Litecoin Adds $1 Billion to Its Market Cap, LTHs Begin to Liquidate

Litecoin’s market cap has risen by $1 billion as LTHs liquidate their positions, yet bullish momentum suggests further price gains.

Litecoin (LTC) has seen its market capitalization grow by 15% in the past week, adding $1 billion as its price reached a two-year high of $119.64.

This surge has led long-term holders (LTH) to sell their coins to secure profits. However, the LTC price rally shows signs of continuing momentum.

Litecoin Long-Term Holders Book Gains

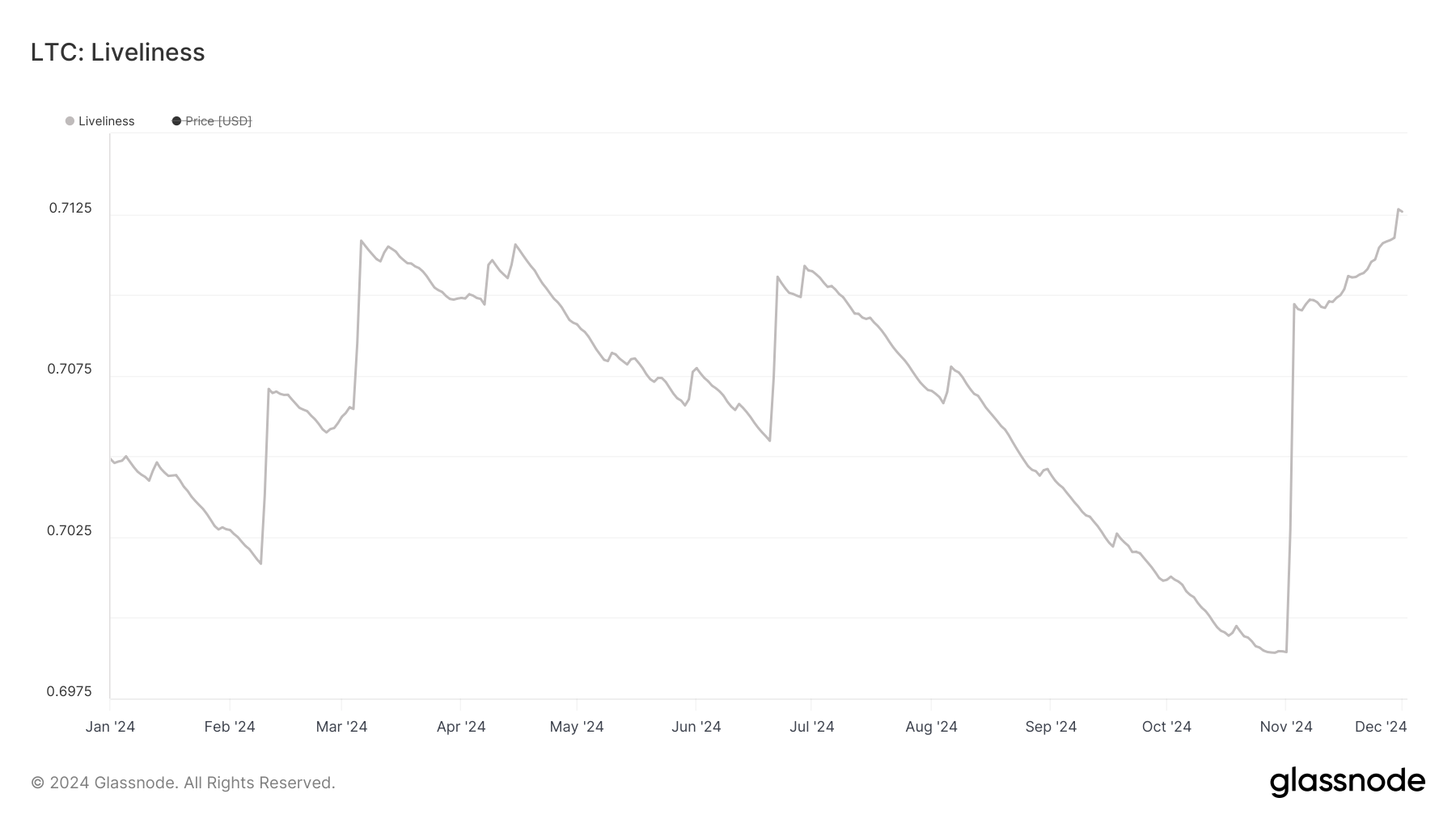

BeInCrypto’s on-chain assessment of LTC’s Liveliness metric has revealed a surge in the number of recently moved or spent coins. Per Glassnode, this currently sits at a year-to-date high of 0.71. For context, as of November 1, LTC’s Liveliness had plummeted to a year-to-date low of 0.69.

An asset’s Liveliness provides insights into the spending behavior of its LTHs. It measures the proportion of coins that have been recently moved or spent. When it spikes, it indicates that many long-term holders are liquidating their positions.

LTC Liveliness. Source:

Glassnode

LTC Liveliness. Source:

Glassnode

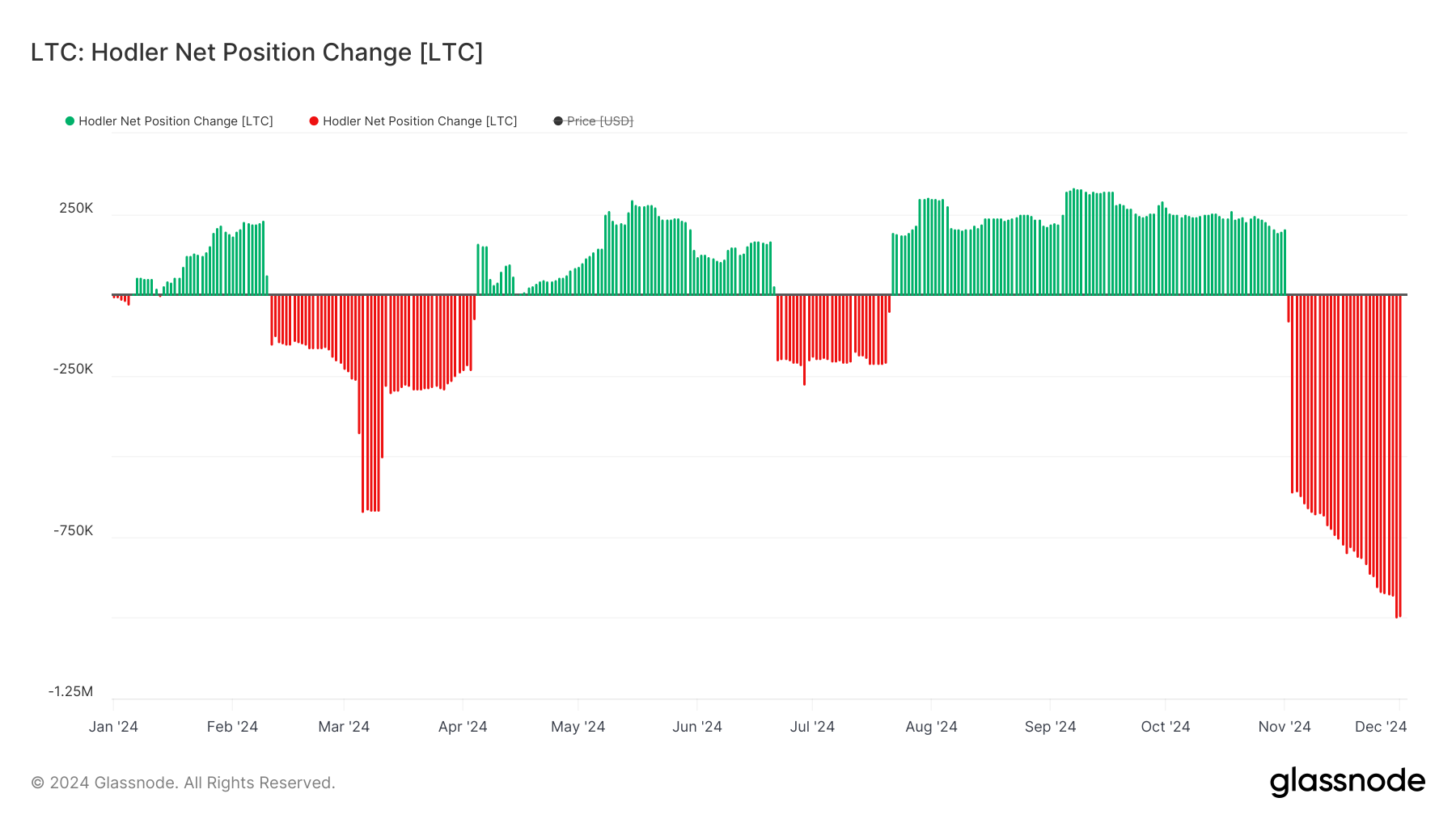

Notably, the negative readings from LTC’s Hodler Net Position Change confirm this distribution trend among its LTHs. This metric, which also tracks the behavior of LTHs, has returned only negative values since November 2. In fact, on December 1, it closed at a year-to-date low of -993,199.

When the Hodler Net Position Change is negative, long-term holders (HODLers) are selling more of their holdings than they are accumulating, indicating profit-taking.

LTC Hodler Net Position Change. Source:

Glassnode

LTC Hodler Net Position Change. Source:

Glassnode

LTC Price Prediction: The Bulls Remain in Control

Despite the selling activity by the coin’s LTHs, the bullish bias toward the LTC remains significant. At press time, LTC trades above its Ichimoku Cloud, confirming the positive momentum in the market.

This indicator tracks the momentum of an asset’s market trends and identifies potential support/resistance levels. When an asset’s price rests above the Ichimoku Cloud, it indicates a bullish trend, indicating that the asset is in an upward momentum with the potential for further gains.

LTC Ichimoku Cloud. Source:

TradingView

LTC Ichimoku Cloud. Source:

TradingView

If this holds true, the LTC price rally may continue toward $143.41, a level it last traded at in January 2022. Conversely, LTC’s price may drop to $107.58 if this bullish momentum wanes.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

New spot margin trading pair — HOLO/USDT!

FUN drops by 32.34% within 24 hours as it faces a steep short-term downturn

- FUN plunged 32.34% in 24 hours to $0.008938, marking a 541.8% monthly loss amid prolonged bearish trends. - Technical breakdowns, elevated selling pressure, and forced liquidations highlight deteriorating market sentiment and risk-off behavior. - Analysts identify key support below $0.0080 as critical, with bearish momentum confirmed by RSI (<30) and MACD indicators. - A trend-following backtest strategy proposes short positions based on technical signals to capitalize on extended downward trajectories.

OPEN has dropped by 189.51% within 24 hours during a significant market pullback

- OPEN's price plummeted 189.51% in 24 hours to $0.8907, marking its largest intraday decline in history. - The token fell 3793.63% over 7 days, matching identical monthly and yearly declines, signaling severe bearish momentum. - Technical analysts cite broken support levels and lack of bullish catalysts as key drivers of the sustained sell-off. - Absence of stabilizing volume or reversal patterns leaves the market vulnerable to further downward pressure.

New spot margin trading pair — LINEA/USDT!