WisdomTree files for XRP ETF with Delaware Trust Filing

WisdomTree files for a Delaware trust to launch an XRP ETF, joining Bitwise and Canary Capital as SEC leadership changes spark hope for crypto ETF approvals.

WisdomTree, a global asset manager overseeing around $113 billion in assets, has initiated the process for launching an XRP ETF.

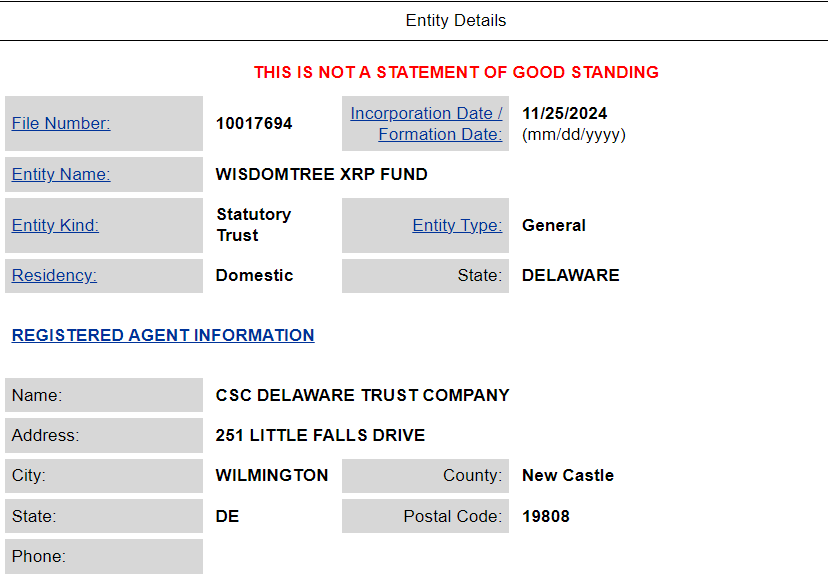

The firm recently filed for a trust entity in Delaware, a necessary precursor before submitting a formal application to the SEC.

Increasing Optimism for XRP ETF Approvals

This move positions WisdomTree alongside other asset managers entering the XRP ETF market. Bitwise filed for a similar product last month. The trust emphasized that it uses cold storage for most of its XRP holdings to ensure investor’s security.

In October, Canary Capital also applied to launch a spot XRP ETF. The fund would track XRP’s price using a benchmark index, pulling data from regulated exchanges.

Now, WisdomTree has become the third, and potentially the largest asset manager to apply for an XRP ETF. Unlike Bitwise and Canary Capital, the proposed ETF aims to track XRP’s market performance.

WisdomTree XRP ETF Filing. Source:

State of Delaware Official Website

WisdomTree XRP ETF Filing. Source:

State of Delaware Official Website

WisdomTree has yet to disclose an exchange listing or a ticker symbol for the fund.

“I have confirmed with the company this is a legitimate filing. Wisdom Tree has over $100 billion in assets under management,” FOX Business journalist Eleanor Terrett wrote on X (formerly Twitter)

Meanwhile, XRP has regained momentum in the bull market following Gary Gensler’s resignation from the SEC earlier this month. The token has surged by nearly 180% in November, reaching its highest price in over three years.

The leadership changes at the SEC could shift the agency’s stance on digital assets. Ripple Labs’ legal challenges with the SEC have underscored the need for regulatory clarity, and Gensler’s departure might ease restrictions on XRP ETFs.

Ripple has consistently highlighted XRP’s potential for institutional adoption. The firm’s CEO Brad Garlinghouse previously expressed optimism about the eventual approval of an XRP fund. He called it an inevitable development for the asset class.

Furthermore, XRP is not the only digital asset looking for ETF approval after the success of Bitcoin and Ethereum ETFs. VanEck and 21Shares have also filed for Solana ETFs. The SEC currently has a deadline of January 6, 2025, to decide on these applications.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

New spot margin trading pair — HOLO/USDT!

FUN drops by 32.34% within 24 hours as it faces a steep short-term downturn

- FUN plunged 32.34% in 24 hours to $0.008938, marking a 541.8% monthly loss amid prolonged bearish trends. - Technical breakdowns, elevated selling pressure, and forced liquidations highlight deteriorating market sentiment and risk-off behavior. - Analysts identify key support below $0.0080 as critical, with bearish momentum confirmed by RSI (<30) and MACD indicators. - A trend-following backtest strategy proposes short positions based on technical signals to capitalize on extended downward trajectories.

OPEN has dropped by 189.51% within 24 hours during a significant market pullback

- OPEN's price plummeted 189.51% in 24 hours to $0.8907, marking its largest intraday decline in history. - The token fell 3793.63% over 7 days, matching identical monthly and yearly declines, signaling severe bearish momentum. - Technical analysts cite broken support levels and lack of bullish catalysts as key drivers of the sustained sell-off. - Absence of stabilizing volume or reversal patterns leaves the market vulnerable to further downward pressure.

New spot margin trading pair — LINEA/USDT!