-

Cardano holders are showcasing their confidence as approximately $100 million has been pulled from exchanges in just two days, signaling bullish behavior.

-

Recent on-chain data indicates a surge in trading activity among once-dormant tokens, suggesting that investor sentiment remains strongly positive.

-

“ADA’s price has formed a bull flag on the 4-hour chart,” asserts a COINOTAG source, predicting a potential rally toward $2.

Cardano holders demonstrate bullish conviction as $100 million exits exchanges, hinting at a possible rally. Will ADA climb back to $2?

Cardano’s Investors Maintain Bullish Confidence Amidst Market Corrections

Currently, Cardano’s price stands at $0.98, a minor dip from its recent peak of $1.15, largely attributed to the wider cryptocurrency market fluctuations, including Bitcoin’s fall below $95,000. Nonetheless, investors appear unfazed, as evidenced by significant withdrawals from exchanges.

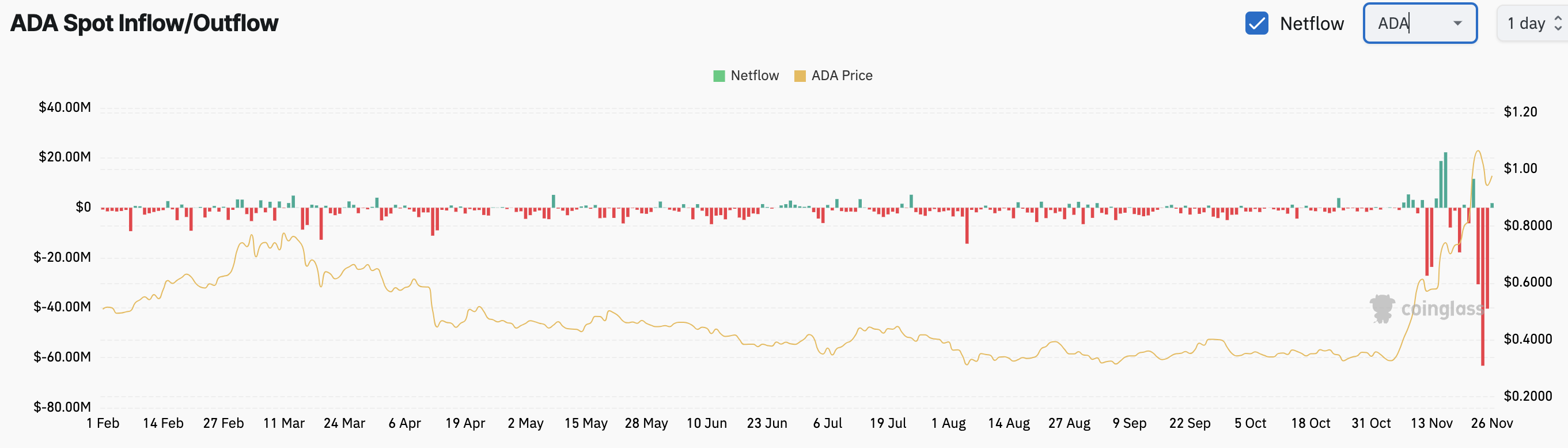

As detailed in Coinglass data, the ADA Spot Inflow/Outflow ratio is at -$40 million, improving from -$63 million observed earlier on November 25. This decline in outflow indicates that Cardano bulls have removed nearly $100 million from exchanges within two days, which typically reflects a lack of intention to sell and suggests potential upward price pressure.

When investors withdraw their assets from exchanges, it often implies they anticipate price increases, contrasting with inflows, which might indicate selling pressure. Such dynamics play a crucial role in shaping market sentiment.

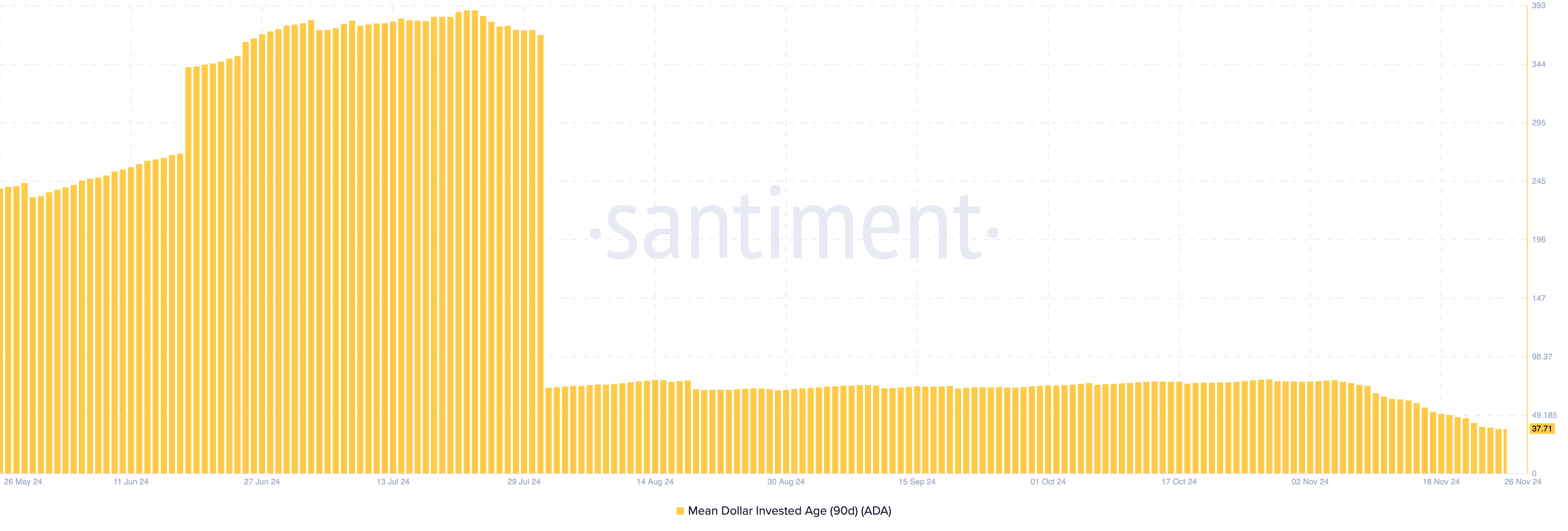

Should this outflow trend continue, Cardano’s price may witness a short-term rebound. Supporting this potential is another indicator known as the Mean Dollar Invested Age (MDIA).

The MDIA metric reflects the average duration that tokens have remained on the blockchain, weighted by their acquisition price. An increase in MDIA suggests that tokens are experiencing stagnation, making it challenging for prices to fluctuate significantly. However, for Cardano, a notable decrease in the 90-day MDIA hints at a resurgence of trading activity among previously inactive coins, potentially paving the way for ADA to rise as buying pressure builds.

ADA Price Prediction Suggests Continued Uptrend

The 4-hour ADA chart reveals the formation of a bull flag, a bullish technical pattern characterized by two notable price spikes divided by a brief consolidation period. Initially rising sharply creates the flagpole, influenced by robust buying momentum. This is followed by a pullback, forming a rectangular flag, which signifies a continuation of the preceding upward trend upon breakout.

Considering the current market dynamics and technical formation, Cardano bulls could potentially push prices above $1.15. A successful breakout could see ADA targeting the $2 range. Conversely, increased selling pressure could drive the price down to $0.85.

Conclusion

In summary, with approximately $100 million leaving exchanges, increased trading activity among dormant tokens, and the emergence of bullish technical patterns, Cardano appears positioned for potential growth. Should positive sentiment persist, ADA’s price could see significant upward movement, presenting a compelling opportunity for both existing and prospective investors.