Ripple (XRP) Jumps 450% in a Month, Eyes New All-Time High Next

XRP price has reached its highest levels in six years, surging 450% in the past 30 days amid growing ecosystem optimism.

XRP (Ripple) price has surged to its highest levels in six years, reaching new milestones amid growing optimism around the coin’s ecosystem. The coin has skyrocketed approximately 450% over the past 30 days, making it one of the best-performing cryptocurrencies in the market.

The remarkable price action comes as technical indicators suggest strong bullish momentum, though some metrics hint at potential consolidation ahead.

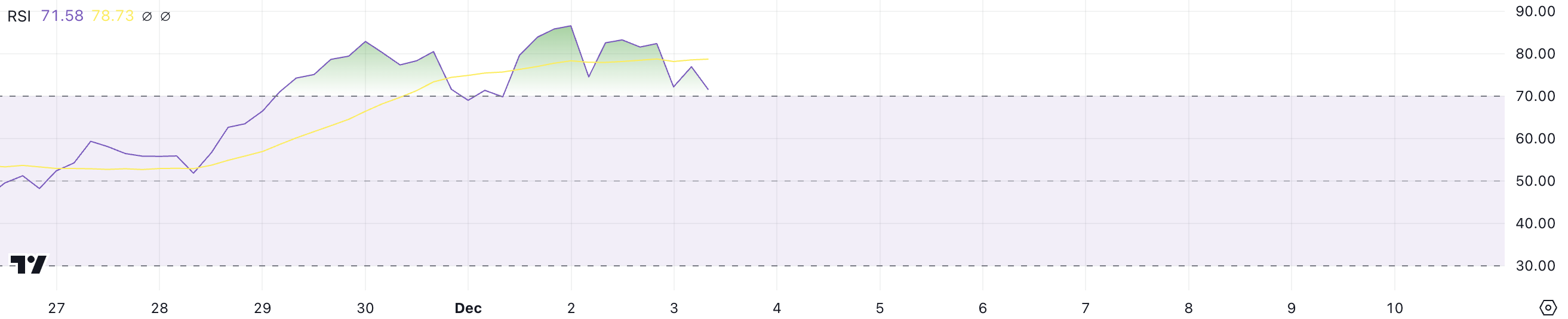

XRP RSI Is Still Above 70

The Relative Strength Index (RSI) for XRP has maintained an overbought position above 70 since late November, reaching peaks near 90 before recently declining to 71.5. This sustained period in overbought territory aligns with Ripple significant price surge, demonstrating strong bullish momentum that has dominated the market for several weeks.

The RSI serves as a momentum indicator, measuring the speed and magnitude of price movements on a scale of 0 to 100. Readings above 70 typically indicate overbought conditions, and below 30 suggest oversold conditions.

XRP RSI. Source:

TradingView

XRP RSI. Source:

TradingView

While XRP RSI remains in overbought territory at 71.5, its gradual decline from recent highs near 90 could signal that buying pressure is starting to ease. However, this doesn’t necessarily predict an immediate reversal of the uptrend, as assets can maintain overbought conditions during strong bull runs.

The decreasing RSI might suggest a potential consolidation phase or a more sustainable pace of growth rather than a definitive end to the current uptrend.

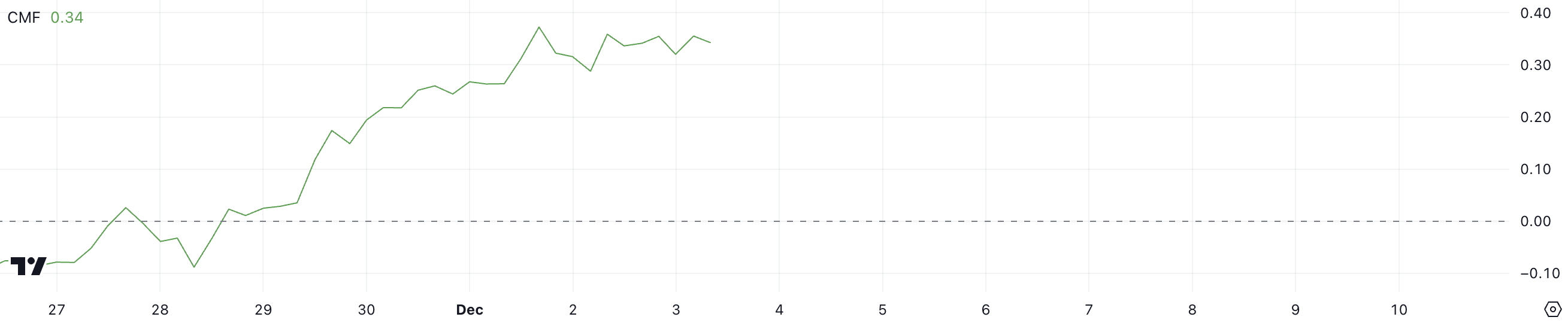

Ripple CMF Has Been Positive For Four Days

The Chaikin Money Flow (CMF) for Ripple price has maintained a strong positive value of 0.34, continuing its upward momentum since November 29.

The CMF is a volume-weighted average of accumulation/distribution over a specified period, typically 20 days, that helps measure buying and selling pressure. Values above zero indicate net buying pressure, while negative values suggest selling pressure.

XRP CMF. Source:

TradingView

XRP CMF. Source:

TradingView

XRP elevated CMF reading of 0.34 indicates substantial buying pressure and institutional interest, supporting the current uptrend. This high positive value suggests that most trading volume occurs at prices higher than the previous period, reinforcing bullish sentiment.

While the CMF remains significantly positive, it supports the continuation of the uptrend.

XRP Price Prediction: Can It Rise To $3 In December?

XRP EMA Lines display a strong bullish structure, with faster EMAs positioned above slower ones and price trading comfortably above the shortest EMA. As the bull run continues, XRP faces a significant psychological and historical target at $3.00.

Beyond that, the all-time high of $3.18 presents the next major resistance, representing a potential 18.5% gain from the current XRP price.

XRP Price Analysis. Source:

TradingView

XRP Price Analysis. Source:

TradingView

However, the uptrend carries downside risks that traders should consider. Key support levels have formed at $2.29 and $1.88, marking potential pullback targets if momentum wanes.

A correction to these levels would represent a significant retracement of up to 32% for XRP price, though such pullbacks are common even within sustained bull trends.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Trend Research: The "Blockchain Revolution" is underway, remaining bullish on Ethereum

In a scenario of extreme fear, where capital and sentiment have not yet fully recovered, ETH is still in a relatively good buying "strike zone."

Should You Still Believe in Crypto

No industry has always been right along the way, until it truly changes the world.

Gavin Wood: After EVM, JAM will become the new industry consensus!

BTC Dips Below $90K Despite Fed Rate Cut Boost