Bitcoin’s Bullish Rally Drives $6,4 Billion in ETF Inflows in November

The recent bullish rally in the price of Bitcoin drove billion-dollar inflows in November into exchange-traded funds (ETFs) based on the largest cryptocurrency traded on the U.S. market.

With renewed confidence in the market, US investors poured $6,4 billion into spot Bitcoin ETFs last month amid Bitcoin's 45% surge, which saw its price jump to the $99 zone for the first time in history.

In a significant development in the cryptocurrency market, spot Bitcoin ETFs have reached a Marco significant in November. The products recorded $6,4 billion in net inflows. This is the largest monthly inflow since trading began in January. The recent surge in inflows into Bitcoin ETFs broke the previous high of $6 billion, which was recorded in February. The significant increase suggests growing interest from institutional investors in products based on the largest cryptocurrency on the market.

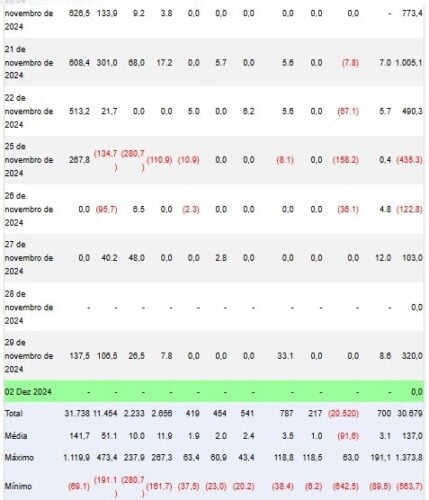

Bitcoin’s November bull run saw its price jump from $68 to $99. Given the current bullish market outlook, BTC-based ETFs have seen total inflows of $6,87 billion, with outflows of $411 million.

Data from the Farside Investors platform revealed that, only the ETF of the giant BlackRock, the iShares Bitcoin Trust, presented a collection of US$ 5,6 billion in investments last month. The amount is equivalent to almost 87% of the total monthly inflows.

Source: Farside Investors

Source: Farside Investors

O Bitcoin price today 02/12/2024 is showing a notable drop that made the asset return to trading in the US$ 95 thousand zone. Yesterday the asset peaked at US$ 98.145, but did not sustain the level and retracted to the current zone. At the time of publication, the price of Bitcoin was quoted at US$ 95.186,18 with a drop of 2% in the last 24 hours, equivalent to approximately R$ 570.486,91 BRL and € 90.363,16 EUR.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

New spot margin trading pair — HOLO/USDT!

FUN drops by 32.34% within 24 hours as it faces a steep short-term downturn

- FUN plunged 32.34% in 24 hours to $0.008938, marking a 541.8% monthly loss amid prolonged bearish trends. - Technical breakdowns, elevated selling pressure, and forced liquidations highlight deteriorating market sentiment and risk-off behavior. - Analysts identify key support below $0.0080 as critical, with bearish momentum confirmed by RSI (<30) and MACD indicators. - A trend-following backtest strategy proposes short positions based on technical signals to capitalize on extended downward trajectories.

OPEN has dropped by 189.51% within 24 hours during a significant market pullback

- OPEN's price plummeted 189.51% in 24 hours to $0.8907, marking its largest intraday decline in history. - The token fell 3793.63% over 7 days, matching identical monthly and yearly declines, signaling severe bearish momentum. - Technical analysts cite broken support levels and lack of bullish catalysts as key drivers of the sustained sell-off. - Absence of stabilizing volume or reversal patterns leaves the market vulnerable to further downward pressure.

New spot margin trading pair — LINEA/USDT!