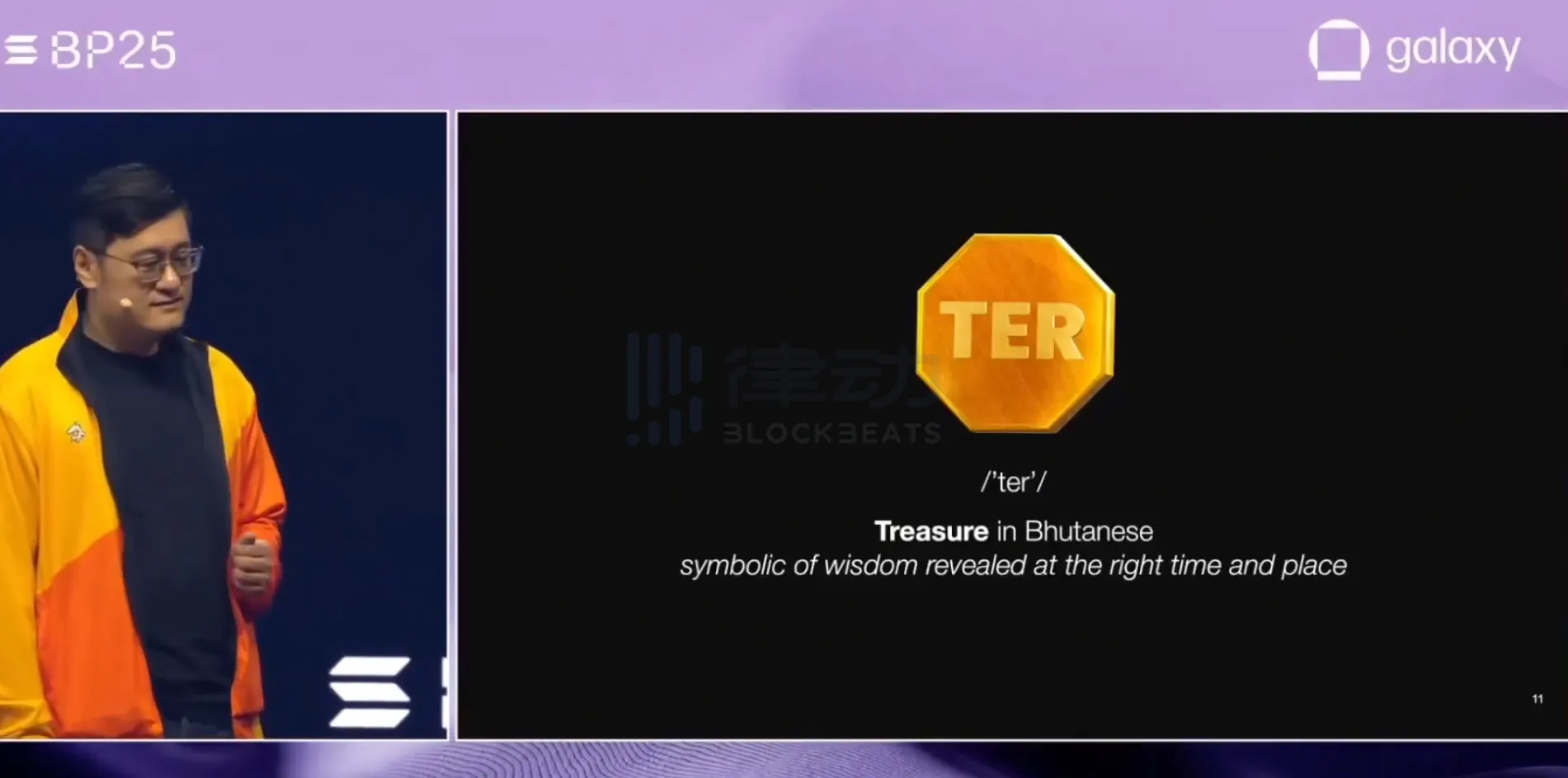

Bhutan announces the launch of the world's first sovereign-backed gold token TER on Solana