Societe Generale and the Bank of France conduct blockchain-based repurchase transactions

On December 13, according to CoinDesk, Societe Generale announced that it has successfully completed a blockchain-based repurchase agreement with the Bank of France. This is the first time such a tokenized transaction has been conducted with a central bank in the eurozone. In a press release, Societe Generale stated that its digital asset subsidiary SG-Forge used some bonds issued on the public Ethereum blockchain in 2020 as collateral to obtain Central Bank Digital Currency (CBDC) issued by the Bank of France on its DL3S blockchain. With the regulatory framework for stablecoin issuers already in place under EU's Markets in Crypto Assets (MiCA), SG-Forge has been actively exploring how to use its Euro Stablecoin EUR CoinVertible (EURCV). However, this repurchase transaction did not involve this token. Societe Generale said: "This transaction demonstrates the technical feasibility of conducting interbank refinancing operations directly on the blockchain and shows potential for CBDCs to improve liquidity of digital financial securities."

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

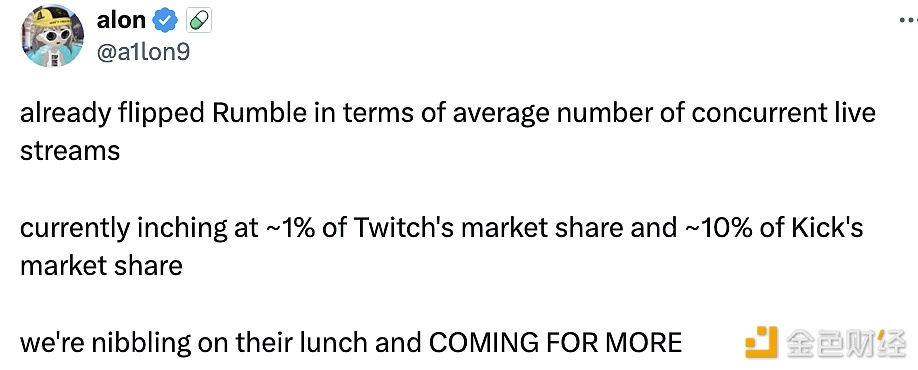

Pump.fun Co-Founder: Pump.fun's average concurrent live streams have surpassed Rumble

Data: Galaxy Digital purchased another 325,000 SOL in the past 5 hours