- Stablecoins drive altcoin trading growth, replacing Bitcoin as a primary trading pair.

- BTC pairs’ declining volume signals a shift in crypto market dynamics since 2022.

- Fiat pairs retain relevance in rallies but cede dominance to stablecoins in trading.

The altcoin market is undergoing a dramatic shift, with trading patterns and market structure evolving rapidly. Data and insights from CryptoQuant CEO Ki Young Ju show that the traditional idea of an “altcoin season,”—where capital rotates from Bitcoin into altcoins—is outdated.

Instead, altcoin trading growth now stems from stablecoin and fiat currency pairs, not Bitcoin trading pairs. This change suggests a deeper, more sustainable evolution in the crypto market, driven by the increased liquidity and stability that stablecoins provide.

Bitcoin’s Diminishing Role in Altcoin Trading

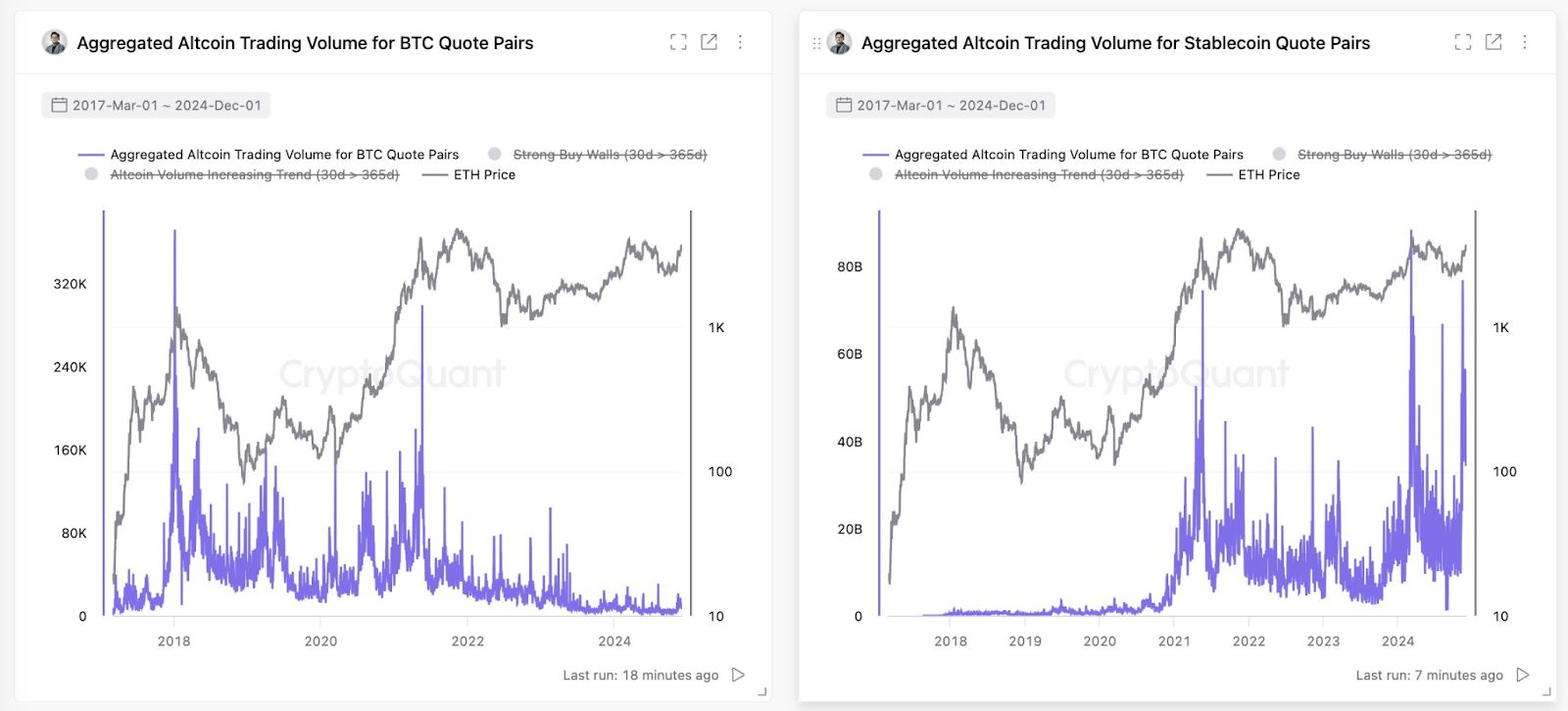

Trading volume data from March 2017 to December 2024 reveals a drop in demand for Bitcoin as a trading pair for altcoins. Historically, BTC quote pairs saw volume surges during bull and bear cycles, peaking in 2018 and 2021 due to Bitcoin’s price volatility.

Source: X

Source: X

However, trading volumes for BTC pairs have fallen since 2022. Despite Ethereum’s price recovery in 2023 and 2024, BTC pair volumes have not rebounded, indicating a change in market dynamics.

Rise of Stablecoins in Altcoin Trading

Stablecoins like USDT and USDC have become crucial for altcoin trading, offering stability and liquidity in volatile markets. Data shows a steady rise in trading volumes for stablecoin quote pairs since 2020, aligning with their increased use as base pairs.

Source: CryptoQuant

Source: CryptoQuant

These volumes peaked during the bullish cycles in 2021 and 2023, matching Ethereum price trends and market rallies. Unlike BTC pairs, stablecoin pairs reduce the risks tied to price fluctuations, making them popular with traders and investors.

Fiat Trading Pairs Remain Relevant in Specific Cycles

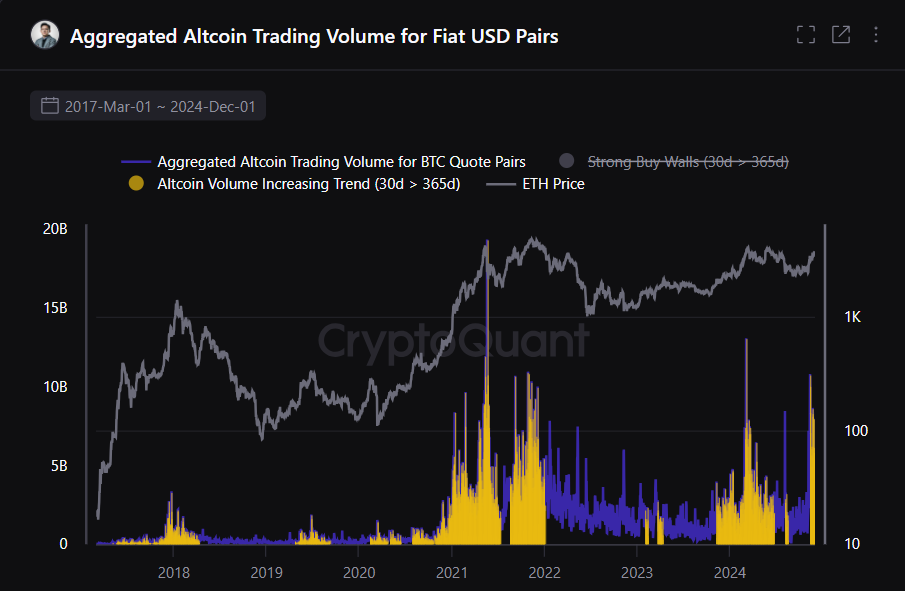

Although stablecoins dominate, fiat currency pairs remain important during certain market events. Data from 2017 to 2024 shows that fiat USD pairs saw volume spikes during market rallies, particularly in 2018, 2021, and late 2023.

Source: CryptoQuant

Source: CryptoQuant

However, these volumes follow a cyclical pattern, falling after market corrections. Despite Ethereum’s recovery, trading volumes for fiat pairs remain low, suggesting a gradual shift toward stablecoins as the preferred trading medium.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.