Solana’s Pump.fun Blocks UK Users After FCA Warning

Pump.fun UK shuts access after FCA warnings, facing backlash over harmful content, user losses, and rising competition from rival platforms.

Pump.fun, the Solana blockchain-based meme coin launchpad, has restricted access for UK users. This decision, announced on Friday, follows increasing regulatory pressures and warnings from the Financial Conduct Authority (FCA).

The FCA recently cautioned that Pump.fun might be operating without proper authorization.

FCA Continues to Probe Unregistered Crypto Platforms

Since its launch earlier this year, Pump.fun has seen some notable success with tokens like PNUT and WIF. These projects are currently among the largest meme coins, and the platform’s developers have reportedly earned $250 million.

However, the platform’s initial financial success is now fading, and regulators and community members are scrutinizing it. On December 3, the UK’s FCA released a statement announcing that the platform is unauthorized to target UK users.Also, the regulator cautioned that if users continue to access Pump.fun, they would not be protected by the FCA’s compensation scheme. Following this warning, the platform has restricted all services in the UK. The website itself cannot be accessed in the country starting Friday.

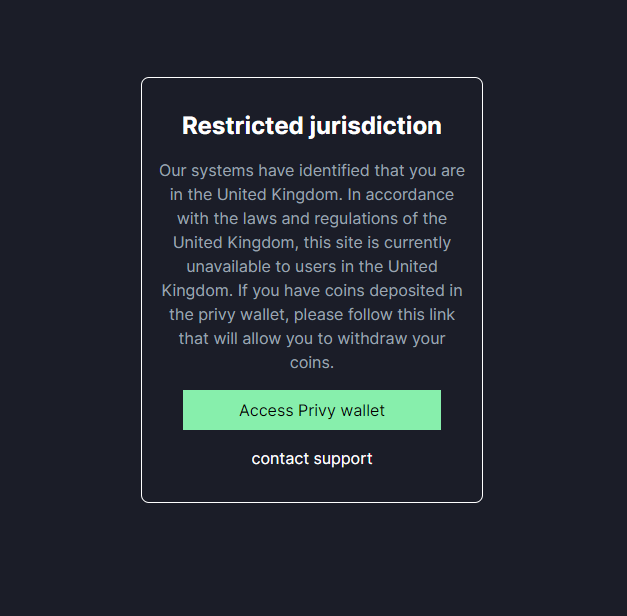

Pump.fun Website Showing this Message to UK Users

Pump.fun Website Showing this Message to UK Users

This isn’t the first time that the FCA’s warning has led to crypto companies halting their services in the UK. Last year, Binance stopped onboarding new users after canceling registration with the regulator.

Meanwhile, the FCA has been trying to bring regulatory clarity into the country’s crypto industry. In November, the agency announced that it would finalize crypto regulations by 2026, with a major focus on stablecoins.

“Pump Fun’s business model relied on organizing mass buying to drive up crypto prices, often leaving regular investors at a loss when prices crashed after the “pump.” The FCA says Pump Fun was offering financial services without permission, violating UK regulations, and putting users at risk of scams,” Mario Nawfal wrote on X (formerly Twitter).

Pump.fun Continues to Face Challenges and Backlash

Pump.fun has been facing continuous challenges in the past few months. Recently, the platform’s live-streaming feature has sparked significant backlash due to its misuse.

Initially designed to help developers promote their projects, the feature has been exploited to broadcast harmful content. There have been instances of individuals making threats to harm pets or people if market cap goals were not achieved.

At the same time, data revealed that over 60% of Pump.fun traders lose money, with fewer than 10% securing significant profits. Nearly 90% of traders reportedly either lost their investments or earned minimal returns, often under $100.

Also, the regulatory and reputational challenges have paved the way for alternative platforms to enter the market. PancakeSwap recently introduced SpringBoard, a memecoin launchpad on the BNB Chain.

Additionally, Virtuals Protocol is gaining momentum with its focus on AI agent tokens. The platform reported significant growth in November, with over 21,000 tokens created and a market cap exceeding $1.8 billion.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

New spot margin trading pair — HOLO/USDT!

FUN drops by 32.34% within 24 hours as it faces a steep short-term downturn

- FUN plunged 32.34% in 24 hours to $0.008938, marking a 541.8% monthly loss amid prolonged bearish trends. - Technical breakdowns, elevated selling pressure, and forced liquidations highlight deteriorating market sentiment and risk-off behavior. - Analysts identify key support below $0.0080 as critical, with bearish momentum confirmed by RSI (<30) and MACD indicators. - A trend-following backtest strategy proposes short positions based on technical signals to capitalize on extended downward trajectories.

OPEN has dropped by 189.51% within 24 hours during a significant market pullback

- OPEN's price plummeted 189.51% in 24 hours to $0.8907, marking its largest intraday decline in history. - The token fell 3793.63% over 7 days, matching identical monthly and yearly declines, signaling severe bearish momentum. - Technical analysts cite broken support levels and lack of bullish catalysts as key drivers of the sustained sell-off. - Absence of stabilizing volume or reversal patterns leaves the market vulnerable to further downward pressure.

New spot margin trading pair — LINEA/USDT!