Liquidations Rock the Market, but Solana Clings to Key Levels – Is $300 in Sight?

Amidst a $1.6 billion tidal wave of liquidations yesterday, Solana proved among the most resilient to the market downturn, stoking anticipations of a potential new all-time high.

With today’s 4.27% price lapse, the Solana price finds itself at a critical juncture as it retests crucial supports to its uptrend so far. Losing which, stands to derail bullish end-of-year projections for the front-running altcoin .

These levels mark a potential turning point from the 4.01% loss over the past week, highlighting a crucial moment for reinstating Solana’s path to a new all-time high.

Particularly amidst elevated trader activity, with trading volume surging 154% to $9.62 billion over the past 24 hours, increased volatility stands to bolster Solana’s next move.

Bitcoin Dip Sparks Liquidation Landslide

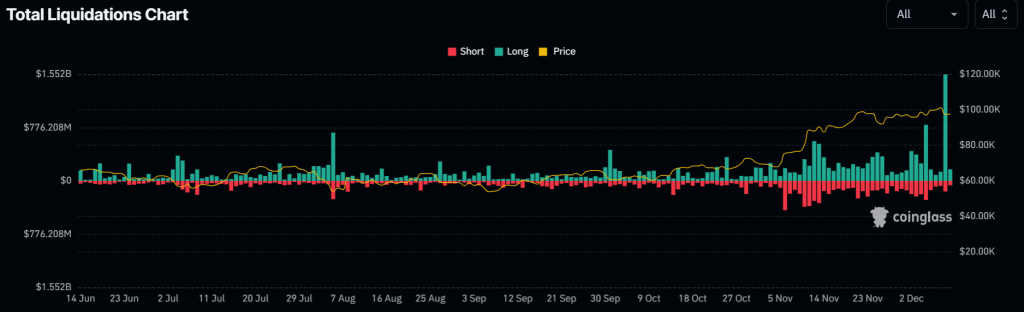

Bitcoin’s sudden dip to $94,000 sparked market-wide volatility, with increased supply pressure triggering over $1.6 billion in liquidation over a 24-hour window, according to coinglass data .

Total liquidations chart. Source: Binance.

Total liquidations chart. Source: Binance.

The event marks the biggest since 2021. While the short side has lost only $154.6 million, the majority of the losses stem from long-side optimistic traders.

This ongoing pullback is assumed to be a long squeeze, as heightened optimism led to highly leveraged positions being liquidated.

Solana Price Analysis: Is $300 Next?

The recent downtrend appears poised to come to a head as the Solana price holds strong following a test of a critical support juncture.

SOL / USDT 4H chart, descending channel pattern. Source: Binance.

SOL / USDT 4H chart, descending channel pattern. Source: Binance.

The altcoin seems to have made a decisive bounce from the lower support of a descending channel pattern forming since its last high. This bounce not only affirms the pattern’s integrity but also solidifies a support zone between $210.58 and $203.56.

This strong backing makes a reversal credible, eyeing an advance towards a retest of the pattern’s upper boundary next. Even more so, the Relative Strength Index (RSI) stint in oversold territory lends to a bullish correction.

Given the Solana price finds the momentum for a bullish breakout of the pattern, it would set a price target around $275, though the uptrend could well continue towards the $300 mark.

Disclaimer: Crypto is a high-risk asset class. This article is provided for informational purposes and does not constitute investment advice. You could lose all of your capital.Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

New spot margin trading pair — HOLO/USDT!

FUN drops by 32.34% within 24 hours as it faces a steep short-term downturn

- FUN plunged 32.34% in 24 hours to $0.008938, marking a 541.8% monthly loss amid prolonged bearish trends. - Technical breakdowns, elevated selling pressure, and forced liquidations highlight deteriorating market sentiment and risk-off behavior. - Analysts identify key support below $0.0080 as critical, with bearish momentum confirmed by RSI (<30) and MACD indicators. - A trend-following backtest strategy proposes short positions based on technical signals to capitalize on extended downward trajectories.

OPEN has dropped by 189.51% within 24 hours during a significant market pullback

- OPEN's price plummeted 189.51% in 24 hours to $0.8907, marking its largest intraday decline in history. - The token fell 3793.63% over 7 days, matching identical monthly and yearly declines, signaling severe bearish momentum. - Technical analysts cite broken support levels and lack of bullish catalysts as key drivers of the sustained sell-off. - Absence of stabilizing volume or reversal patterns leaves the market vulnerable to further downward pressure.

New spot margin trading pair — LINEA/USDT!