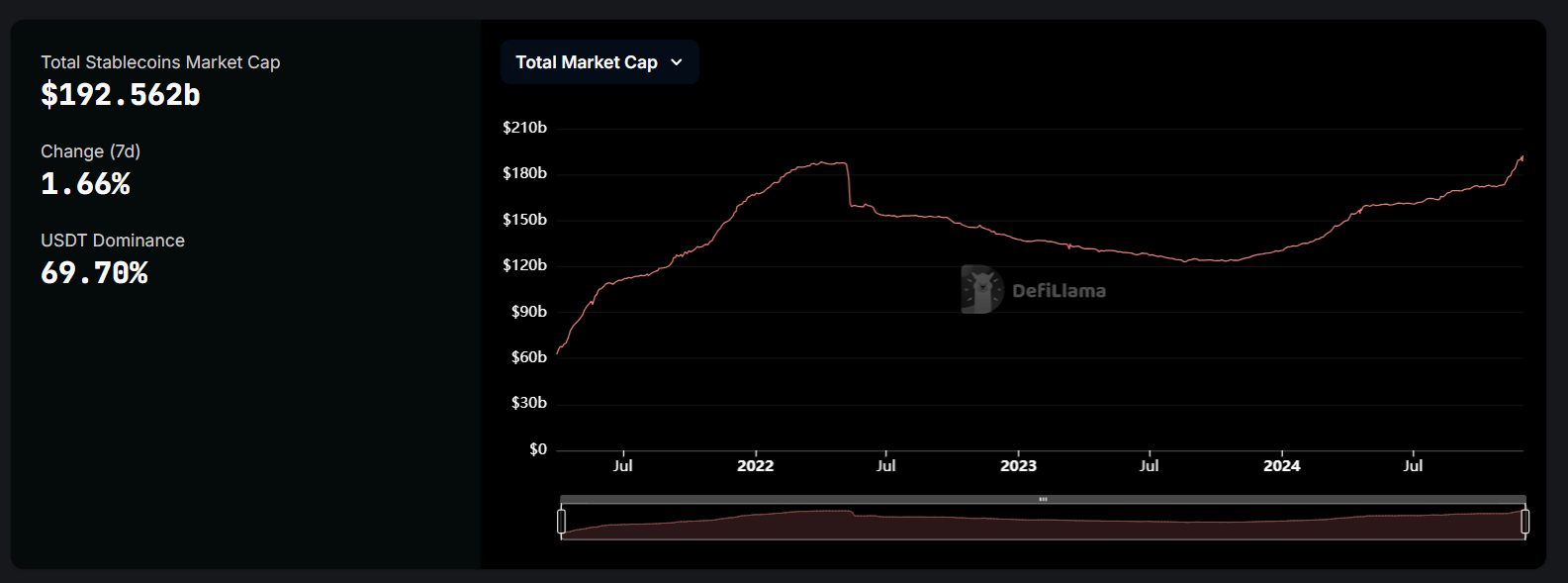

The supply of stablecoins within the crypto market has blown to a new high. With ever increasing supply, the global stablecoin market cap is now nearing $200 billion.

According to data from DefiLlama, the market capitalization of stablecoins has expanded by 46% this year, reaching $192.56 billion at the time of writing. Data shows that the stablecoin market is largely covered by Tether (USDT) with 69.70% dominance.

Stablecoin Market – DeFiLlama

Stablecoin Market – DeFiLlama

Tether (USDT) is currently the biggest stablecoin in the domain with a market cap of $134.21 billion. It is followed by the Circle’s USDC with a $39.7 billion market cap. The remaining $18 billion includes several algorithmic and fiat-backed stablecoins such as DAI, Ethena USD (USDe), First Digital USD (FDUSD) and others.

As the cryptocurrency market is currently going through a bullish phase, we have seen that a large amount of stablecoin supply is minted in such time to meet the increased market demand. This year’s increase of 46% shows the same scenario with Tether alone minting over $50 billion of USDT in the past year.

The rise in stablecoin supply is also attributed to Donald Trump’s strong crypto stance with him becoming the next U.S. president. Trump’s victory has been one of the key reasons behind Bitcoin’s impressive surge to $99,000.

Moreover, the urge to use stablecoins has also been blazing in the United Kingdom as the policy makers in the country have decided to introduce a framework for the crypto market in 2025.