Cardano’s 27% Surge Brings 32 Billion Coins into Profit Zone

Cardano’s 27% surge has moved 88% of ADA’s circulating supply into profit, creating a sell-off risk. If profit-taking prevails, ADA may test support at $0.93.

Cardano’s ADA has surged by 27% in the past week, pushing a significant portion of its circulating supply into profit.

However, this could threaten ADA’s uptrend, as holders may be tempted to sell and secure their gains.

Cardano’s Supply in Profit Spikes

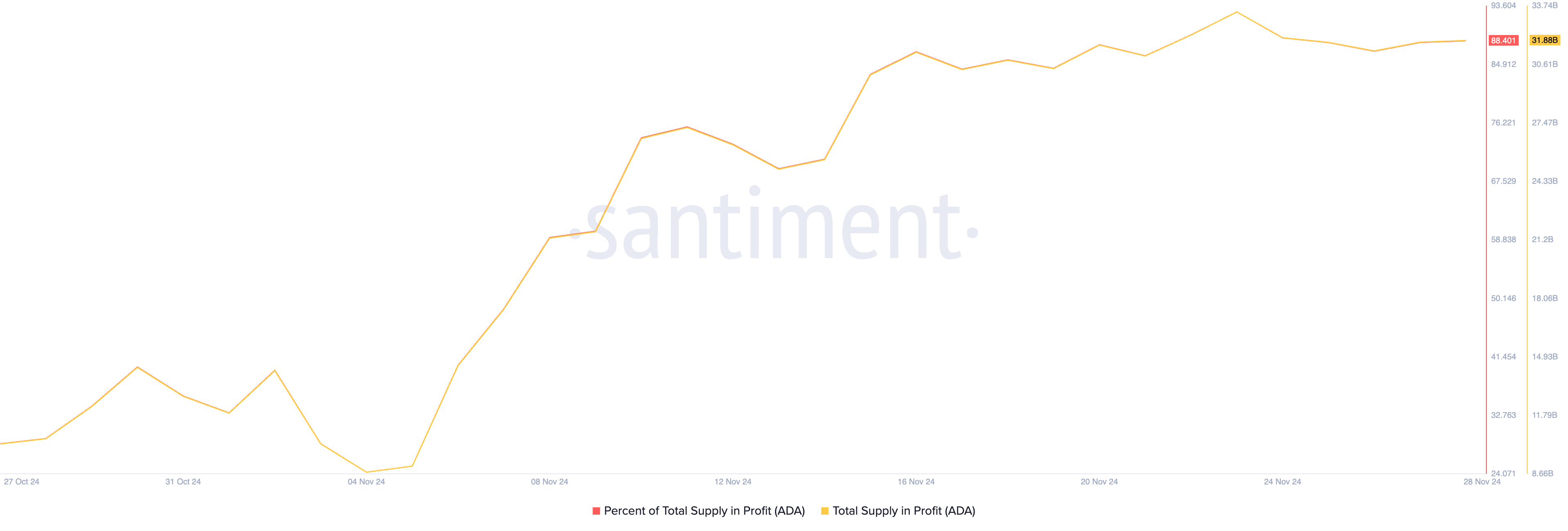

Cardano’s double-digit rally over the past week has pushed a substantial portion of the coin’s circulating supply into the profit area. At current market prices, investors hold 32 billion ADA coins worth $31 billion in profit, accounting for 88.40% of ADA’s circulating supply.

For context, at the beginning of the month, only 40% of all ADA coins in circulation were held in profit. However, while this represents bullish momentum in the coin’s market, it has risks. When a significant portion of an asset’s supply moves into profit, it can trigger profit-taking behavior as holders sell to lock in gains.

ADA Total Supply in Profit. Source:

Santiment

ADA Total Supply in Profit. Source:

Santiment

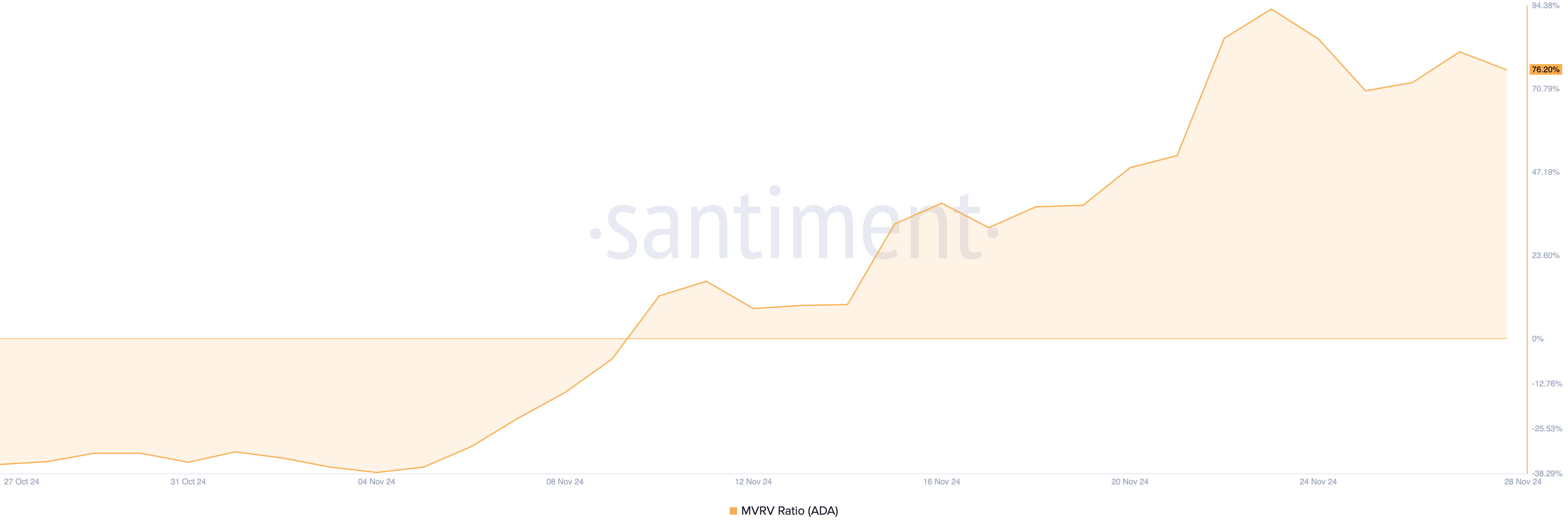

An assessment of ADA’s market value to realized value (MVRV) ratio confirms this risk. According to Santiment’s data, ADA’s current MVRV ratio is 76.20%.

This MVRV ratio suggests that ADA is overvalued, as its market value is significantly higher than its realized value. Therefore, if all coin holders were to sell, they would, on average, realize 76.20% profit.

ADA MVRV Ratio. Source:

Santiment

ADA MVRV Ratio. Source:

Santiment

ADA Price Prediction: A Decline to $0.79 or Rally Above $1?

At press time, ADA trades at $0.98, sitting above support at $0.93. If profit-taking activity commences, the coin’s price will attempt to test this support level. If it fails to hold, the downward trend receives confirmation, and ADA dips further to $0.79.

ADA Price Analysis. Source:

TradingView

ADA Price Analysis. Source:

TradingView

On the other hand, if market participants refrain from profit-taking, this may propel ADA’s price above $1 to trade at $1.15, a level it last reached in April 2022.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Sol Strategies rings the 'STKE' listing bell: Solana's Wall Street debut

The Death of Charlie Kirk: America Lost the "Young Salesman" of the Crypto World