Bitcoin exchange-traded funds (ETFs) have seen over $1 billion in inflows in the first days of December, fueled by major contributions from asset management giants BlackRock and Fidelity.

On December 2, BlackRock gained $338.3 million, and Fidelity added $25.1 million, totaling $353.6 million for the day. The next day, BlackRock brought in $693.3 million, and Fidelity added $52.2 million. Despite Bitwise losing $93.5 million, total inflows on December 3 reached $676 million.

Sponsored

Bitcoin ETFs have gained $1.03 billion in December, raising their total assets under management to $31.7 billion. This surge reflects growing confidence in Bitcoin ETFs as mainstream adoption increases, with Bitcoin’s price climbing toward $100,000.

Billion-Worth BTC Amounts Left Exchanges

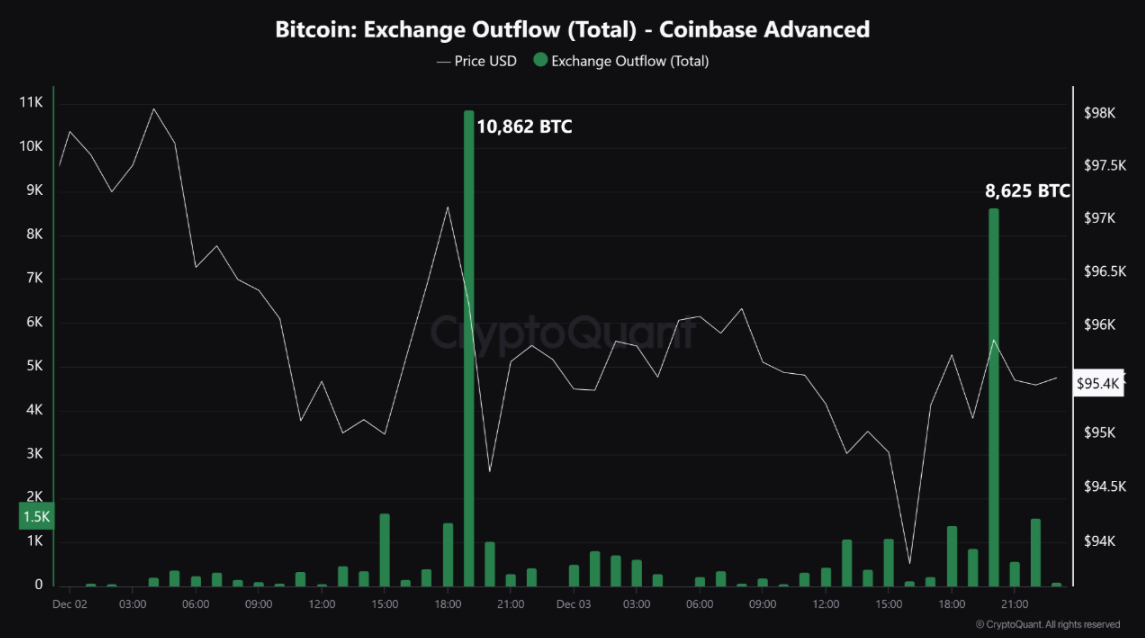

Crypto data firm CryptoQuant recently reported two notable outflows from the Coinbase exchange, surpassing 8,000 BTC, stating:

“19,487 BTC were withdrawn, with an average cost of $96,043. The total value of these two transactions amounts to approximately $1.87 billion.”

According to CryptoQuant analyst Burak Kesmeci, such large transactions highlight the sustained and strong interest of institutional investors in Bitcoin.

“Since the approval of spot Bitcoin ETFs, institutional demand has significantly increased. With retail investor interest likely to join this trend soon, Bitcoin appears poised to surpass the $100,000 level in the near future,” Kesmeci stated.

Bitcoin exchange outfow data. Source: CryptoQuant

Bitcoin exchange outfow data. Source: CryptoQuant

Bitcoin Shortage Might Trigger a Shock in Supply

As institutional investors aggressively accumulate Bitcoin, market watchers predict a potential supply shock for the world’s dominant crypto.

Tom Lee, Chief Investment Officer at financial research firm Fundstrat, recently told CNBC that such a scenario could unfold as Bitcoin breaks through the psychological $100,000 threshold, igniting a wave of buying activity.

Lee forecasts that this surge could propel Bitcoin’s price even higher, with a target of $250,000 by 2025.

On the Flipside:

- Altcoin-focused ETFs could siphon investor attention and capital from Bitcoin ETFs, potentially affecting further growth trajectory.

Why This Matters

As Bitcoin’s market capitalization grows with continued institutional involvement, its position as a store of value may solidify, attracting even more investors seeking long-term growth.

Explore DailyCoin’s other articles:

Michael Saylor Proposes Bitcoin Strategy to Microsoft’s Board

Crypto Whales Stir Concerns as Market Cap Hits $3.4T