The US stock and cryptocurrency markets remain active, with this week's CPI data being key to the Federal Reserve's decision to cut interest rates in December

Data released last Friday showed that non-farm payrolls exceeded expectations, while the unemployment rate slightly increased, reinforcing expectations for a rate cut in December. The market now estimates an approximately 85% probability of a December rate cut. Monitoring data indicates that last week, surging tech stocks pushed major U.S. stock indices to new highs, with the Nasdaq soaring over 3% and the SP 500 rising nearly 1%. Both the Nasdaq and the SP hit all-time highs, while the Dow was the only index to decline, falling around 0.5%.

The crypto market maintained strong momentum, with Bitcoin spot ETFs experiencing a net inflow for seven consecutive days, totaling nearly $2.8 billion. The stablecoin market cap increased by $3.9653 billion, up 2.56%. This influx of funds drove Bitcoin to surpass the $100,000 level and ETH to break through $4,000. Altcoins saw broad-based gains, with several mainstream tokens doubling in value. Bitcoin is currently consolidating around the $100,000 level, providing opportunities for altcoins.

In the forex and commodities markets, the dollar continued to strengthen last week. While the release of non-farm data caused a sharp dip in the dollar, it eventually rebounded, posting a weekly gain of 0.22%. The dollar’s rise limited gold’s upside potential, but expectations for a rate cut provided support, keeping gold prices fluctuating within a narrow range amid cautious market sentiment. Oil prices fell for three consecutive days last week due to concerns over excess supply, with WTI crude dropping 1.17% for the week and Brent crude declining 1%.

Recent data suggests that U.S. progress in combating inflation may have stalled. The CPI data to be released this Wednesday will be a key determinant for the Federal Reserve's interest rate decision later this month. The market currently estimates an 85% probability of a 25 basis-point rate cut on December 18. However, expectations for fewer rate cuts next year continue to strengthen. Additionally, as year-end approaches, major investment institutions face portfolio rebalancing to accommodate end-of-year balance sheets and tax considerations. This could create short-term liquidity shocks in the U.S. stock market, posing the most significant downside risk and potentially suppressing risk assets.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Data: "Machi Big Brother" Jeff Huang has lost over $53 million in trading on Hyperliquid in the past month

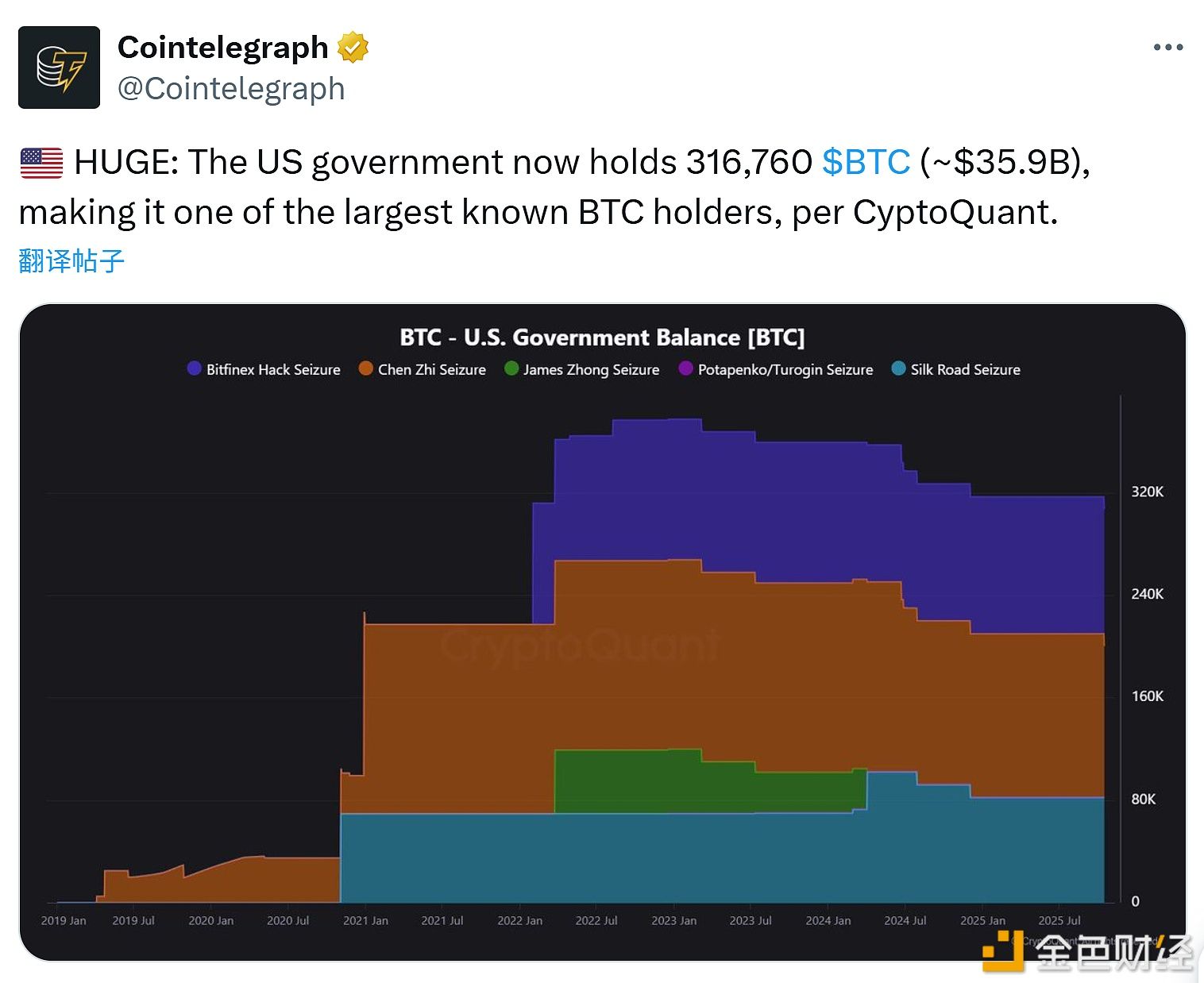

CryptoQuant: The U.S. government currently holds 316,760 BTC

Over $127 million in liquidations in the past hour, mainly long positions