The trading volume of encrypted stablecoins broke through 700 billion US dollars in November, setting a new record

According to data compiled by Visa, the transaction volume of cryptocurrency stablecoins broke through 700 billion USD in November, setting a new record and approaching the annual transaction level of payment giant Visa. Of this, Tether's USDT accounted for 500 billion USD, Tron chain's transaction volume reached 314 billion USD, and Ethereum was at 247 billion USD. If stablecoins maintain a monthly growth rate of 700 billion USD, they could reach an annual transaction volume of 8.4 trillion USD next year, comparable to Visa's projected figure of 12.3 trillion USD for 2023.

This growth is due to Tron's low cost and high speed while also benefiting from an increase in the supply of stablecoins on the Ethereum blockchain. This shows different use cases for stablecoins on different blockchains: Tron leans towards payments while Ethereum is more used for DeFi lending. The total market value of the stablecoin market has also reached a historic high exceeding $1930 Billion further demonstrating its potential in both crypto markets and mainstream payment sectors.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

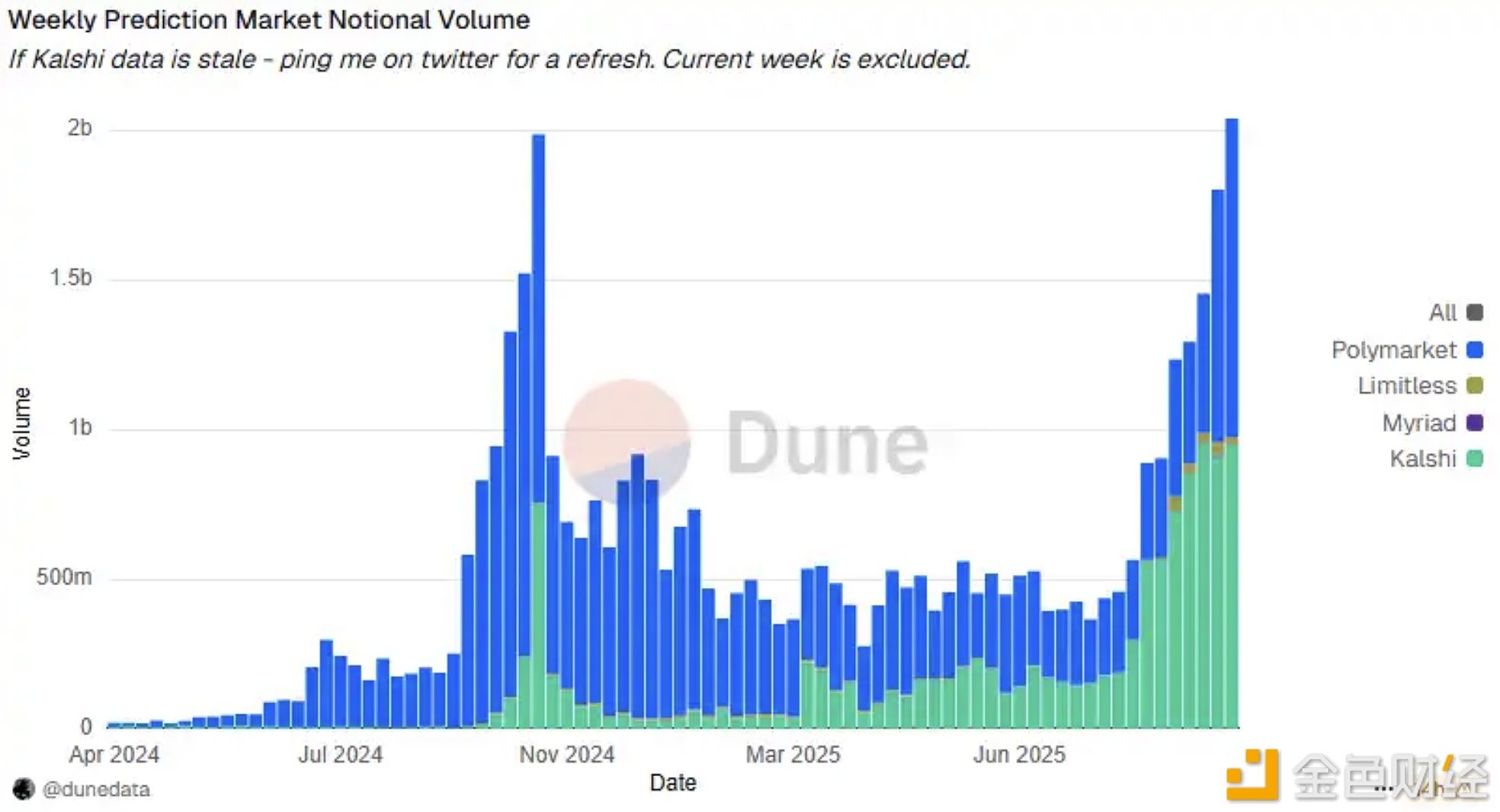

Polymarket and Kalshi Dominate the Prediction Market, Newcomers Struggle to Survive

Vitalik: If validator sets act maliciously, users may have no recourse

Analysis: Polymarket and Kalshi Dominate the Prediction Market

Vitalik: 51% attacks cannot rewrite blocks, but off-chain trust introduces new risks