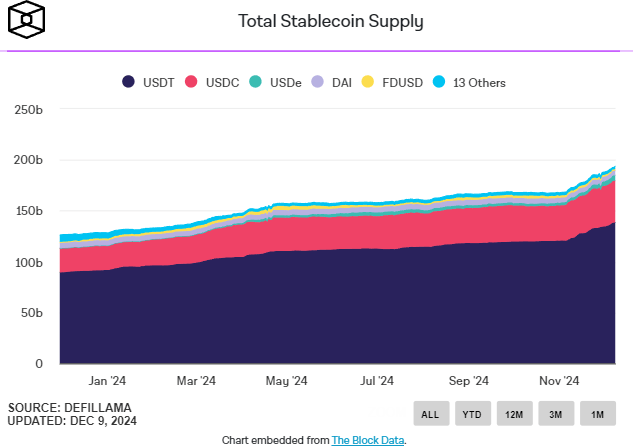

The combined market capitalization of stablecoins has surpassed $200 billion, up 13% from last month, according to data from The Block.

Stablecoin Market Cap

Coinbase analysts David Duong and David Han attributed the growth in stablecoin market cap to investors seeking to profit from the rising yields offered by the protocols. DeFi - lending.

We believe the increase in this indicator indicates a new influx of capital into this area and a desire to benefit from higher lending rates, which are more than three times higher than long-term bond yields, the analysts said.

According to DeFiLlama, the sharp rise in stablecoin market cap began around November 5, coinciding with Donald Trump's victory in the US presidential election. Over the past month, USDC deposit rates on protocols DeFi - lending has doubled, analysts noted.

Stablecoin lending and borrowing rates have risen, reaching 10-20% per annum on Aave and Compound across almost all participating networks, including Ethereum and Base, analysts said.

Experts also noted that the total amount locked in the lending protocols reached a record high of $54 billion, exceeding the previous maximum of $52 billion.