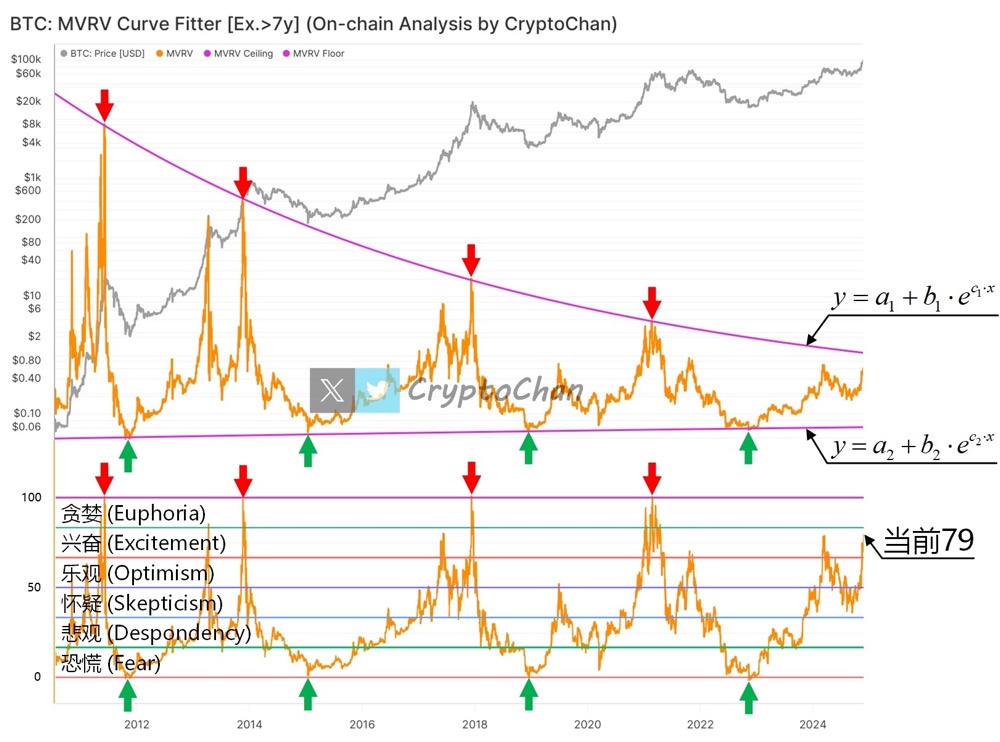

Precision top escape bottom fishing artifact? Bitcoin MVRV indicator appears again, currently scoring 79.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Top VC a16z Discusses the Truth About Crypto Hiring: Crypto Veterans vs. Cross-Industry Experts, Who Is the Real Winner?

The article discusses the challenges faced by the crypto industry in recruiting talent, analyzes the advantages of crypto-native talent versus traditional tech talent, and provides recruitment strategies and onboarding advice. Summary generated by Mars AI. This summary is generated by the Mars AI model, and the accuracy and completeness of its content are still in the process of iterative updates.

‘Certainty Assets’ in a Bear Market? Fair3 Uses On-Chain Insurance to Unlock a New Wave of Buying Logic

The article discusses the frequent occurrence of rug pull incidents in the crypto industry and their impact on investors. It introduces the decentralized insurance mechanism of the Fair3 Fairness Foundation, which provides protection through on-chain transparency, position-linked guarantees, and community governance. This mechanism may potentially change the operational logic of tokenomics. Summary generated by Mars AI This summary is generated by the Mars AI model. The accuracy and completeness of its content are still in the iterative updating stage.

Fluence DePIN Day 2025: Building the Cornerstone of Future Web3 Infrastructure

The 12th DePIN Day will be held in Singapore in October, focusing on how decentralized technology is reshaping real-world infrastructure. The event is co-hosted by Fluence and Protocol Labs and will bring together top builders and thinkers from around the world. Summary generated by Mars AI. This summary is generated by the Mars AI model, and the accuracy and completeness of its content are still being iteratively improved.

FED's Kashkari confident in achieving inflation targets