Analyst: Recently, ETF investors are shifting towards a pure long strategy, rather than executing arbitrage models

According to CoinDesk, analyst James Van Straten stated that since November 20th, the open contracts of CME have decreased by nearly 30,000 to 185,485. Meanwhile, during the same period, the net inflow of funds into U.S. spot-listed ETFs exceeded $3 billion. This unusual phenomenon indicates that investors are shifting towards a purely bullish strategy rather than the previously common spot-futures arbitrage model.

James Van Straten explained that since the listing of ETFs in January this year, institutional investors have mainly adopted a spot-futures arbitrage strategy - holding long positions in ETFs and short positions in futures to earn spread profits. Currently, CME's three-month futures annualized basis still maintains an impressive level of 16%, far higher than US ten-year treasury bonds and Ethereum staking yields. However, it seems that investors prefer betting on Bitcoin's rise directly through ETFs.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Nasdaq-listed Lion Group spends $8 million to purchase 88.49 bitcoins

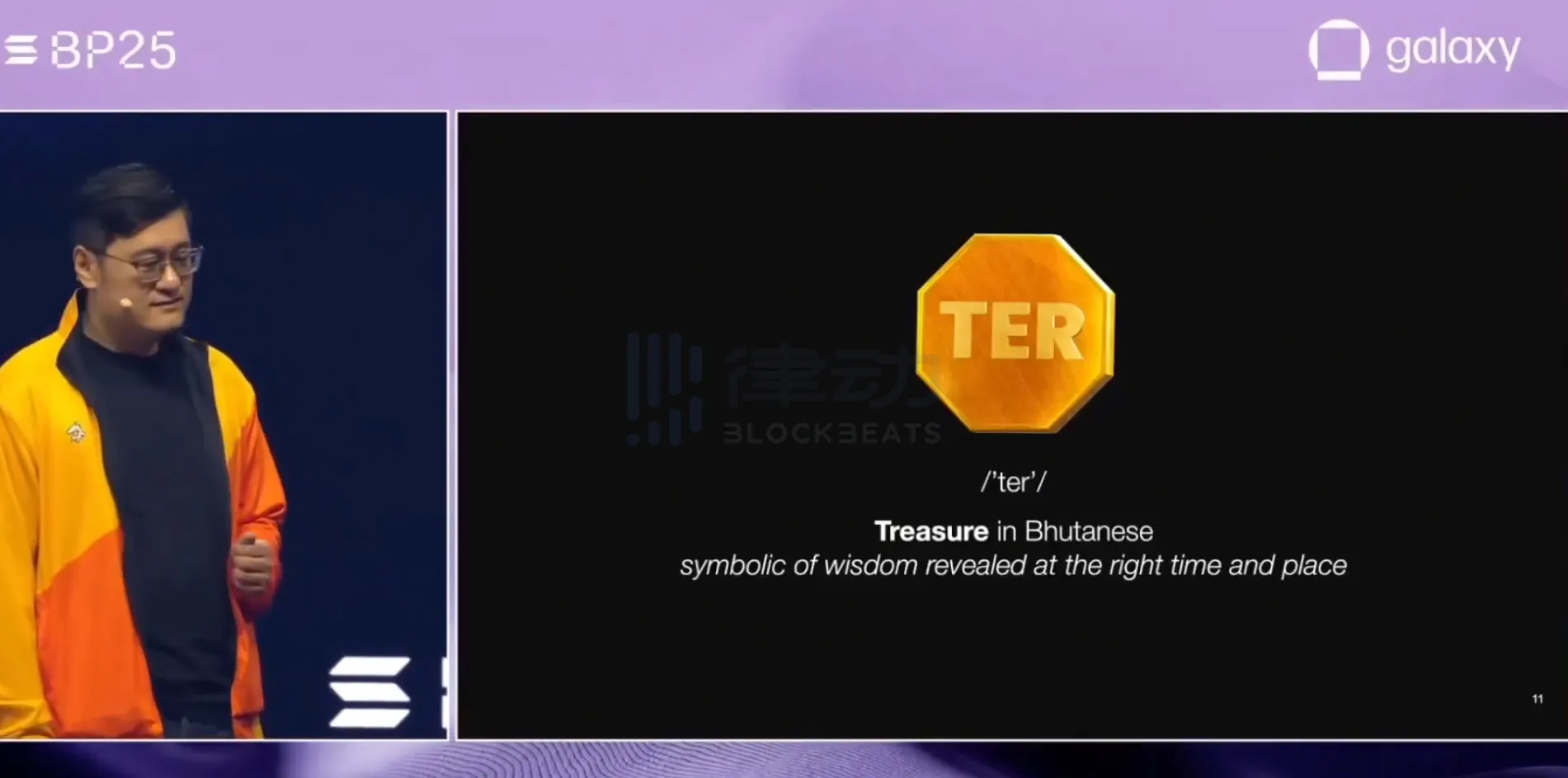

Bhutan announces the launch of the world's first sovereign-backed gold token TER on Solana

dYdX launches spot trading on Solana and opens access to US users

JPMorgan issues Galaxy short-term bonds on the Solana network