Global crypto investment products see record weekly inflows: CoinShares

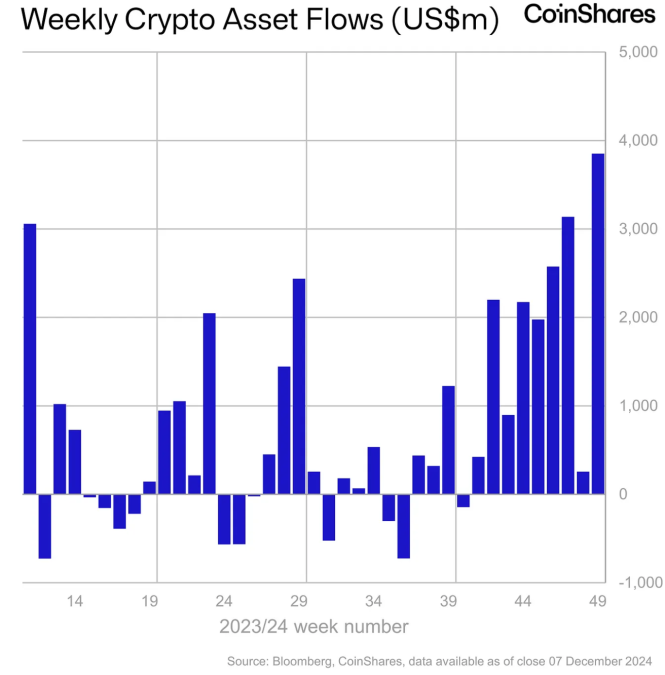

Crypto investment products saw their largest weekly inflows on record, totaling over $3.85 billion, according to CoinShares.

This brings the funds' year-to-date (YTD) net inflows to $41 billion, with total assets under management (AuM) reaching a new all-time high of over $165 billion.

"Digital asset investment products saw the largest weekly inflows on record last week totalling, smashing the prior record set just a few weeks ago," CoinShares Head of Research James Butterfill said in a blog post .

Regionally, several countries saw inflows, with the U.S. leading at $3.6 billion, followed by Switzerland ($160 million), Germany ($116 million), Canada ($14 million), and Australia ($10 million).

Digital asset investment products saw a record-high weekly inflow of $3.85 billion last week, according to CoinShares. Image: CoinShares.

Bitcoin saw the greatest share of inflows, totaling $2.5 billion, bringing its year-to-date inflows to $36.5 billion.

"Short bitcoin products saw tepid inflows of $6.2 million," Butterfill said. "Historically, we have seen much higher inflows after sharp price rises, suggesting investors remain cautious about betting against the recent strong price momentum."

U.S.-based funds dominated overall, with $2.74 billion worth of net inflows over the past week, according to The Block's data .

CoinShares research also noted that Ethereum products saw their largest weekly inflows on record, totaling $1.2 billion, surpassing the inflows from the ETF launches in July.

"This has come at the expense of Solana, which has seen $14 million in outflows, marking its second consecutive week of outflows," said Butterfill.

At publication time, bitcoin changed hands for $100,536, according to The Block’s Bitcoin Price Page — increasing by around 1% over the past 24 hours and up 4.7% over the past week. The GMCI 30 index, which represents a selection of the top 30 cryptocurrencies, is down 1.79% over the past day to 215.26.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

New spot margin trading pair — HOLO/USDT!

FUN drops by 32.34% within 24 hours as it faces a steep short-term downturn

- FUN plunged 32.34% in 24 hours to $0.008938, marking a 541.8% monthly loss amid prolonged bearish trends. - Technical breakdowns, elevated selling pressure, and forced liquidations highlight deteriorating market sentiment and risk-off behavior. - Analysts identify key support below $0.0080 as critical, with bearish momentum confirmed by RSI (<30) and MACD indicators. - A trend-following backtest strategy proposes short positions based on technical signals to capitalize on extended downward trajectories.

OPEN has dropped by 189.51% within 24 hours during a significant market pullback

- OPEN's price plummeted 189.51% in 24 hours to $0.8907, marking its largest intraday decline in history. - The token fell 3793.63% over 7 days, matching identical monthly and yearly declines, signaling severe bearish momentum. - Technical analysts cite broken support levels and lack of bullish catalysts as key drivers of the sustained sell-off. - Absence of stabilizing volume or reversal patterns leaves the market vulnerable to further downward pressure.

New spot margin trading pair — LINEA/USDT!