Bitcoin exchange reserves drop to lowest levels in years: CryptoQuant

A CryptoQuant report noted that Bitcoin exchange reserves have fallen to multi-year lows.This reduces the amount of the available assets for immediate sale, impacting bitcoin market supply and demand dynamics.

Bitcoin exchange reserves have plummeted to their lowest levels in years, signaling increasing investor confidence in holding the cryptocurrency long-term.

Data from CryptoQuant reveals that more than 171,000 bitcoin have been withdrawn from major cryptocurrency exchanges since Donald Trump won the U.S. presidential election on November 5. This trend, reducing bitcoin's liquid supply, suggests investors are moving their holdings to cold storage, likely as part of a long-term strategy.

Exchange reserves have been in decline since 2021, reflecting a broader trend of long-term holding. According to CryptoQuant, reserves stood at about 3.2 million bitcoin in October 2021 and have now fallen to a multi-year low of 2.46 million coins.

Bitcoin exchange reserves have plummeted to their lowest level in years. Image: CryptoQuant.

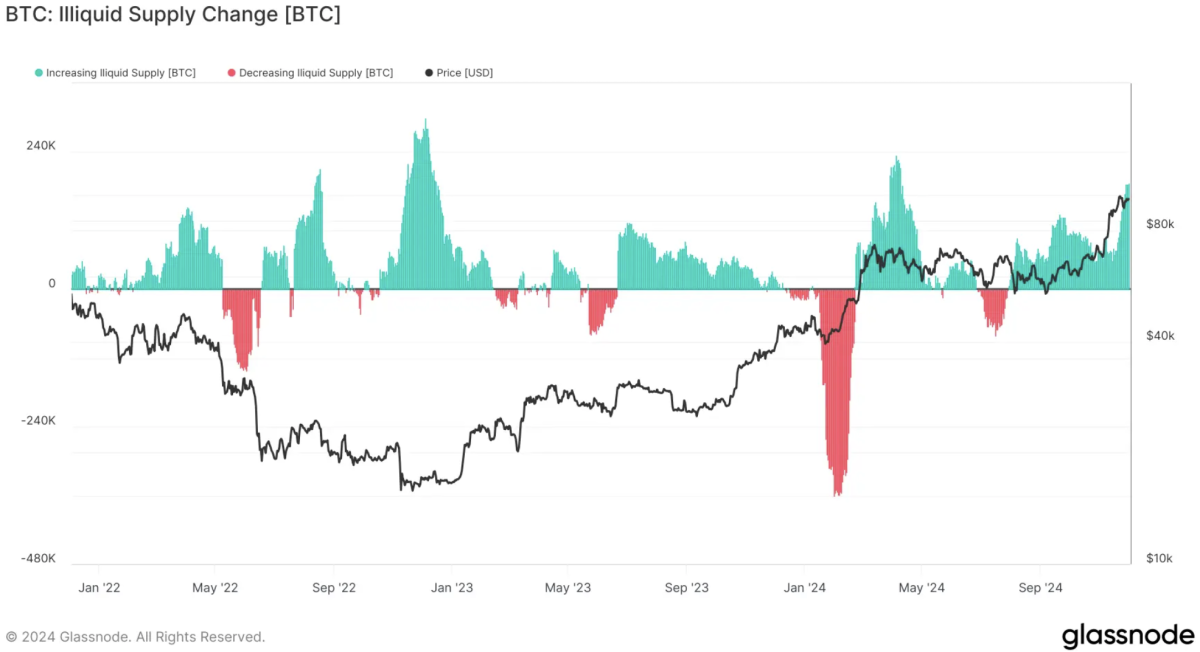

Similarly, Glassnode data indicates that their illiquid supply metric—bitcoin held by long-term investors not actively trading—has risen by 185,000 bitcoin in the last 30 days, reaching an all-time high of 14.8 million bitcoin. This represents 75% of the current circulating supply of around 19.79 million coins.

Bitcoin illiquid supply has increased sharply over the past month. Image: Glassnode.

Despite a tightening supply, bitcoin fell about 2% below the $94,000 mark in the past 24 hours, significantly impacting traders, according to The Block’s Bitcoin Price Page . Coinglass data shows that 207,454 traders were liquidated over the past day, with total liquidations reaching $578.6 million. Bitcoin accounted for $90 million of these liquidations, primarily from long positions betting on the digital asset's continued upward momentum.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

KITEUSDT now launched for futures trading and trading bots

Bitget x BAY Carnival: Grab a share of 4,000,000 BAY!

Front-Run the Chain — Join Onchain Alpha Community & Bag Rewards

Your personal AI trading co-pilot is ready — Join GetAgent TG and grab extra rewards!