Analysis: The rise in the US unemployment rate is sufficient to prompt the Federal Reserve to cut interest rates by 25 BP next week

Pepperstone's senior research strategist Michael Brown stated in a report that the rise in U.S. unemployment rate should be enough to solidify the Federal Reserve's reason for lowering interest rates by 25 basis points next week. The number of non-farm jobs in the U.S. in November was 227,000, higher than the 214,000 expected by analysts surveyed by The Wall Street Journal, but the unemployment rate rose from 4.1% announced last Friday to 4.2%.

If Fed policymakers are worried about Trump hindering inflation decline early in his presidency or potential upward inflation risks, they may skip raising interest rates in January.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

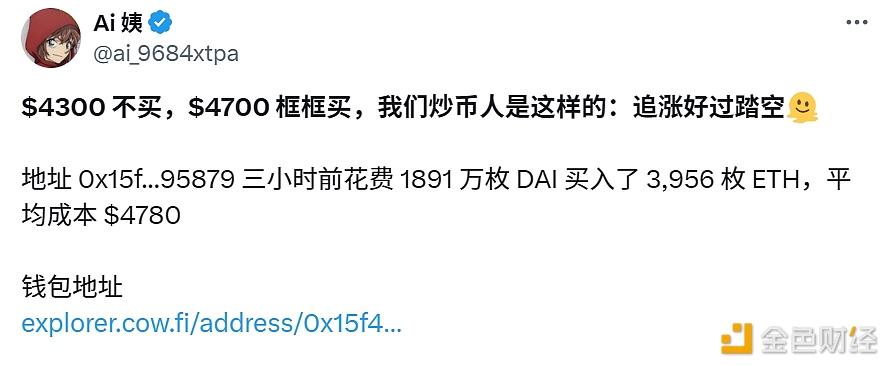

Data: A certain whale address bought 3,956 ETH at an average price of $4,780

A wallet address spent 18.91 million DAI to purchase 3,956 ETH three hours ago.

Bitget launches a new round of contract new token event, with a maximum reward of 4,000 USDT per person