Volume 211: Digital Asset Fund Flows Weekly Report

From CoinShares Research Blog by James Butterfill

Ethereum makes new record with YTD inflows now at US$2.2bn

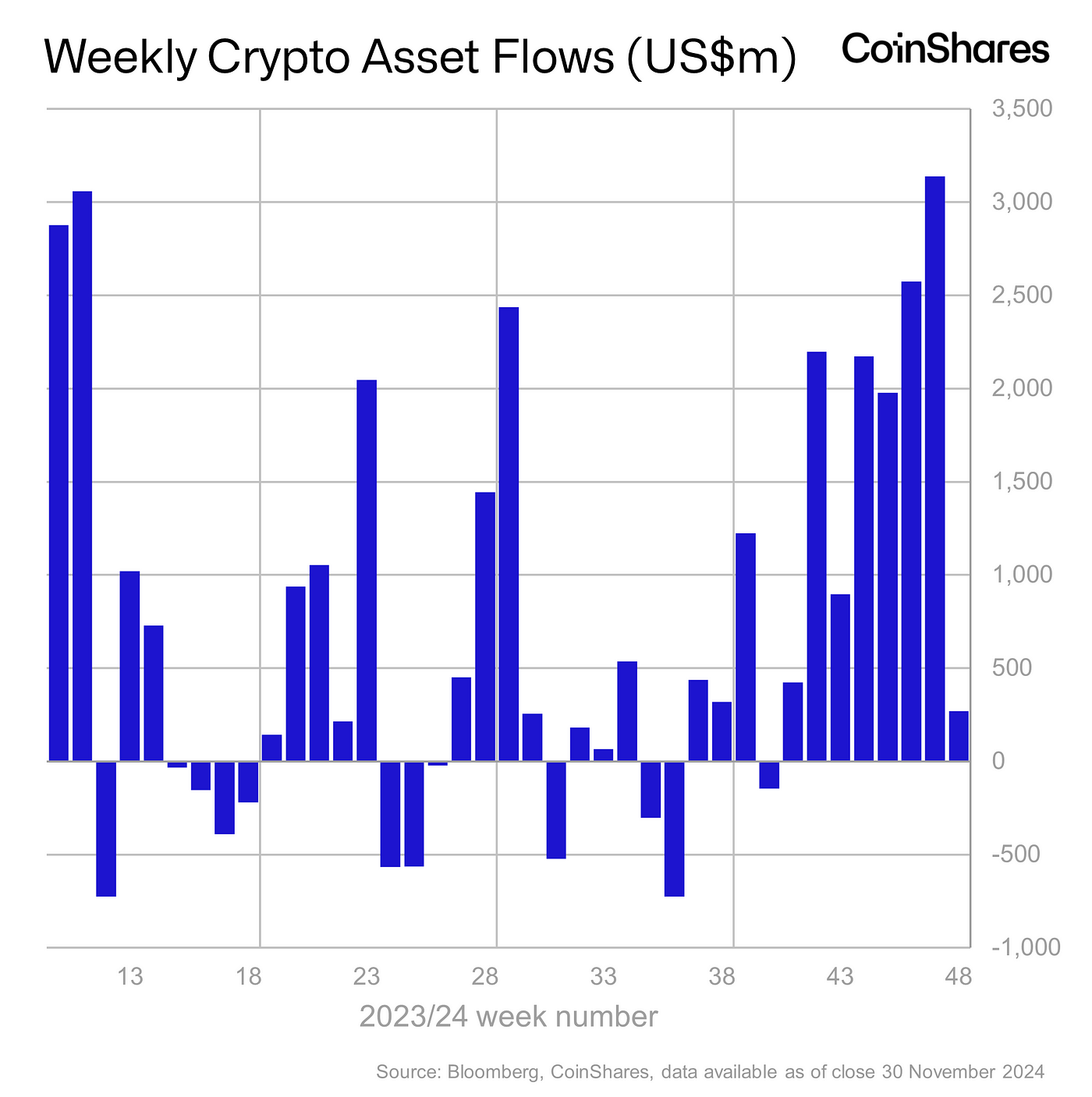

- Digital asset investment products saw inflows totalling US$270m last week, while total inflows this year so far are at a new record of US$37.3bn.

- Bitcoin saw outflows of US$457m, the first significant outflows since early September this year in what we believe is profit taking following bitcoin testing the very psychological level of US$100k.

- Ethereum saw inflows of US$634m, and has experienced a dramatic turnaround in sentiment which has seen year-to-date inflows hit US$2.2bn.

Digital asset investment products saw inflows totalling US$270m last week, while the flows displayed an unusual dichotomy between assets within the asset class. Since the launch of options on US ETFs, despite their high initial volumes, we have not seen a commensurate rise in ETP volumes at US$22bn last week, compared to US$34bn the week prior. Total inflows this year so far are at a new record of US$37.3bn.

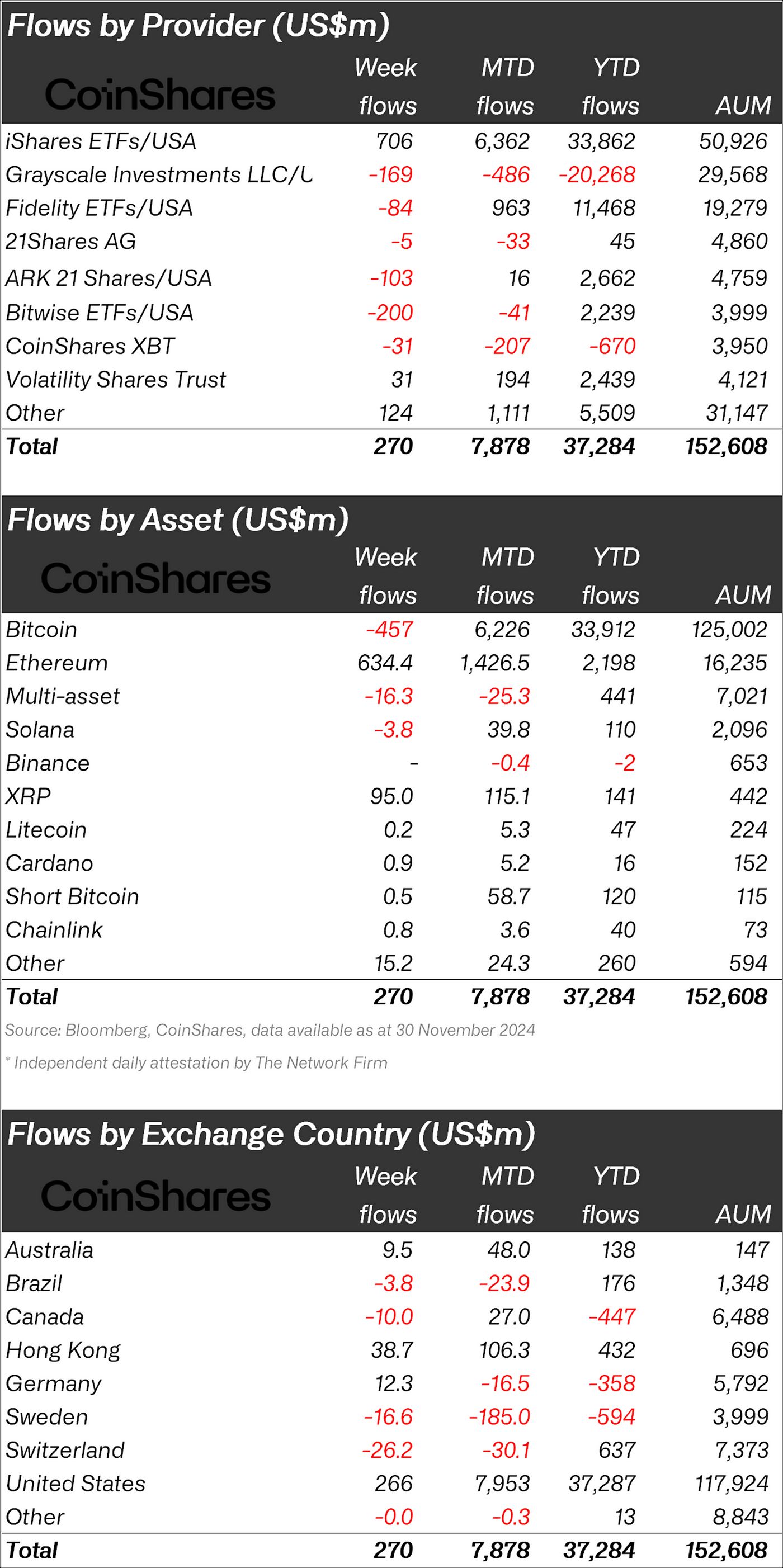

Regionally, the focus was on the US, which saw US$266m inflows, with Germany and Hong Kong also having notable inflows of US$12.3m and US$39m respectively. Minor outflows were seen in Switzerland and Canada of US$26m and US$10m respectively.

Bitcoin saw outflows of US$457m, the first significant outflows since early September this year in what we believe is profit taking following bitcoin testing the very psychological level of US$100k.

In stark contrast, Ethereum saw inflows of US$634m, and has experienced a dramatic turnaround in sentiment which has seen year-to-date inflows hit US$2.2bn, finally beating its 2021 inflows record of US$2bn.

XRP saw inflows totalling US$95m, the largest in record in what we believe is due to hype surrounding the potential for a US ETF.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.