US spot Bitcoin ETFs surpass 500,000 BTC in cumulative net inflows

Quick Take The 12 U.S. spot Bitcoin ETFs have surpassed 500,000 BTC in cumulative net inflows less than a year after trading began. The ETFs have now absorbed more than 2.5% of bitcoin’s 19.8 million BTC circulating supply since their January launch.

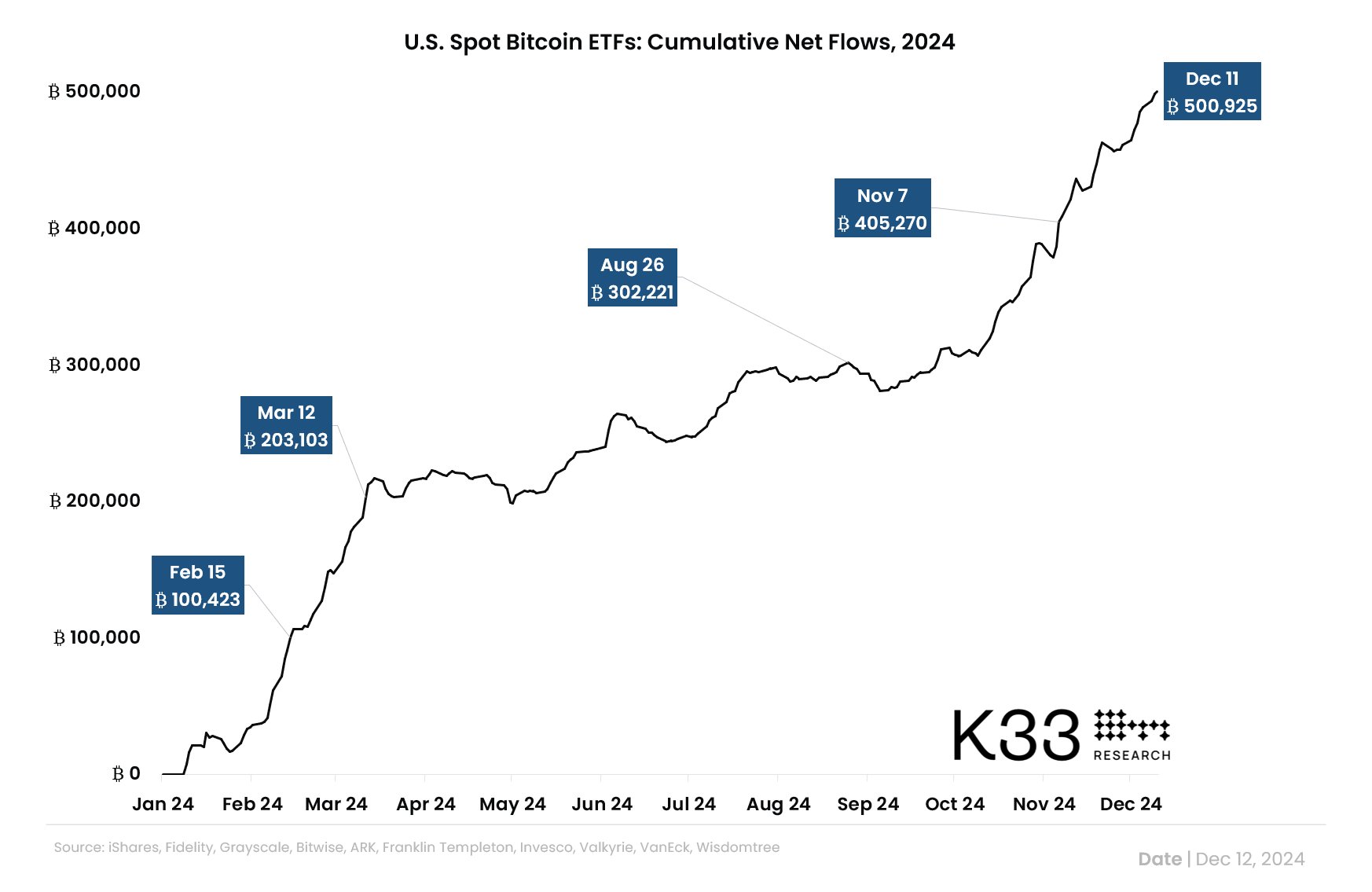

The 12 U.S. spot Bitcoin exchange-traded funds surpassed 500,000 BTC in cumulative net inflows on Wednesday, less than a year after trading began on Jan. 11.

“Year-to-date flows to spot ETFs have surpassed 500,000 BTC,” K33 Head of Research Vetle Lunde noted . “U.S. ETFs have absorbed more than 2.5% of the circulating supply since their launch in January.” Bitcoin’s current circulating supply is around 19.8 million BTC, according to The Block’s Bitcoin Price Page , with a total supply of 21 million BTC.

U.S. spot Bitcoin ETF cumulative net flows. Image: K33 .

Net inflows of $223.1 million into the spot Bitcoin ETFs on Wednesday were enough to take them over the milestone, reaching 500,925 BTC, according to Lunde, led by $121.9 million worth of net inflows into Fidelity’s FBTC fund. The spot Bitcoin ETFs are now on a 10-day inflow streak totaling nearly $4.3 billion, with cumulative net inflows of $34.7 million since launch in dollar terms.

BlackRock’s IBIT spot Bitcoin ETF alone had already exceeded 500,000 BTC in net inflows last week. However, substantial net outflows from Grayscale’s converted and higher-fee GBTC fund mean that the spot Bitcoin ETFs overall have only just reached that level in terms of cumulative flows.

GBTC bitcoin holding. Image: CoinGlass .

IBIT has also now overtaken BlackRock’s gold ETF, the iShares Gold Trust (IAU), according to CryptoQaunt CEO Ki Young Ju, with more than $50 billion in assets under management. “Smart money already knows the winner,” he posted on X. “In a market blending dumb money, gold's market cap is $17T, Bitcoin's $2T. Be on the right side of history.”

US spot Bitcoin ETFs hold more bitcoin than Satoshi

On Friday, the U.S. spot Bitcoin ETF surpassed the 1.1 million BTC estimated to be held by the cryptocurrency’s pseudonymous creator Satoshi Nakamoto for the first time. Holdings differ from cumulative flows, mainly due to the substantial bitcoin holdings GBTC carried over during its conversion from a closed-end fund and its subsequent outflows.

BlackRock’s IBIT leads the spot Bitcoin ETFs by onchain holdings with more than 520,000 BTC, according to The Block’s data dashboard, followed by Fidelity’s FBTC with over 247,000 BTC and Grayscale’s GBTC with 210,000 BTC — down from a head start of around 619,000 BTC on Jan. 11.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Interop roadmap "accelerates": After the Fusaka upgrade, Ethereum interoperability may reach a key milestone

a16z "Big Ideas for 2026: Part Two"

Software has eaten the world. Now, it will drive the world forward.

When the Federal Reserve "cuts interest rates alone" while other central banks even start raising rates, the depreciation of the US dollar will become the focus in 2026.

The Federal Reserve has cut interest rates by 25 basis points as expected. The market generally anticipates that the Fed will maintain an accommodative policy next year. Meanwhile, central banks in Europe, Canada, Japan, Australia, and New Zealand mostly continue to maintain a tightening stance.

From MEV-Boost to BuilderNet: Can True MEV Fair Distribution Be Achieved?

In MEV-Boost auctions, the key to winning the competition lies not in having the most powerful algorithms, but in controlling the most valuable order flow. BuilderNet enables different participants to share order flow, reshaping the MEV ecosystem.