BItcoin Could Surpass $150,000 This Cycle, According to VanEck CEO

Jan van Eck, CEO of global investment firm VanEck, has forecasted that Bitcoin could reach a price between $150,000 and $180,000 during the current market cycle.

He attributes this projection to Bitcoin’s halving events, which have historically driven substantial price gains by reducing the rate of new supply. Van Eck also views Bitcoin as a unique “value transfer network,” where increased usage and adoption drive its overall value. He suggested that Bitcoin could eventually rival gold as a store of value, potentially reaching half of gold’s market capitalization. If gold’s value holds steady, this would place Bitcoin’s price at over $400,000 in future cycles.

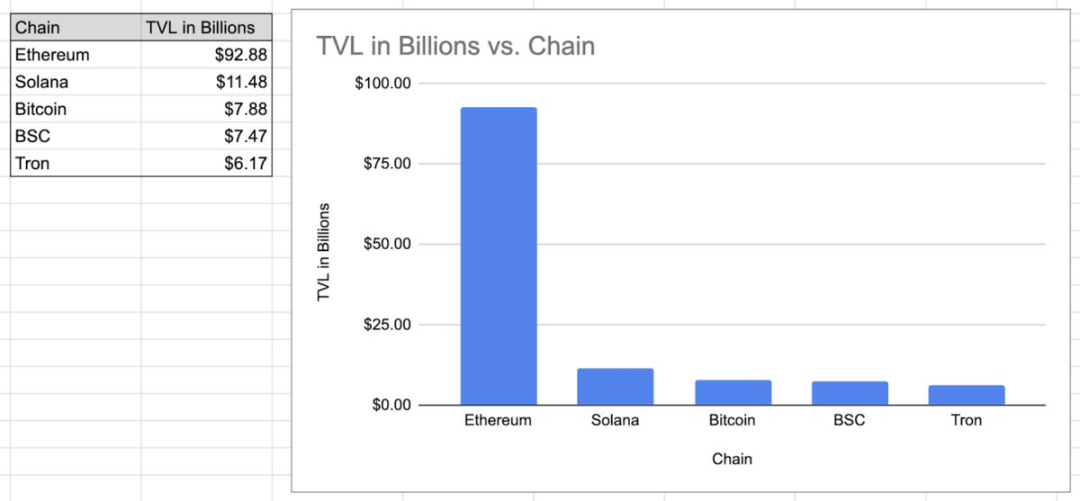

Beyond Bitcoin, van Eck highlighted the importance of stablecoins, describing them as one of the most transformative developments in the cryptocurrency sector. These assets, often pegged to fiat currencies, have gained significant traction due to their utility in facilitating transactions and providing liquidity.

Van Eck also emphasized the growing role of institutional investors in crypto, particularly in regions with clearer regulatory frameworks, such as Europe and Asia. He noted that this interest is further reflected in strong inflows into VanEck’s token-based exchange-traded products tied to blockchain networks like Solana and Sui .

READ MORE:

Crypto Experts Predict Unprecedented Bull Market in 2025Despite his optimism, van Eck acknowledged challenges facing Bitcoin and the broader market. Bitcoin’s strong correlation with the NASDAQ has discouraged some investors seeking diversification, as its price movements often mirror those of tech stocks. Additionally, while retail enthusiasm for memecoins remains high, van Eck remarked that these assets hold little appeal for institutional investors, who prefer projects with stronger fundamentals.

Regulation remains a critical factor shaping the industry’s future. Van Eck praised Europe’s proactive regulatory approach, contrasting it with the restrictive environment in parts of the U.S., such as New York. He predicted that regulatory competition between regions will intensify as countries vie to establish themselves as hubs for crypto innovation, setting the stage for the next phase of industry growth.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Cboe to debut bitcoin and ether Continuous futures in November

Cboe Futures Exchange aims to introduce long-dated crypto contracts under US regulatory oversight

The Internet is building a native financial system, and the key to success or failure still lies in user experience.

Infrastructure provision is possible, but user experience wins everything.

Why are perpetual contracts inevitably part of general-purpose blockchains?

The future trend is that perpetual contracts (and all "killer applications") will make leading general-purpose blockchains even more powerful.

Seraph S4 Season PTR Goes Live: $SERAPH Surges 43% in a Week, Full-scale Competition Season Kicks Off

The fourth season not only continues Seraph's upward momentum but also marks a new turning point for the game.